Lower than a month after TradeXYZ deployed tokenized Nasdaq futures (XYZ100) on Hyperliquid, a number of protocols have launched TSLA, NVDA, and SPACEX perpetual buying and selling previously 24 hours.

TradeXYZ, the permissionless persistence arm of Unit, a Hyperliquid tokenization layer, began a gold rush yesterday with the launch of tokenized NVDA. At the moment, Felix Protocol and TradeXYZ comply with TSLA and Ventures launches SPACEX.

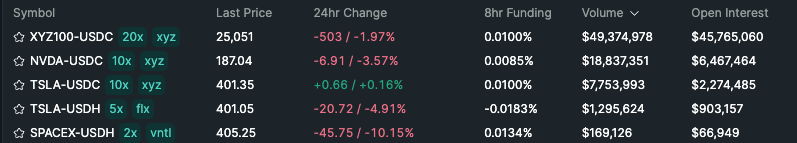

Whereas the XYZ100 nonetheless leads the HIP-3 sector by a large margin in complete quantity and open curiosity, TradeXYZ’s NVDA and TSLA markets have expanded, producing $26 million in 24-hour quantity and almost $9 million in open curiosity throughout that point.

HIP-3 Market by Quantity – Hyperliquid

A notable distinction between TradeXYZ’s market and the markets operated by Felix and Ventures is that the XYZ market is denominated in USDC, Hyperliquid’s dominant stablecoin, whereas Felix and Ventures are settled in USDH, Native Markets’ lately launched stablecoin.

This transfer will likely be USDH’s first actual supply of demand, as it is going to funnel 50% of its reserve yield into the acquisition of HYPE tokens.

All new markets are launched with low open curiosity limits, that are anticipated to extend over time because the crew continues to observe efficiency.

HIP-3 Market Scaling and Distribution

Felix Protocol contributor Charlie spoke to The Defiant about new developments in HIP-3, together with the fragmentation of liquidity throughout markets representing the identical tokenized shares, and the way the market can anticipate HIP-3 to develop past its crypto-native viewers.

He stated there may be at the moment overlap between Unit and Felix, with each providing tokenized TSLA markets. Nonetheless, this overlap is anticipated to diverge as Felix develops different companies that don’t rely solely on Hyperliquid’s UI as the first TSLA/USDH distribution supply.

Charlie added that there are a number of advantages to utilizing USDH, together with a 20% discount in taker charges, a 50% improve in rebates, and a 20% improve in quantity contributions. “This implies it is cheaper and extra liquid to commerce the identical markets on Felix. Moreover, our payment schedule is decrease as nicely. Subsequently, the primary differentiator between Felix and Unit is value.”

Though the HIP-3 perpetual market continues to be in its infancy, even for crypto-native use circumstances, the crew goals to increase the HIP-3 funnel and appeal to conventional monetary merchants as nicely.

“I feel this (supply to non-crypto audiences) primarily comes all the way down to regulatory readability and distribution, and the 2 work together with one another. As soon as one giant participant begins consolidating PERP, and begins consolidating fairness P/E in response to buyer demand, regulatory readability will comply with.”

“On the distribution facet, non-crypto natives gained’t wish to undergo the complexities of issues like pockets administration to commerce these markets. That’s the place issues like Privy+ Hyperliquid builder code built-in into identified interfaces like Bloomberg fill the hole,” Charlie concluded.