Whereas the broader crypto market seems to be anticipated to finish 2025 in a subdued state, a number of property are standing out with enormous capital inflows.

The truth is, the yr is coming to an finish because the maiden cryptocurrency, Bitcoin (BTC), has struggled to realize traction after falling under the $100,000 mark.

Bitcoin began the yr robust, however it’s on monitor to publish losses whereas different property are coming off a few of the most spectacular years on file.

To this finish, Zcash (ZEC) has emerged as one of many standout performers of 2025, dramatically outperforming Bitcoin regardless of beginning the yr as a comparatively missed, low-cost crypto asset.

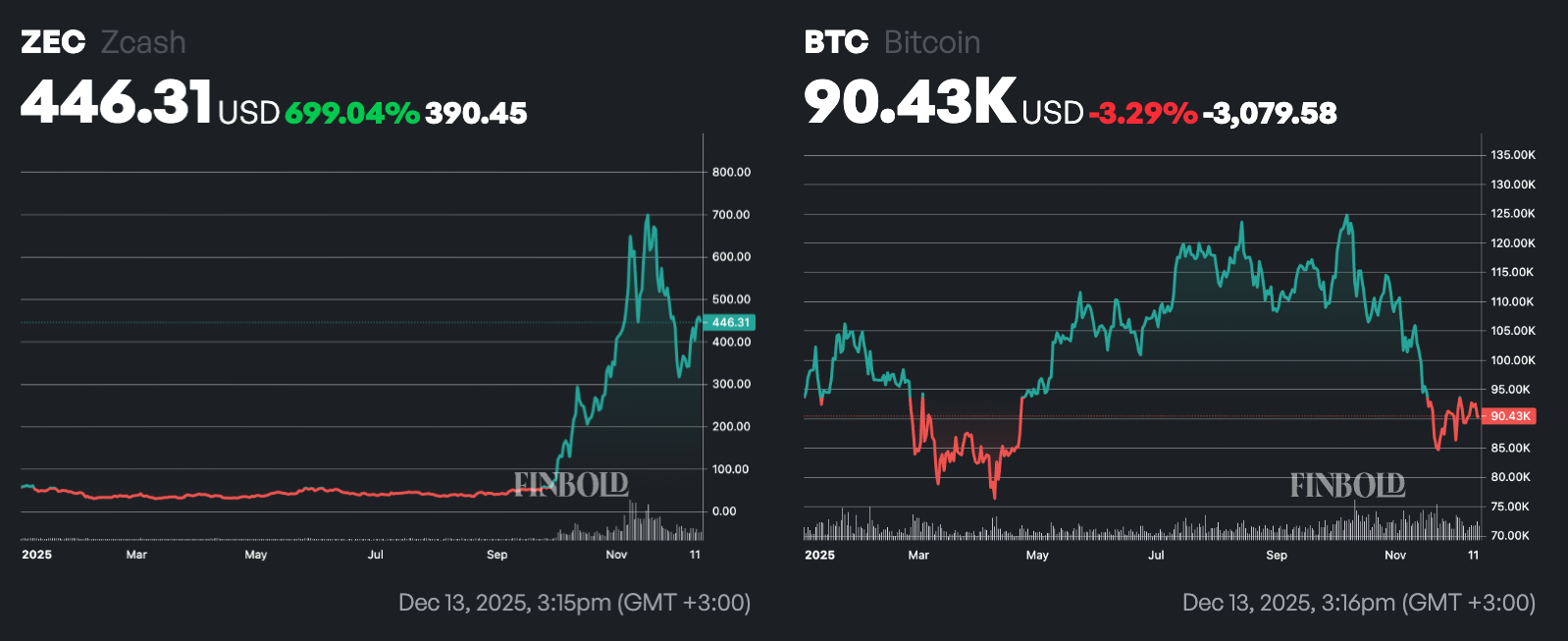

On the time of writing, ZEC is buying and selling at $446, reflecting a rise of roughly 699% because the starting of the yr. In distinction, Bitcoin hovered round $90,430, down about 3.3% because the starting of the yr after giving up a lot of its early good points.

This divergence highlights how capital will rotate inside the crypto market in 2025. Bitcoin, particularly, began the yr with robust momentum, supported by inflows from institutional traders and optimism following the earlier cycle’s highs.

Nonetheless, because the yr progressed, BTC struggled to keep up upward traction amid profit-taking, volatility in ETF flows, and widespread risk-off circumstances. These pressures have weighed on Bitcoin’s efficiency, which has suffered solely modest declines this yr regardless of a number of rallies.

Why Zcash dwarfed Bitcoin

In the meantime, Zcash has benefited from a brand new give attention to privateness in digital finance, steering traders towards property that provide stronger transaction confidentiality. That is an space the place ZEC has lengthy differentiated itself.

On the similar time, the elevated use of shielded transactions has decreased the liquid provide, whereas ongoing community upgrades have improved ease of use and elevated confidence within the protocol’s long-term relevance.

Shortage dynamics additionally performed a job. Expectations concerning Zcash’s issuance schedule and tight efficient provide led to an prolonged upside transfer as soon as momentum took maintain.

As soon as ZEC broke by way of long-standing resistance ranges within the second half of the yr, technical shopping for and leverage-driven momentum accelerated the rally, pushing the token from a double-digit worth initially of the yr to effectively above $400 by December.

Due to this fact, an investor who allotted funds to Zcash in the beginning of 2025 might earn roughly 6-7 instances the preliminary funding, whereas an investor who allotted related funds to Bitcoin would now be within the pink.

Featured picture through Shutterstock