US inflation was the largest draw back shock in months. Nevertheless, as a substitute of a sustained rally, each Bitcoin and US shares bought off sharply throughout US buying and selling hours.

This value transfer has puzzled many merchants, however the chart factors to a well-recognized rationalization rooted in market construction, positioning, and liquidity reasonably than macro fundamentals.

What occurred after the US CPI launch?

Composite CPI in November slowed to 2.7% in comparison with the identical month final yr, properly beneath the anticipated 3.1%. Core CPI was additionally decrease than anticipated at 2.6%.

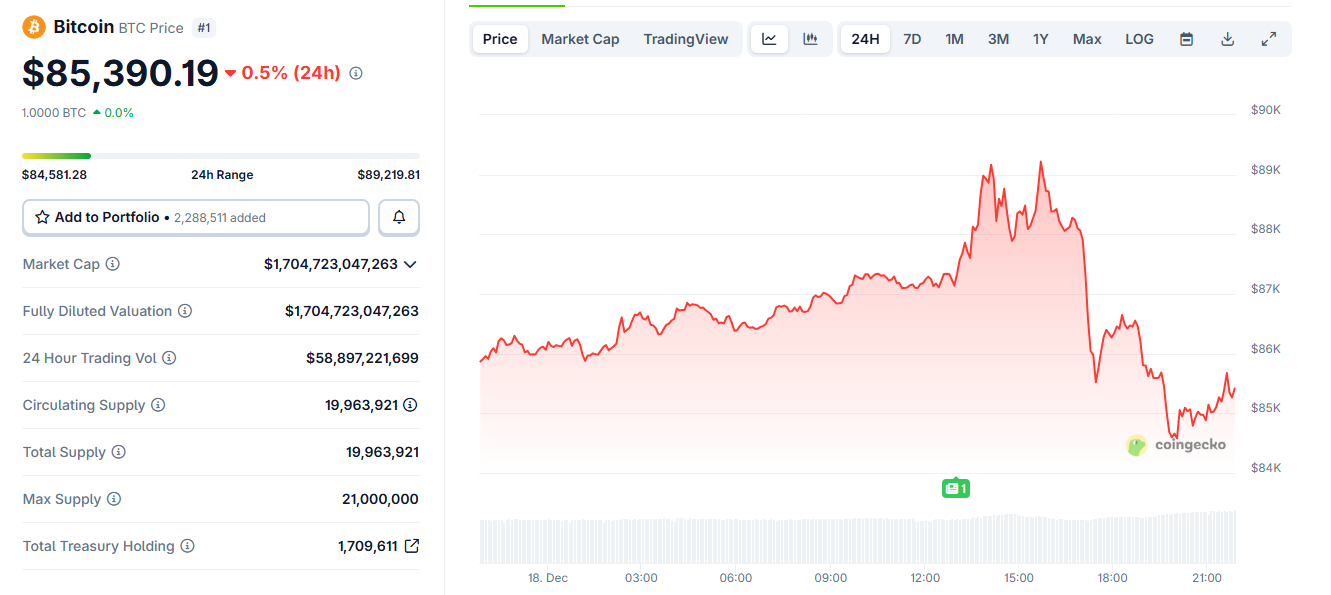

In concept, this was one of the crucial risk-positive inflation conditions in 2025. The market initially reacted as anticipated. Bitcoin soared in the direction of the $89,000 space, whereas the S&P 500 soared instantly after this information hit.

The assembly didn’t final lengthy.

Bitcoin costs quickly rose after which plummeted in response to US CPI information. Supply: CoinGecko

Inside about half-hour of the CPI statistics, Bitcoin made a pointy reversal. After hitting an intraday excessive close to $89,200, BTC bought aggressively and fell in the direction of the $85,000 space.

The S&P 500 adopted an analogous path, with sharp intraday fluctuations erasing a lot of the preliminary CPI features earlier than stabilizing.

The S&P 500 plunged after the US CPI after which soared. Supply: X/Kobeissi Letter

This synchronized reversal throughout cryptocurrencies and shares is important. This reveals that the transfer was not based mostly on any explicit asset or sentiment. It was structural.

