Bitcoin worth at the moment: the actual state of the market

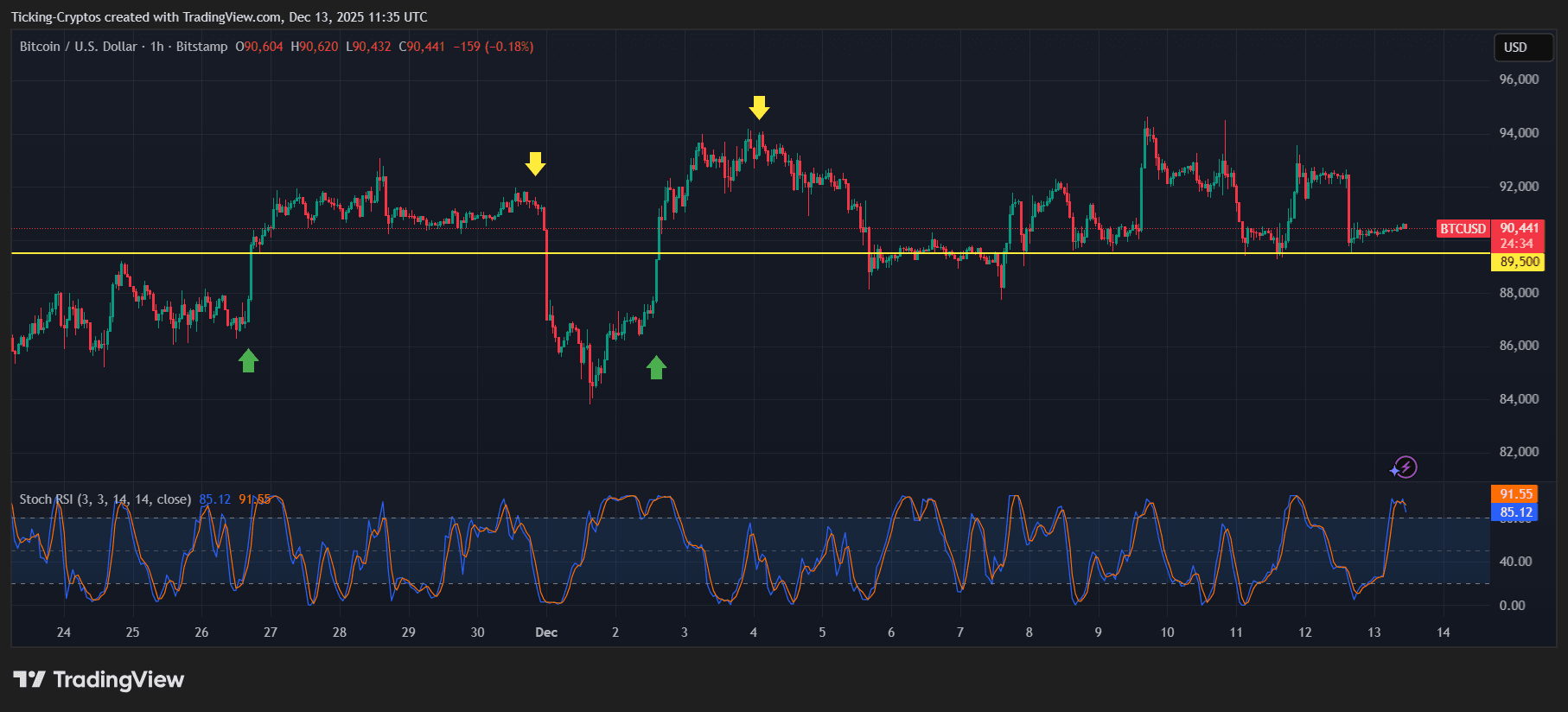

$Bitcoin is at present being traded $90,550based mostly on the most recent market knowledge and accompanying charts. Worth actions over the previous few weeks have proven consolidation moderately than enlargement, with Bitcoin struggling to regain greater resistance zones after a pointy correction.

BTC/USD 1 hour chart – TradingView

Nonetheless, a rising variety of analysts and social media commentators proceed to assert that Bitcoin will attain the subsequent stage. $150,000 by the tip of the yrstatements which are inconsistent with previous efficiency, reasonable market mechanics, or present macro situations.

How a lot does Bitcoin have to rise to achieve $150,000?

To know how unrealistic this objective is, it is vital to take a look at the numbers.

- Present $BTC worth: ~$90,550

- Goal worth: $150,000

This requires a achieve of approx. 65.7% inside a number of weeks.

For Bitcoin to realize this, it could require the strongest short-term rally in Bitcoin’s total historical past absent a comparable catalyst, akin to a worldwide liquidity shock, emergency financial easing, or unprecedented institutional capital inflows.

Bitcoin returns in December: What historical past can educate us

A have a look at Bitcoin’s historic December efficiency gives vital context.

The strongest December on report was December 2020when Bitcoin rises 46.92%. Though spectacular, even this historic rally 65% or extra A revenue is required to achieve $150,000 from present ranges.

Different December performances paint a clearer image.

- 2021: –18.9%

- 2022: –3.59%

- 2023: +12.18%

- 2024: –2.85%

Statistically, December shouldn’t be the month for such an explosive bull market. Expectations for Bitcoin to considerably outperform its all-time robust December should not supported by historic knowledge.

The place did the $150,000 story come from?

Whereas the $150,000 Bitcoin goal is usually attributed to well-known bullish numbers within the cryptocurrency trade, most of those statements are long run forecastnot a short-term year-end forecast.

Michael Saylor and different long-term Bitcoin proponents level to $150,000 as a possible milestone associated to institutional adoption and a multi-year progress cycle. Nevertheless, these views are often misquoted or recast into short-term predictions.

In the meantime, main establishments have grow to be much less aggressive and extra conservative. For instance, Customary Chartered not too long ago revised its outlook for Bitcoin and raised its goal to $150,000. 2026However, short-term expectations will decline.

This divergence highlights an vital situation. Many on-line “analyst” forecasts are based mostly on sentiment and extrapolation moderately than up to date macro knowledge and market construction.

Why the $150,000 Bitcoin prediction is deceptive

unrealistic time-frame

A 65% rally in a matter of weeks would require sustained shopping for stress that far exceeds what the market is at present displaying, particularly contemplating we’re already 15 days into December.

Seasonality would not assist it

Bitcoin by no means posted a big sufficient December rally to justify this prediction.

Institutional forecasts soften

Huge banks and analysis desks are tempering expectations moderately than elevating them.

Increasing social media

Lots of the $150,000 calls stem from recycled headlines, influencer posts, or selectively quoted interviews moderately than formal analysis.

Overview of Bitcoin

This doesn’t suggest Bitcoin would not have long-term upside potential. Construction adoption, ETFs, and institutional participation will proceed to be key drivers over the subsequent few years.

Nevertheless, it’s complicated long run potential and Brief-term worth actuality It creates false expectations and undermines severe market evaluation.

Whereas it might nonetheless be attainable for Bitcoin to achieve $150,000 in future cycles, presenting that as a short-term certainty is deceptive and unsupported by knowledge.