The “infinite funds glitch” in company Bitcoin treasuries has stalled.

For many of this market cycle, buying and selling was easy. Shares of firms that maintain Bitcoin traded at a big premium to their underlying internet asset worth (NAV).

This allowed firms to situation costly shares to purchase cheaper cash, regularly growing Bitcoin per share. It was a flywheel of economic engineering that relied on one key enter: a sustained fairness premium.

Why the premium for Bitcoin treasury firms has evaporated

Nonetheless, that injection has disappeared amid Bitcoin’s latest worth battle.

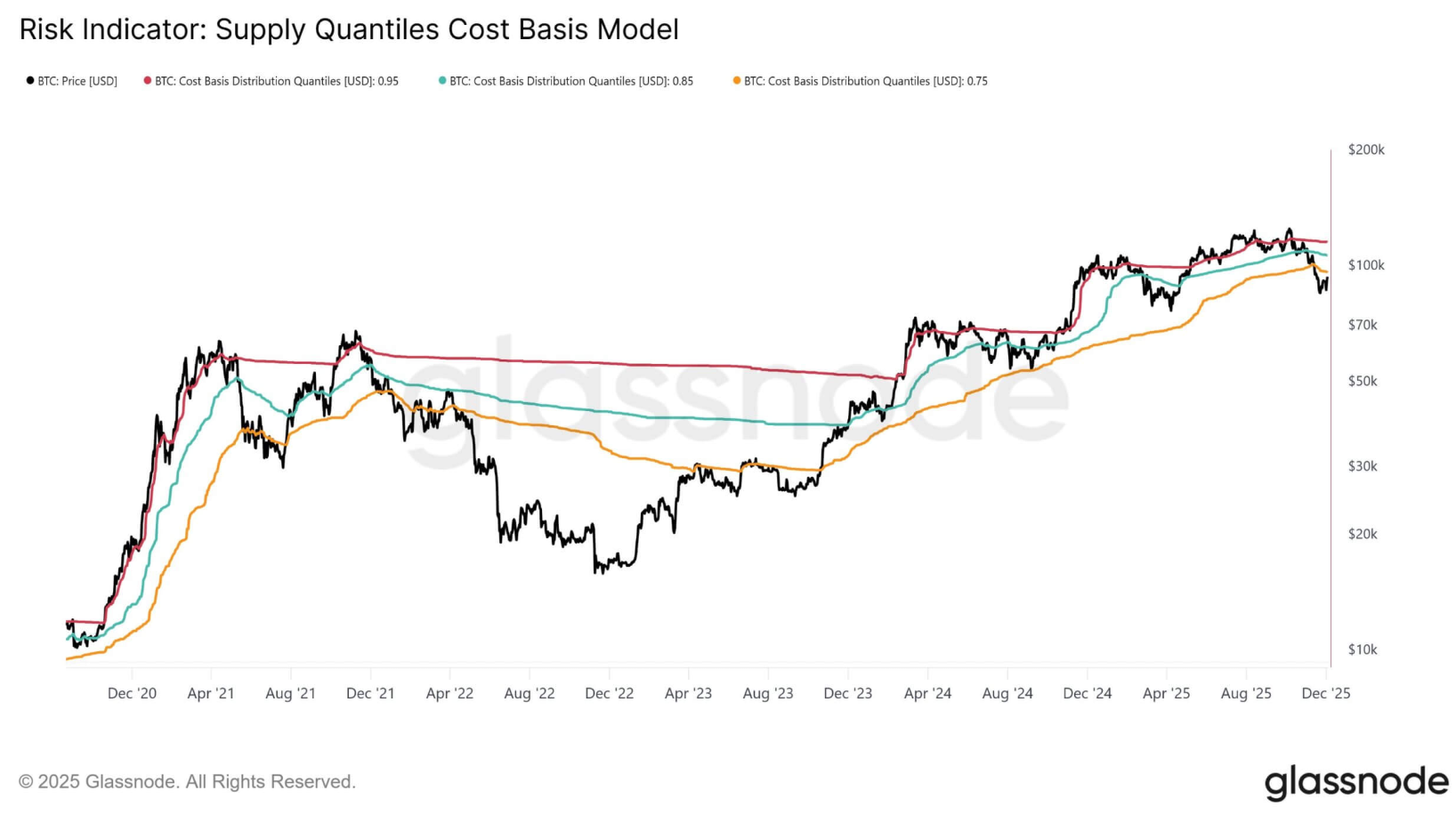

In line with Glassnode information, the value of BTC has been beneath the 0.75 decimal level since mid-November, with greater than 1 / 4 of the circulating provide in unrealized losses.

Contemplating this, firms within the Bitcoin Digital Asset Treasury (DAT) basket, a sector with a market capitalization of about $68.3 billion, are down 27% within the final month and practically 41% in three months, in response to Artemis information.

In distinction, Bitcoin itself has misplaced about 13% and 16% over the identical interval.

