SWIFT is getting ready for main structural modifications within the world funds system. This migration deprecates older messaging frameworks and >See how London’s neobank turns into wealthtech on fmls25

On November 22, 2025, SWIFT will full the transition to the ISO 20022 CBPR+ commonplace. The community connects greater than 11,000 banks and monetary establishments in additional than 200 nations. This cutover will retire the long-standing MT format for core fee directions and substitute it with an built-in framework constructed for richer, extra constant knowledge.

SWIFT additionally examined connectivity with blockchain networks to discover cross-border remittances, CBDC funds, and asset tokenization.

This transition has been underway since March 2023, when SWIFT entered a coexistence interval permitting each MT and MX codecs. This era ends on November 22, 2025. After that date, fee directions between monetary establishments have to be despatched in ISO 20022 solely.

(#Highlighted hyperlink#)

Establishments that proceed to make use of MT for core cross-border funds danger delays, denials, and compelled conversions by emergency response providers, rising prices and lowering transparency.

related blockchain

SWIFT has examined connections between the ISO 20022 framework and several other blockchain networks. Ripple is used for interbank funds and CBDC funds. Stellar helps cross-border remittances and stablecoins.

Algorand is testing asset tokenization and digital bonds. Hedera has been utilized to company and authorities registries. Quant acts as a gateway between banks and blockchain.

Trade observers count on additional integration of CBDCs and tokenized property to happen by January 2026, doubtlessly supporting new fashions of digital foreign money transactions and interoperability between networks.

