A crypto dealer recorded practically $2 million in realized losses after putting a sequence of aggressive lengthy positions in Monad’s newly launched MON token.

In accordance with the newest on-chain knowledge obtained by Finbold, MON skilled wild worth fluctuations throughout its debut on the secondary market, with losses amounting to roughly $1.9 million occurring inside hours of buying and selling. look on chain November thirtieth.

Transaction information present a sequence of liquidations and evictions, together with one liquidation that worn out greater than $963,000. Costs for some others ranged from tens of 1000’s of {dollars} to properly over $300,000.

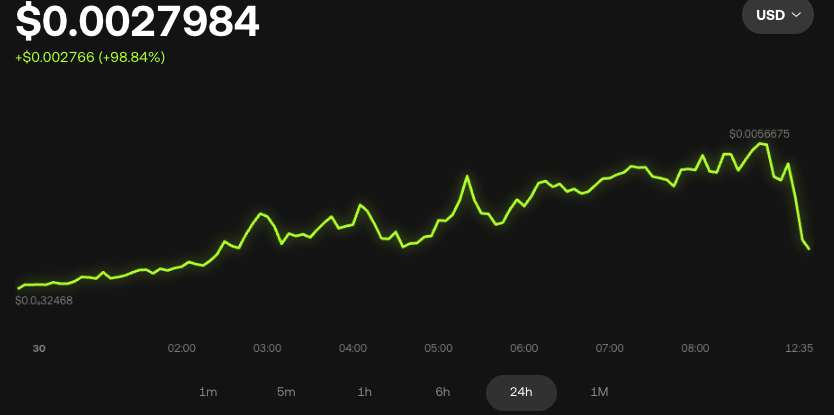

Merchants constructed lengthy exposures across the $0.034 stage, however a pointy intraday reversal despatched MON plummeting from its peak, triggering a sequence of liquidations. MON rose practically 99% at one level inside the 24-hour body, however the speedy decline seen on the value chart worn out merchants’ positions nearly immediately.

This massive loss occurred throughout one of the crucial broadly attended token gross sales held on Coinbase’s new launch platform. The week-long sale attracted practically 86,000 consumers from greater than 70 nations, amassing $269 million in pledges and oversubscribing the $187.5 million allotment by an element of 1.43.

Though most contributors entered looking for long-term publicity, early buying and selling exercise proved to be rather more unstable than the gross sales themselves.

Notably, MON launched with 10.8% of its 100 billion provide unlocked, break up between normal gross sales at $0.025 and airdrops, whereas the remaining stays locked throughout staff, investor, monetary, and ecosystem allocations for years. The staff’s giant share sparked backlash from some neighborhood members who thought of the distribution to be insider-centric.

The explanation why MON was launched

Monad’s mainnet was up and operating, with apps and builders energetic from day one, producing prompt on-chain exercise. The mix of early robust demand and low circulating provide fueled MON’s worth spike and equally speedy reversal.

However not everybody within the trade shares that enthusiasm. On this case, BitMEX co-founder Arthur Hayes reiterated his view that the majority new layer 1 blockchains will ultimately decline, arguing that solely Ethereum and Solana have sustainable institutional sturdiness.

He characterised Monad as a extremely valued, low-float token that’s vulnerable to plummeting as soon as preliminary launch momentum wanes.

Featured picture by way of Shutterstock