The “excessive beta” promise of those shares has been maintained, however strictly to the draw back. In consequence, the mechanism broke.

The NAV premium that when justified the aggressive issuance methods of firms like MicroStrategy (now generally known as Technique) and Metaplanet has all however disappeared.

On the identical time, a lot of the sector is presently buying and selling close to or beneath 1.0x ‘mNAV’ (debt-adjusted market worth).

When premiums flip into reductions, issuing shares to purchase Bitcoin turns into value-destroying reasonably than value-adding.

Subsequently, for this sector to return from a basket of distressed proxies to a premium asset class, the market will want greater than a easy worth rebound. Structural repairs are wanted throughout costs, liquidity and governance.

Underwater cost-based clear

The primary hurdle is only mathematical. The price base of late entrants to the sector is dangerously excessive, so a knee-jerk rebound in Bitcoin costs won’t be sufficient to restart the issuance engine.

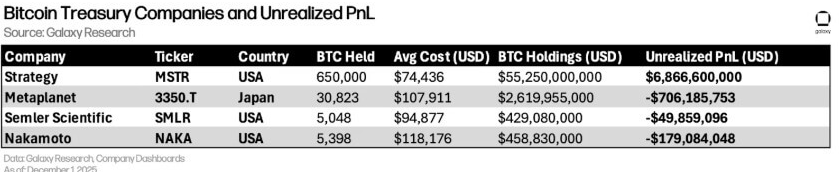

Artemis information reveals a dichotomy out there. Whereas early adopters are sitting on a cushion of earnings, a brand new wave of finance firms stays beneath the floor.

Galaxy Analysis famous that a number of BTC DATs, together with Metaplanet and Nakamoto (NAKA), are actively constructing positions, with the common value base of Bitcoin exceeding $107,000.

With spot costs presently hovering within the low $90,000 vary, these firms are dealing with vital market worth losses.

This has severe implications for the story.

When a Treasury trades nicely above its value foundation, the market treats it as a composite of capital managed by a visionary allocator. When an organization trades beneath its inventory worth, the market treats it as a distressed holding firm.

The leverage inherent within the mannequin, which Galaxy identifies as worth leverage, issuance leverage, and monetary leverage, amplifies this ache.

For instance, Nakamoto inventory has fallen greater than 38% in a single month and greater than 83% in three months, appearing extra like a bankrupt small-cap inventory than a structural proxy inventory.

For the premium to develop once more, Bitcoin not solely must get better, it additionally must get better. It wants to stay nicely above this $107,000 excessive. Solely then can the stability sheet be repaired sufficient to persuade buyers that Bitcoin per share is a rising asset reasonably than a legal responsibility that must be managed.

Restoration of leverage demand

The second requirement is a change in market sentiment concerning leverage. The collapse in DAT valuations reveals that fairness buyers are actually rejecting “unsecured leverage.”

In our evaluation, Galaxy framed the DAT sector because the capital markets’ native resolution to high-beta exposures. Basically, it is a approach for the fund to precise a convex view on Bitcoin with out touching the derivatives market.

Nonetheless, within the present risk-off surroundings, that convexity works in the other way.