The promoting quantity of Bitcoin takers tells the story

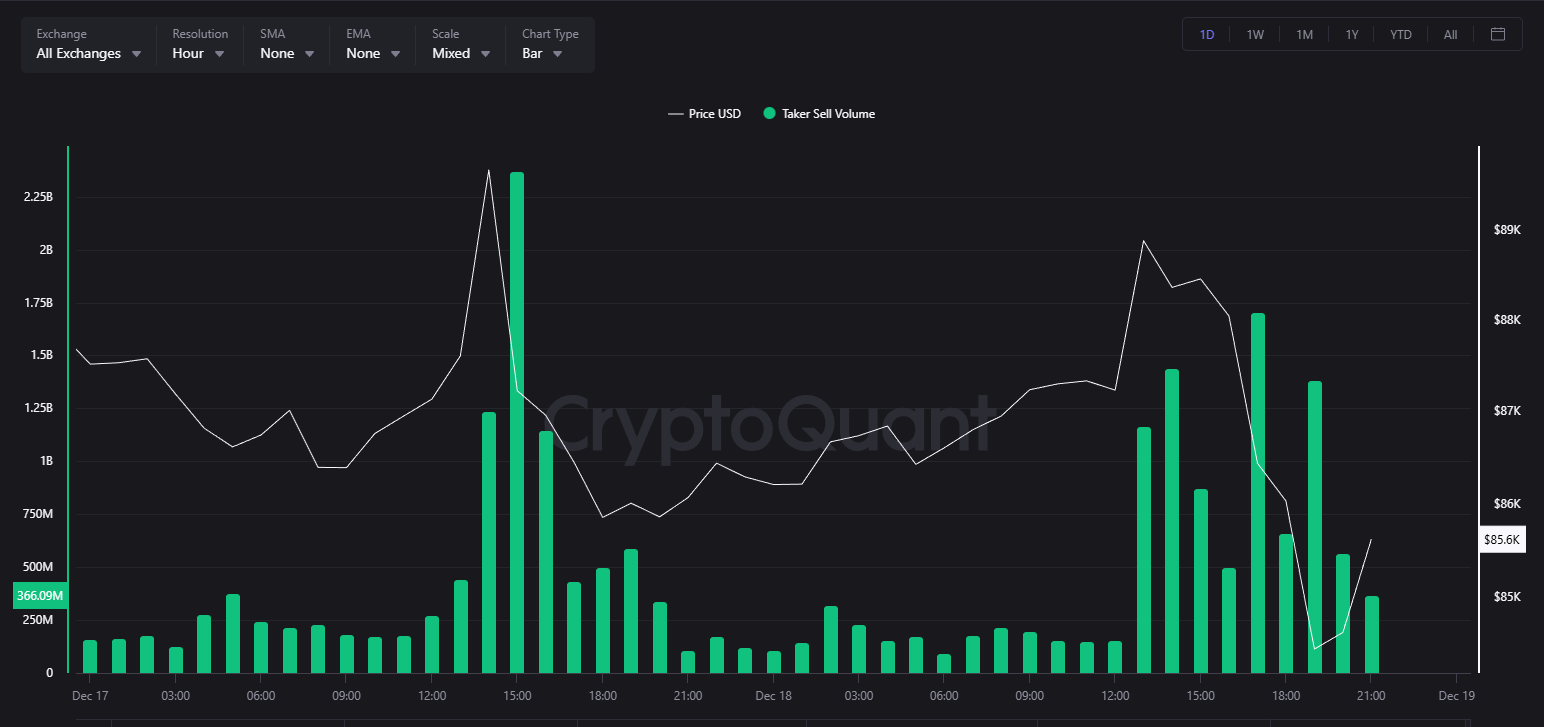

The clearest clue comes from Bitcoin taker cell quantity information.

On the intraday chart, The massive spike in taker promoting quantity appeared simply as Bitcoin fell. A taker promote displays a market order reaching a bid and is an energetic promote reasonably than a passive revenue taking.

These spikes have been concentrated within the hours of the U.S. market and coincided with the quickest elements of the decline.

Bitcoin taker quantity throughout all exchanges on December 18th. Supply: CryptoQuant

