Most crypto merchants nonetheless consider that Bitcoin is following a conventional four-year sample.

Halving → bull market → blowout on the high → multi-year bear market.

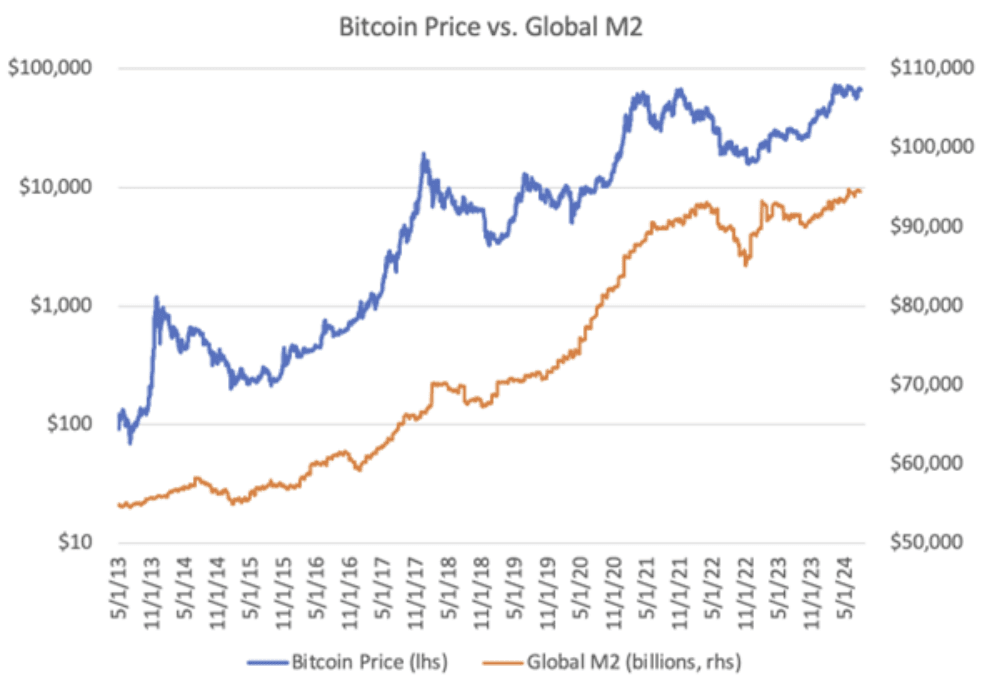

However the proof from the previous decade clearly reveals that: Bitcoin’s largest transfer was not brought on by a halving.

These causes are: Increasing liquidity And that enlargement is now forming once more.

A chart evaluating Bitcoin and the World Liquidity Index makes this case unmistakable.

The date doesn’t halve each time a serious peak happens as liquidity spikes.

And the identical mechanism is beginning to be constructed for 2025-2027.

In response to the X-account bull concept, that is precisely the case.

1. Stablecoin liquidity reveals the reality

Regardless of current value declines, The overall provide of stablecoins continues to extend.

That is necessary as a result of stablecoins are the closest factor cryptocurrencies should the cash provide. An increase in energy signifies:

- Instructional establishments didn’t retreat.

- Capital just isn’t leaving the cryptocurrency ecosystem.

- large gamers are sitting big dry powderready for a macrocatalyst.

A rise in stablecoin liquidity throughout a correction is likely one of the strongest alerts {that a} bullish cycle is underway. pausedwould not have Completed.

2. The US Treasury is quietly bringing liquidity again to the market.

One of many largest catalysts is occurring under the floor.

The TGA (Treasury Basic Account) is near $940 billion, about $90 billion above the conventional vary.

When the Treasury attracts down this stability, that money returns to the monetary system, facilitating:

- market liquidity

- credit score demand

- Danger asset efficiency

This is similar mechanism that drove earlier expansions, and it is occurring once more.

Shopping for again authorities bonds was simply the primary trace.

The actual liquidity enchancment will happen when TGA begins to normalize. And traditionally, Bitcoin response is quick.

3. The worldwide financial system is coming into a brand new part of liquidity enlargement

This cycle differs from all earlier cycles in that Simultaneous world leisure:

- China It has been injecting liquidity for a number of months.

- Japan Launched a roughly $135 billion stimulus bundle and relaxed digital foreign money tax guidelines.

- Canada They’re shifting in direction of decrease rates of interest and simpler phrases.

- Fed has already ended QTwhich is traditionally a step earlier than liquidity enlargement.

