Considerations about stablecoin issuer Tether’s monetary stability resurfaced this week after BitMEX founder Arthur Hayes warned that Tether may face critical issues if the worth of its reserve belongings falls. Nevertheless, James Butterfill, head of analysis at CoinShares, denied these claims.

Butterfill mentioned in a December 5 market replace that considerations about Tether’s solvency “appear misplaced.”

He identified that Tether’s newest certification reveals that it reported $181 billion in reserves towards roughly $174.45 billion in debt, leaving it with a surplus of practically $6.8 billion.

“Whereas the dangers of stablecoins ought to by no means be utterly ignored, the present information doesn’t point out a systemic vulnerability,” Butterfill wrote.

Tether stays one of the crucial worthwhile corporations within the house, producing $10 billion within the first three quarters of this 12 months. That is an unusually excessive quantity on a per worker foundation.

Associated: Arthur Hayes tells Zcash holders to withdraw from CEX and ‘defend’ their belongings

The most recent explanation for tether anxiousness

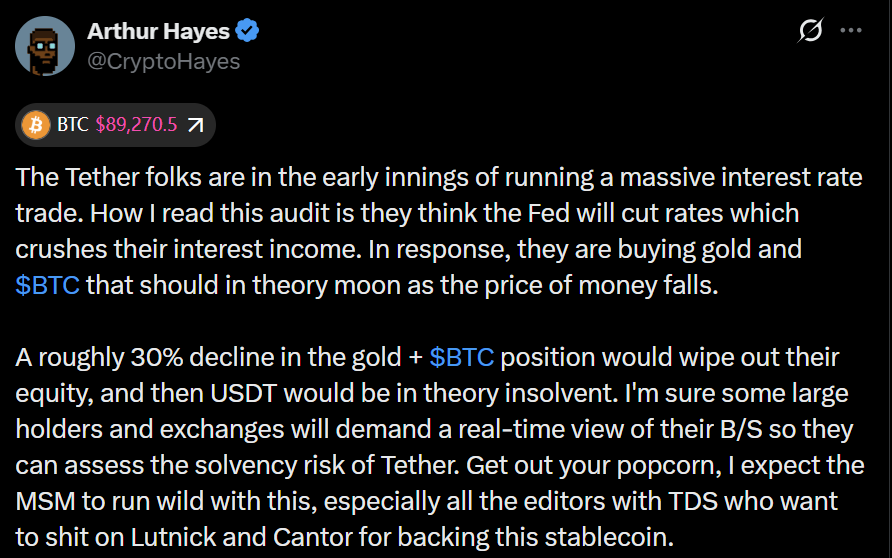

Hypothesis about Tether’s monetary well being isn’t new, as media shops have been investigating Tether’s reserves and asset backing for years, however current solvency considerations seem to stem from Arthur Hayes.

The BitMEX co-founder mentioned final week that Tether is “within the early levels of a large rate of interest commerce” and claimed {that a} 30% drop in Bitcoin (BTC) and gold holdings would “wipe out fairness” and make the USDt (USDT) stablecoin technically “bancrupt.”

Each belongings make up a good portion of Tether’s reserves, and the corporate has elevated its publicity to gold lately.

sauce: Arthur Hayes

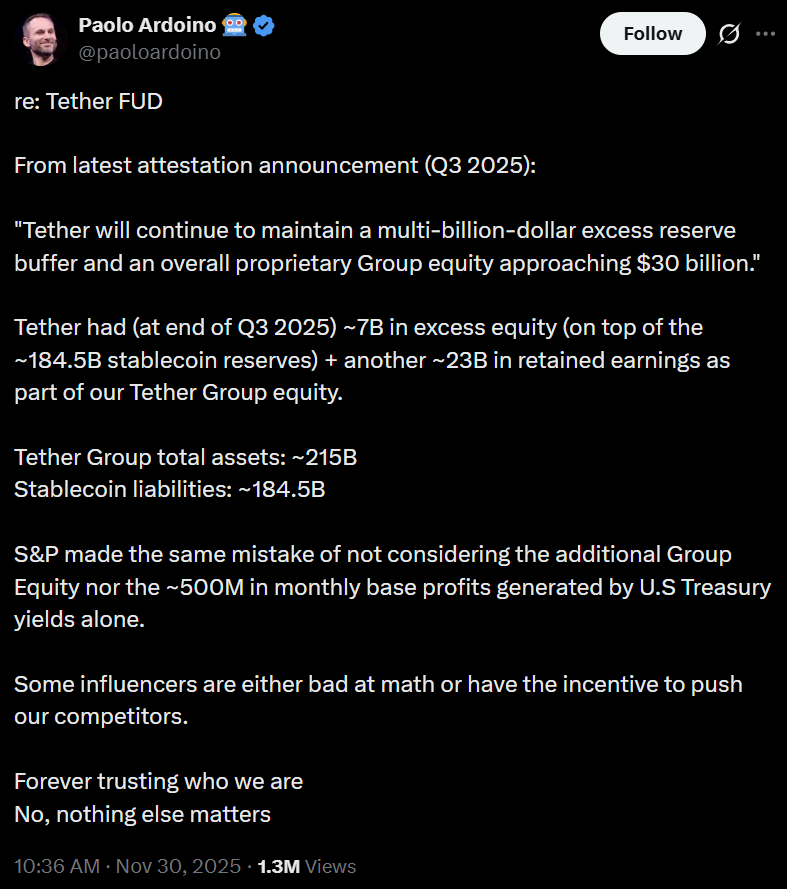

Tether has confronted criticism from extra than simply Hayes. CEO Paolo Ardoino lately defended S&P International’s downgrade of USDt’s skill to defend its greenback peg, dismissing the transfer as “Tether FUD” (an abbreviation for worry, uncertainty, and doubt) and citing the corporate’s third-quarter certification report.

S&P International downgraded the stablecoin on account of stability considerations, citing its publicity to “high-risk” belongings similar to gold, loans, and Bitcoin.

sauce: Paolo Ardoino

Tether’s USDt stays the most important stablecoin within the cryptocurrency market, with $185.5 billion in circulation and practically 59% market share, in keeping with CoinMarketCap.

journal: China formally hates stablecoins, DBS trades Bitcoin choices: Asia Categorical