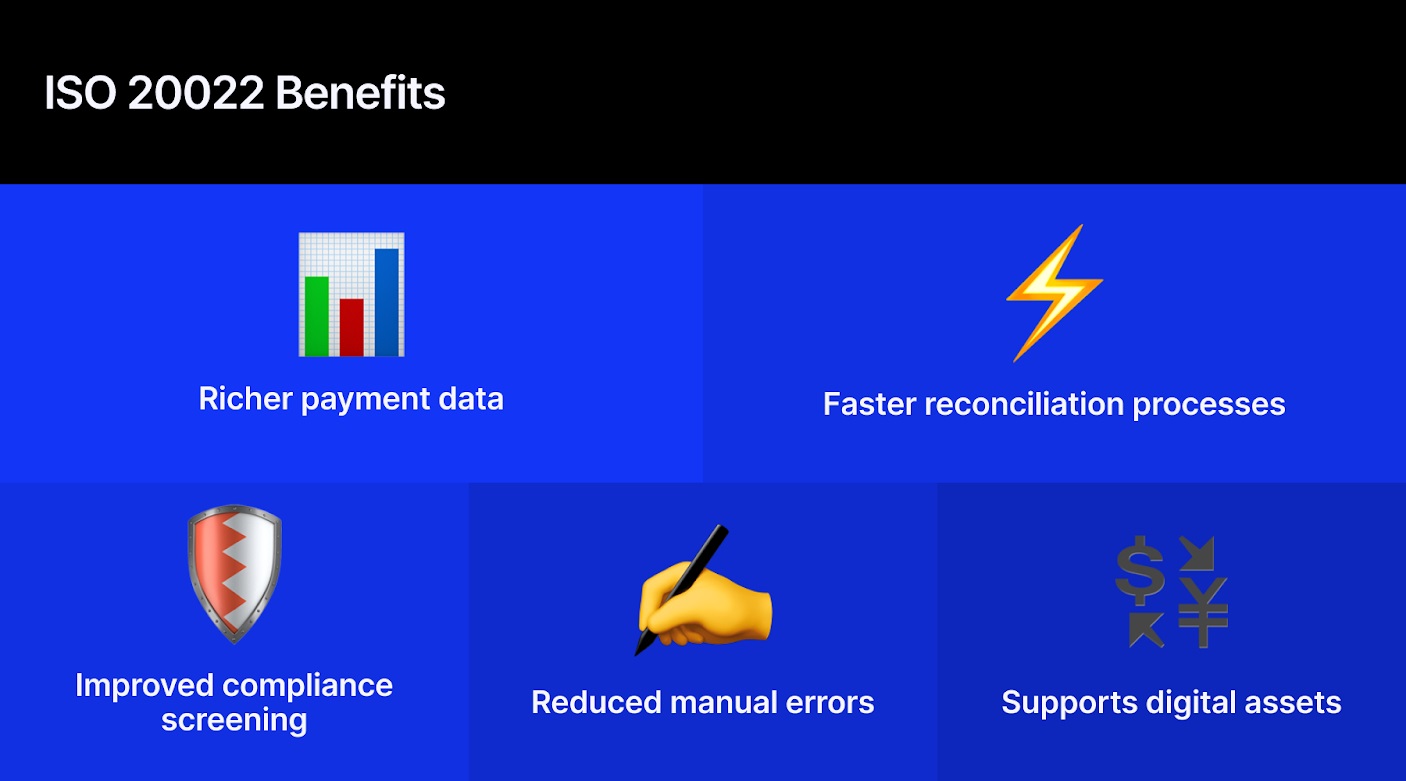

Operational advantages

Murthy Maddali, Managing Director, Techwave

“ISO 20022 facilitates improved compliance with laws corresponding to AML and GDPR by means of wealthy knowledge,” emphasizes Murthy Maddali, Managing Director at Techwave.

He added that “automation reduces prices and errors and will increase processing velocity,” and that “API-driven integrations present scalability, enhanced buyer transparency, and sturdy encryption-based knowledge safety.”

The usual can be designed to scale back fraud and human error, enhance traceability, and assist cross-border transactions, whereas permitting all members to speak utilizing a constant messaging framework for cross-border funds primarily based on CBPR+.

Closing migration timeline

SWIFT has divided the ultimate part into three phases. On November 17, 2025, ISO 20022 will enter full operational readiness. From November seventeenth to twenty fourth, banks and market infrastructure in Europe, Asia and the US will bear a synchronized transition process. The entire switchover on November twenty second marks the purpose at which MT fee directions will now not be supported for reside site visitors.

Citibank is main SWIFT’s ISO 20022 transition. All banks will comply with go well with and it will turn out to be the brand new commonplace for world funds.

ISO 20022 fixes messaging, not funds. That is the hole. #XRP is a bridge that permits real-time worth switch. https://t.co/4RHx9A7CtV pic.twitter.com/H0HuerdH7Y

— Black Swan Capitalist (@VersanAljarrah) September 10, 2025

Scope of change

This cutover primarily applies to fee instruction messages, that are central to correspondent banking. Another MT classes, corresponding to reporting and analysis, will stay on a gradual roadmap past 2025. Nonetheless, the primary impact is important: core cross-border funds will transfer to a single trendy commonplace for the primary time.

Goal of introducing ISO20022

ISO 20022 supplies richer, extra structured knowledge to enhance automation, reconciliation, compliance testing, and processing effectivity. Extra detailed knowledge means much less guide work and fewer probability of error. Regulators consider that elevated granularity will assist enhance transparency and monitor monetary crime.

Connection to market innovation

This commonplace aligns with developments in tokenization, programmable funds, and central financial institution digital foreign money initiatives. SWIFT carried out a trial linking its interface to a distributed ledger community to check how tokenized property, or CBDCs, might be moved between completely different methods.

These trials are exploratory and never a full manufacturing deployment, however they reveal how messaging migrations assist future interoperability.

Trade expectations after cutover

Observers count on consideration to shift to experimentation with tokenized securities, on-chain fee fashions, and nascent CBDC interoperability frameworks in early 2026. The ISO 20022 structured knowledge mannequin is taken into account a prerequisite, permitting conventional establishments to work together with digital asset methods by means of commonplace fields and constant codecs.

Operational readiness and dangers

Banks nonetheless getting ready are dealing with rising urgency. SWIFT has warned that failure to fulfill the November deadline might lead to enterprise interruptions, larger processing prices and decreased effectivity. A number of regional central banks and business associations have launched preparedness applications to assist testing and coaching.

Trade gamers consider the cutover will create a extra standardized surroundings for core cross-border funds. They count on improved knowledge high quality, operational effectivity, and the flexibility to adapt to new fee applied sciences.

The total affect of the transition will turn out to be clearer as soon as ISO 20022 is totally carried out and market members alter their methods and processes.