Though the crypto market has cooled down with uncertainty surrounding most belongings, a dealer with a 100% win charge is as soon as once more lengthy on Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

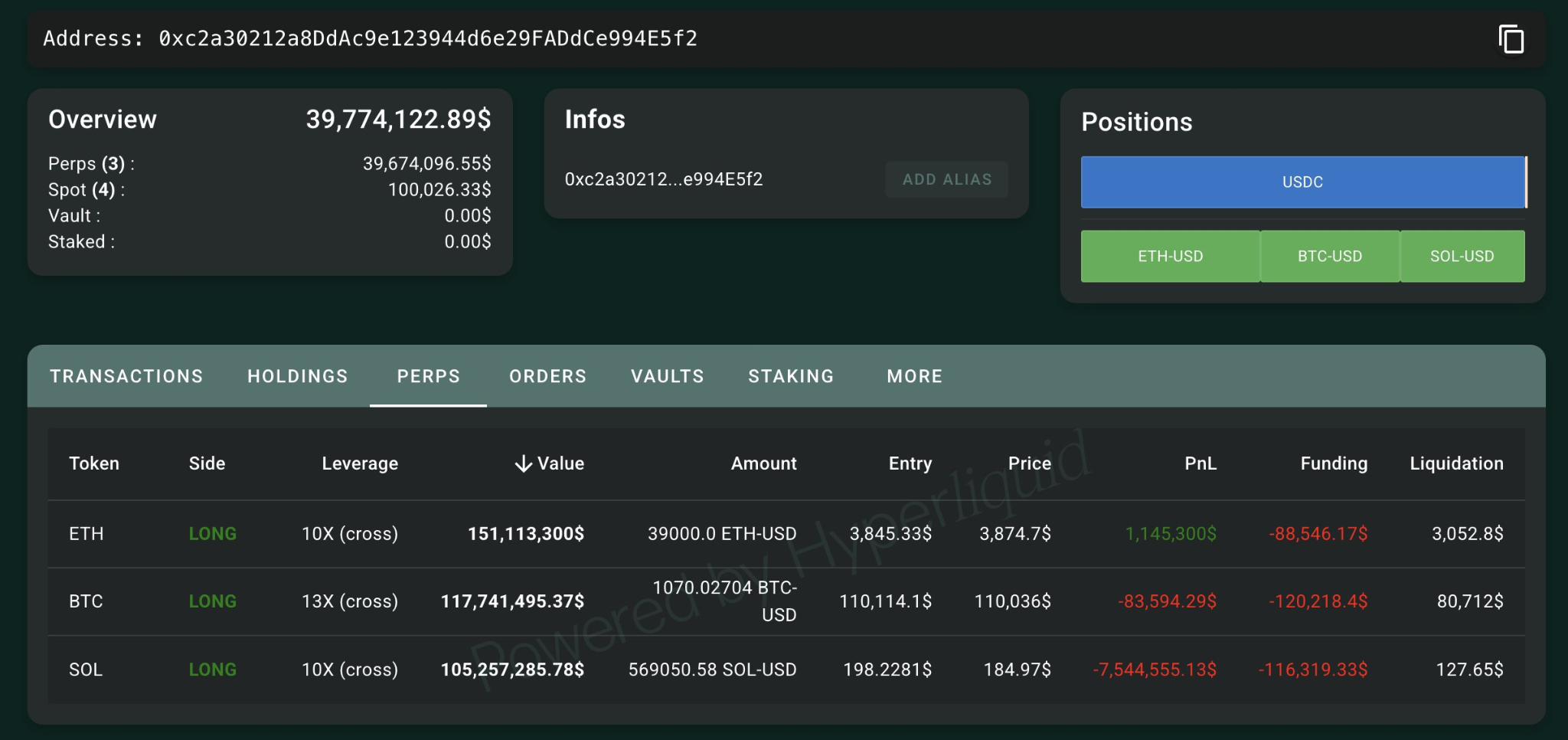

Particularly, merchants at present maintain 39,000 ETH price $151 million with a mean entry worth of $3,845.33, 1,070 BTC price $118 million at $110,114.10, and 569,050 SOL price $105 million at $198.23. look on chain Written by Finnvold, November 2nd.

He additionally positioned a restrict order of 40,000 SOL that will add roughly $7.36 million to his $184 lengthy place, expressing confidence in Solana’s potential rebound regardless of latest volatility.

This transfer follows a earlier commerce on October thirtieth, when he went lengthy in the identical three belongings, holding 1,039 BTC price $114 million, 560,840 SOL price $109 million, and 13,419 ETH price $52.66 million.

Curiously, this dealer accomplished 14 trades with a 100% win charge in 18 days, realizing a revenue of over $16 million.

The dealer is lengthy once more and seems to be betting on a market rebound, indicating robust confidence within the potential upside.

Bitcoin fails to make a giant transfer

Specifically, the Bitcoin-led market briefly rebounded after struggling heavy losses earlier within the week, stabilizing across the $110,000 degree as neither bulls nor bears had a lot confidence to push the value decisively someway.

On the time of writing, Bitcoin was buying and selling at $110,734, up about 0.5% over the previous 24 hours, whereas Ethereum was down lower than 0.1% over the identical interval at $3,872.

Notably, the bearish temper is rising after Bitcoin posted its first month-to-month decline since 2018, ending a seven-year shedding streak that when made October a “fortunate” month for crypto merchants.

The broader market mirrored declines in gold and shares, retreating from report highs amid heightened investor uncertainty. The selloff was additional fueled by US President Donald Trump’s choice to impose 100% tariffs on Chinese language imports and threaten export restrictions on key software program, triggering the biggest cryptocurrency liquidation in historical past. Regardless of the easing of commerce tensions, markets are exhibiting little signal of restoration.

Outflows from exchange-traded funds (ETFs) have been noticeable over the previous week, and costs stay partially weighed down by institutional traders remaining cautious. Nonetheless, as soon as capital inflows resume, bullish sentiment may rise once more.

Featured picture through Shutterstock