Bitcoin costs stabilized in the present day, November 18, as traders purchased on the bullshit and awaited the upcoming FOMC minutes and NVIDIA’s earnings outcomes.

abstract

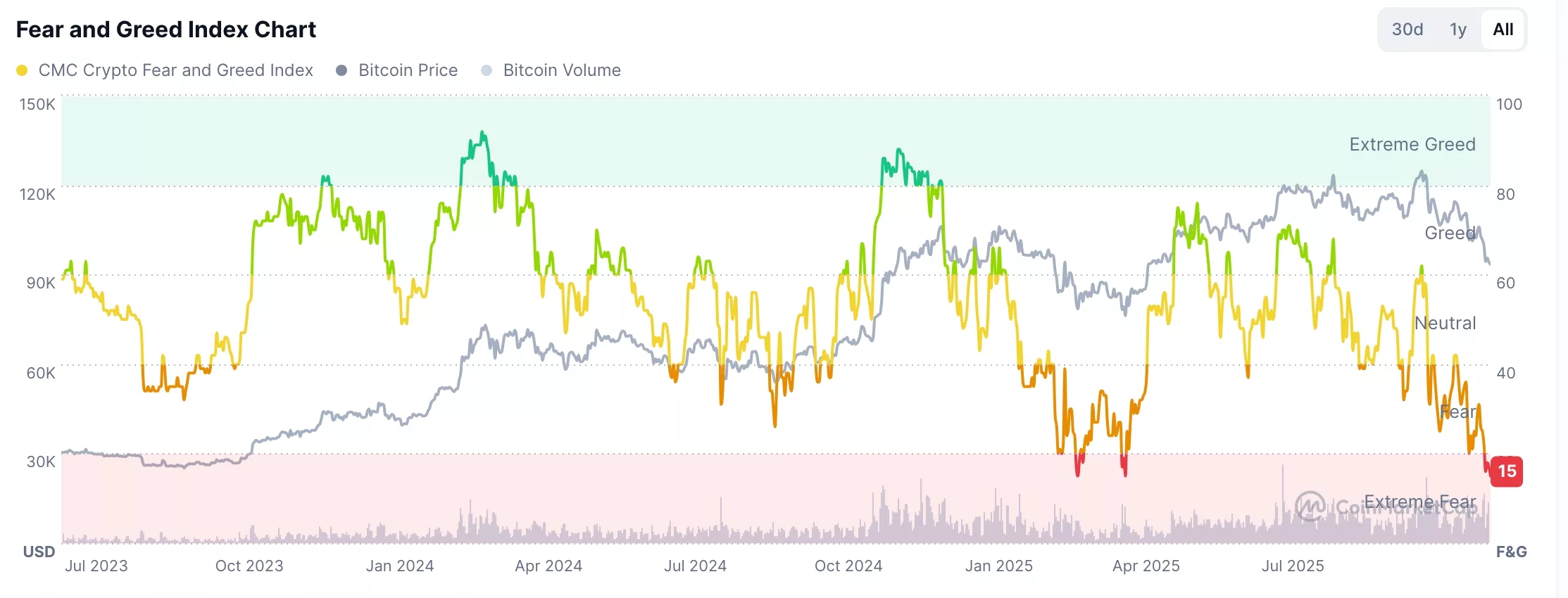

- Bitcoin costs have plummeted to their lowest since April.

- The cryptocurrency worry and greed index has moved into the acute worry zone.

- Technical evaluation means that Bitcoin will hit backside quickly.

Bitcoin (BTC) rose to $93,700, up barely from this week’s low of $88,790. It stays in a deep bear market, down about 26% from this 12 months’s highs.

Cryptocurrency Concern and Greed Index

A possible set off for BTC costs is the continued crash that’s inflicting market nervousness. The crypto worry and greed index has fallen to the acute worry zone of 15, its lowest degree since April of this 12 months, in accordance with information compiled by CoinMarketCap.

Cryptocurrency Concern and Greed Index | Supply: CMC

The Crypto Concern and Greed Index is calculated by taking a look at a number of information factors, together with Bitcoin and different altcoins’ value momentum, volatility, derivatives markets, and Bitcoin’s relative worth available in the market.

Additional information exhibits CNN’s Cash Concern and Greed Index has fallen to 12, its lowest degree since April. Market volatility, put and name choices, demand for secure property, demand for junk bonds, energy in inventory costs – all sub-indices inside the index are within the excessive worry zone.

More often than not, Bitcoin often begins a bull run when there’s worry available in the market. A great instance of that is what occurred final July, when the Concern and Greed Index dropped to 26 and Bitcoin rose to $54,000. A couple of months later, Bitcoin soared to new file highs.

Equally, the crypto worry and greed index fell to 19, the acute worry zone, and BTC rose to $79,000. A month later, it hit a brand new all-time excessive of practically $109,000. Equally, most Bitcoin bear markets start when the coin strikes into excessive greed.

Technical evaluation of Bitcoin value

BTC value chart |Supply: crypto.information

Bitcoin technical evaluation means that Bitcoin nonetheless has upside potential. For instance, the Relative Power Index is in oversold territory at 30. The proportion value oscillator has additionally fallen to its lowest degree this 12 months.

The coin fell to a double backside goal of $92,000. Additionally it is forming a hammer candlestick sample. Subsequently, the almost definitely situation is a rebound to the psychological level of $100,000. A break under this week’s low of $88,790 will invalidate the bullish outlook.

learn extra: Hive Digital’s 53% plunge displays Bitcoin pullback, however analysts predict a bullish rebound to $10