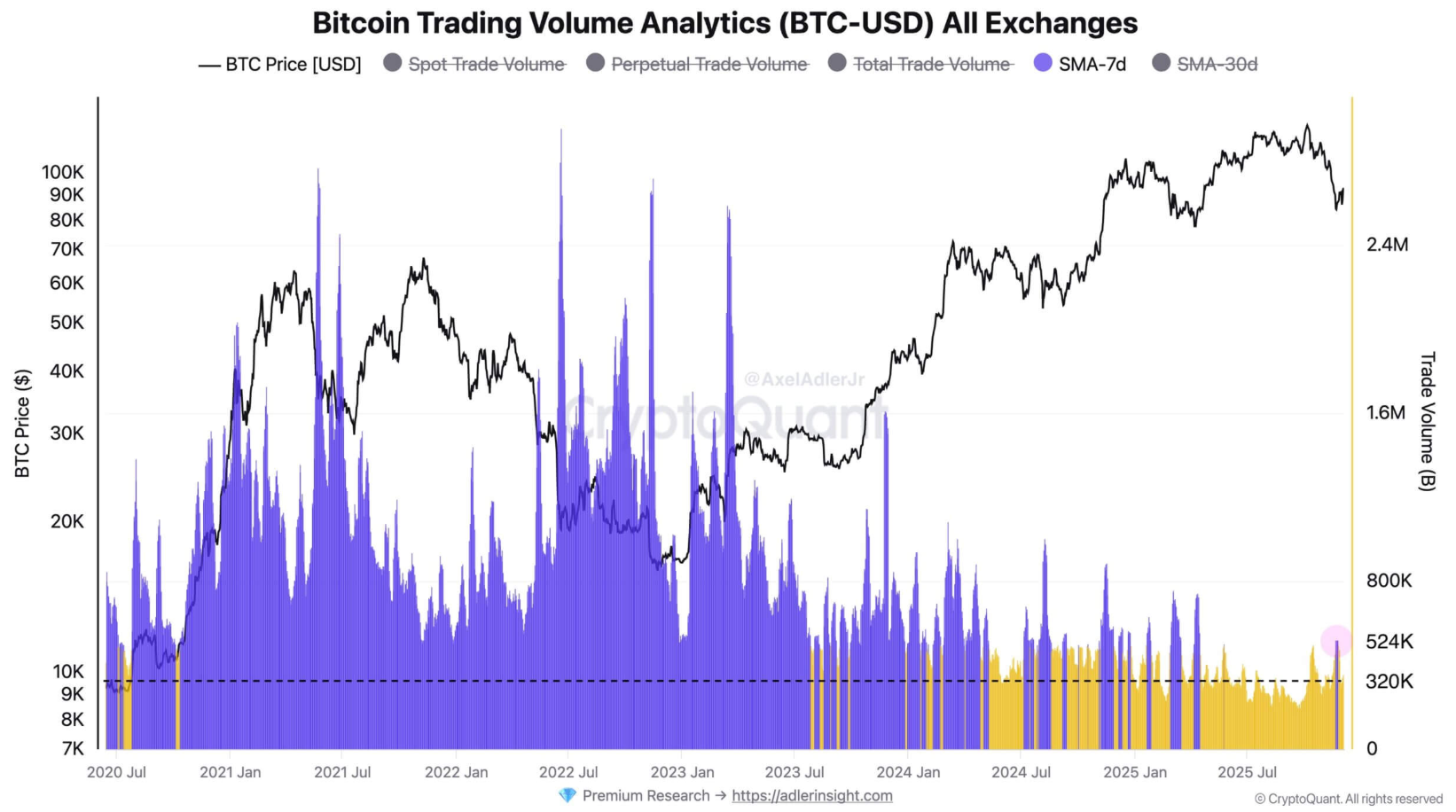

So long as spot ETF flows stay gentle and perpetual futures open curiosity stays depressed, there may be restricted urge for food for added leverage from equities.

In truth, in response to CryptoQuant information, the common weekly quantity for spot and futures has additional decreased by 204,000 BTC to round 320,000 BTC, a stage in step with the cycle’s low liquidity.

In consequence, market volumes have stagnated and positioning has turn out to be defensive.

Contemplating this, if DAT trades at 0.9x NAV, institutional buyers are mathematically higher off proudly owning a spot ETF like BlackRock’s IBIT. It’s because the ETF gives 1.0x publicity with decrease charges, tighter spreads, zero execution danger and company overhead.

Subsequently, for a DAT premium to exist, the market should be in “risk-on” mode, with buyers actively in search of the volatility arbitrage that firms like MicroStrategy provide.

Artemis information helps this “lever” punishment. MicroStrategy is down about 30% over the previous month, and Bitcoin is down 13%, so the market is pricing in mannequin vulnerability reasonably than optionality.

For the premium to return, spinoff metrics comparable to funding charges and open curiosity should sign a brand new urge for food for danger that commonplace ETFs can not fulfill.

From offense to protection

Gone are the times of “print shares and purchase BTC at any worth.” To regain investor confidence, company boards have to deal with defending stability sheets from aggressive accumulation.

In early 2025, the market rewarded blind accumulation. Now we wish survivability.

MicroStrategy’s latest transfer to boost roughly $1.44 billion in money reserves is a number one indicator of this restructuring. This capital is meant to cowl coupon and dividend commitments, successfully constructing a fortress stability sheet that may face up to prolonged bear markets with out compelled gross sales.

This shift from “low cost avoidance” to “premium justification” is essential.

Business consultants had warned that the DAT mannequin was susceptible to a collapse in insurance coverage premiums. Now that disruption has arrived, boards have to exhibit that future issuances might be disciplined and tied to clear worth creation standards.

mNAV multiples may develop once more if buyers imagine that new cash might be deployed judiciously, defending the draw back reasonably than chasing the upside.

Centralization and indexing

Lastly, the market should tackle the overwhelming focus danger inside the DAT sector.

In line with out there information, MicroStrategy alone controls greater than 80% of the Bitcoin held by the DAT sector and accounts for roughly 72% of the market capitalization of this class.

Which means the destiny of all the asset class is carefully tied to MicroStrategy’s particular liquidity dynamics and index standing.

Moreover, the pending MSCI session on whether or not to limit “digital asset treasury firms” from main indexes is the sword of Damocles hanging over the deal.

If MicroStrategy maintains its index standing, passive purchases from funds that monitor the benchmark may mechanically re-raise the premium, pushing the remainder of the basket upward.

However whether it is eliminated, there might be no mechanical bidding and the sector dangers changing into a group of closed-end funds that completely commerce at a reduction to the underlying belongings.