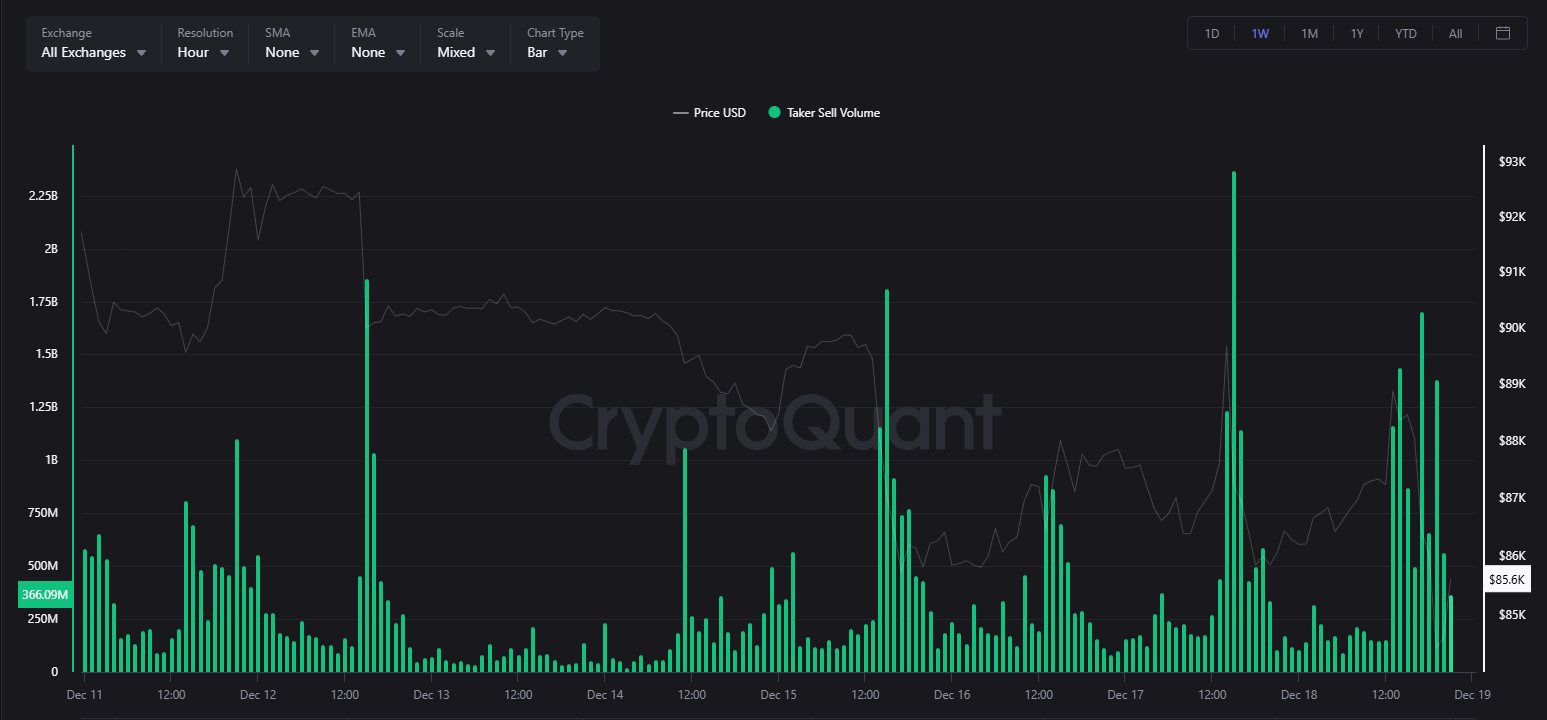

Weekly views reinforce this sample. Related sell-side bursts have occurred a number of occasions over the previous week, many in periods of excessive liquidity, suggesting repeated pressured or organized sell-offs reasonably than particular person retail exits.

This habits is according to liquidation cascades, volatility-targeting methods, and algorithmic threat aversion. All of this accelerates when the value begins shifting in opposition to your leveraged place.

Bitcoin taker quantity throughout all exchanges over the previous week. Supply: CryptoQuant

Why did “Good Information” develop into a set off?

The decline was not brought on by unhealthy CPI statistics. So good that it brought on volatility.

Easing inflation quickly elevated liquidity and narrowed spreads. This atmosphere permits massive gamers to run their dimension effectively.

Bitcoin’s preliminary surge possible entered a zone of dormant orders, cease losses, and short-term leverage. As soon as the upward momentum stalled, the value reversed, inflicting an prolonged liquidation or stop-out.

As soon as the liquidation started, pressured promoting out there amplified the motion. For this reason the decline accelerated reasonably than being gradual.

The S&P 500’s intraday whipsaw reveals an analogous motion. Patterns of fast declines and recoveries throughout macro releases usually replicate seller hedging, possibility gamma results, and systematic flows that modify threat in actual time.

🚨 That is an insane stage of manipulation.

8:30am

CPI was decrease than anticipated.

– Following the bullish CPI information, Bitcoin rose $2,217 from $87,260 to $89,477 in simply 60 minutes.

– $70 billion added to the cryptocurrency market.

– $94 million value of shorts have been liquidated.10am

The… pic.twitter.com/FmJqLDKbBw

— Bull Idea (@Bull Theoryio) December 18, 2025

Does this seem like manipulation?

Charts aren’t proof of operation. However they present Patterns generally related to cease runs and liquidity extraction:

- Fast transition to apparent technical stage

- Reversal instantly after liquidity enchancment

- Lively promoting happens on a big scale throughout failures

- Shut coordination with US buying and selling hours

These actions are widespread in extremely leveraged markets. The probably driver isn’t a person, however Massive funds, market makers and systematic methods We function throughout futures, choices and spot markets. Their purpose is execution effectivity and threat administration, not narrative management.

In cryptocurrencies, these flows can appear excessive as leverage stays excessive and liquidity thins out shortly exterior of key home windows.

🚨 They’re manipulating Bitcoin once more and I’ve proof!!!

Bitcoin plummets $4,000 in minutes…

And only a few individuals truly perceive what occurred.

It’s the identical group of gamers manipulating costs… once more.

You have to cease wanting on the charts and take a look at the leaks… pic.twitter.com/ymU4kXdWvb

— NoLimit (@NoLimitGains) December 18, 2025

What does this imply going ahead?

A decline doesn’t invalidate the CPI sign. Inflation has come down in earnest, which continues to assist threat property over time. What the market skilled was a short-term positioning reset, not a macro reversal.

Within the quick time period, merchants can be watching to see if Bitcoin stabilizes above current assist and if seller-side stress eases as liquidations unwind.

Even when takers promote much less and the value holds, the CPI information might nonetheless assert itself over future periods.