When a number of main nations inject liquidity on the identical time, danger property usually react. in entrance Shares and Commodities.

Because of this Bitcoin’s “delay” cycle is extra extreme. Macro adjustment stage than the completed high.

4. The Hidden Catalyst: The Chance of Salvation for SLR Cameras

In 2020, Exemption for SLR cameras U.S. banks have been in a position to broaden their stability sheets and enhance lending, leading to a big acceleration of liquidity in all markets.

If any SLR treatment is returned:

- Financial institution loans enhance

- credit score expands

- System-wide liquidity will increase

- Bitcoin and cryptocurrencies react immediately

This coverage alone has the potential to reshape all the monetary panorama from 2025 to 2027.

5. The political class will make 2026 a serious turning level.

President Trump’s repeatedly acknowledged coverage route reinforces the shift towards enlargement.

- potential Tax restructuringtogether with consideration of eliminating earnings tax.

- proposed $2,000 Tariff Dividend

- Market-friendly regulatory stance

- in all probability new fed chair Extra supportive of liquidity and constructive in direction of cryptocurrencies

This political cycle is necessary as a result of Coverage shapes liquidityand liquidity kinds the Bitcoin cycle.

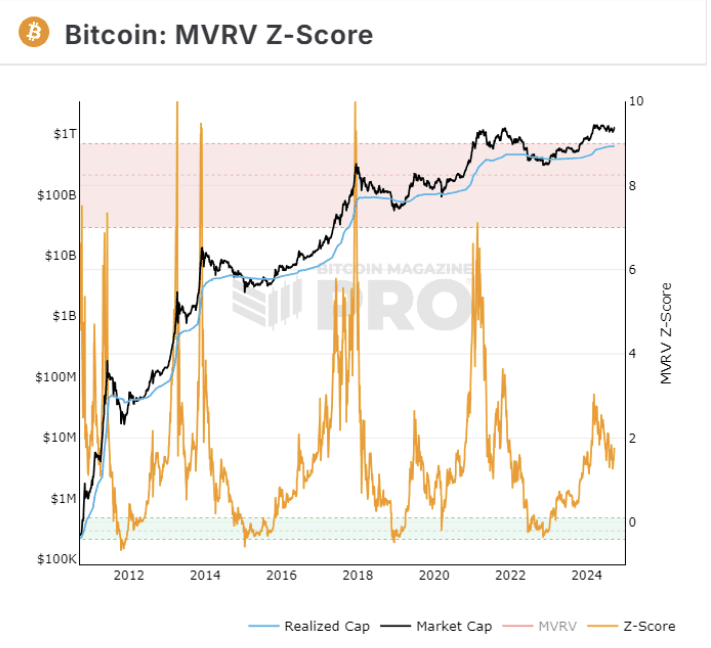

6. Total alerts level to a brand new longer Bitcoin cycle

Whenever you add all the weather collectively, the large image turns into clear.

- Growing stablecoin liquidity

- Ministry of Finance getting ready to inject cashback into the market

- Resurrection of worldwide quantitative easing (China, Japan, Canada, and so on.)

- QT ending within the US

- Chance of increasing financial institution financing

- Market-friendly insurance policies will shift in 2026

- New entrant establishments

- progress of clear technique

- Extra crypto-friendly Fed management is on the horizon

This mix contains by no means It is occurred earlier than in Bitcoin’s historical past.

This may fully break the standard four-year sample.

7. What the brand new Bitcoin cycle will appear to be (2025–2027)

As an alternative of the traditional cycle:

❌Sharp run-up

❌ Blow-off high

❌ Multi-year bear market

Typing:

**Liquidity-driven enlargement part

It might final till 2026-2027. **

A cycle is outlined as:

- Elevated structural liquidity

- world mitigation

- political incentives

- Inflow of institutional buyers

- regulatory readability

This isn’t a Bitcoin cycle of the previous, however a very new macro cycle.

Bitcoin is now not responsive to dam rewards or halvings.

is reacting to world liquidityIn addition to different main danger property.

The info reveals:

- Liquidity has bottomed out.

- Liquidity is rising.

- The economies of main nations are all easing.

- US coverage has turn out to be expansionary.

- Stablecoins are increasing.

- The engine is loading dry powder.

The subsequent main Bitcoin part is not going to observe the outdated situation.

Will probably be longer, broader and extra highly effective, pushed by macro liquidity slightly than mining schedules.