Bloomberg Intelligence Senior Commodity Strategist Mike McGlone has warned that Bitcoin (BTC)’s current underperformance may worsen within the coming months, inflicting the cryptocurrency to fall in the direction of $50,000.

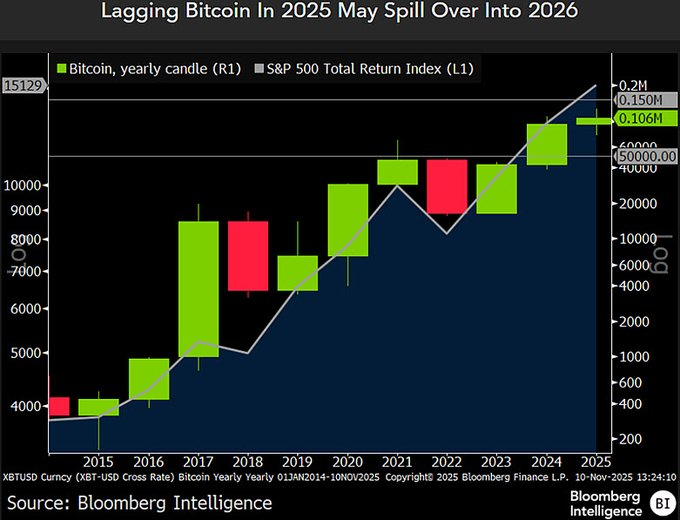

McGlone famous that Bitcoin has lagged the S&P 500 Complete Return Index in 2025, rising solely 13% in comparison with the inventory index’s 17% acquire via November 10.

This weak spot comes regardless of robust ETF inflows and higher-than-normal Bitcoin volatility, suggesting the crypto bull market could also be dropping momentum, he defined, in accordance with an XPost shared on November 11.

particularly, bloomberg intelligence Information backs up McGlone’s warning, displaying that Bitcoin’s annual candlestick remains to be constructive however dropping momentum because it approaches the tip of 2025.

His evaluation reveals Bitcoin’s momentum has weakened relative to conventional “beta” belongings, which may pose a reversal threat into subsequent 12 months.

He cautioned that this sample displays previous cycles through which late-game positive factors for Bitcoin have been changed by sharp corrections, suggesting a potential 2026 buying and selling vary between $50,000 and $150,000.

Cooling of high-risk belongings

The investor additionally linked Bitcoin’s weak spot to broader indicators of cooling in high-risk belongings corresponding to copper, whose record-setting 2025 efficiency slipped again to par with the S&P 500 after tariff-related considerations receded in July.

McGlone advised that this alerts a shift to a extra deflationary atmosphere, which may put additional strain on speculative belongings corresponding to Bitcoin.

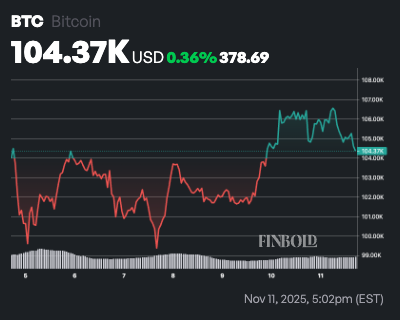

His warning comes as Bitcoin struggles to interrupt above the $105,000 assist stage. Notably, after falling beneath $100,000, Bitcoin rebounded barely following reviews that the U.S. authorities might reopen, however momentum has since stalled.

Bitcoin worth evaluation

On the time of writing, Bitcoin was buying and selling at $104,366, down nearly 2% up to now 24 hours. On a weekly timeline, the cryptocurrency is up by simply 0.36%.

On the present worth, Bitcoin is pegged at $105,751 in opposition to its 200-day easy shifting common (SMA). The value is $7,900 beneath the 50-day SMA of $112,216, confirming near-term bearish management and a transparent downtrend since mid-October.

The 14-day RSI is impartial at 47.76, however it has cooled shortly from overbought ranges, indicating that promoting strain is easing and it’s approaching the zone the place a rally sometimes begins (beneath 40).

If it sustains above $105,751, the macro bullish pattern is sustained and a potential snapback to $112,216-113,264 is focused. Nevertheless, if the day by day shut falls beneath this stage, sentiment turns into bearish and opens the door to a retest of $100,000.

Featured picture by way of Shutterstock