Bitcoin has been buying and selling between $89,250 and $90,500 this weekend, searching for a breakout however missing the power to proceed after that, making a “perhaps, perhaps not” vibe. The market capitalization exceeds 1.8 trillion {dollars}, and the every day buying and selling quantity is 53.15 billion {dollars}, attracting consideration, but it surely has not but proven a transparent course.

Bitcoin chart outlook

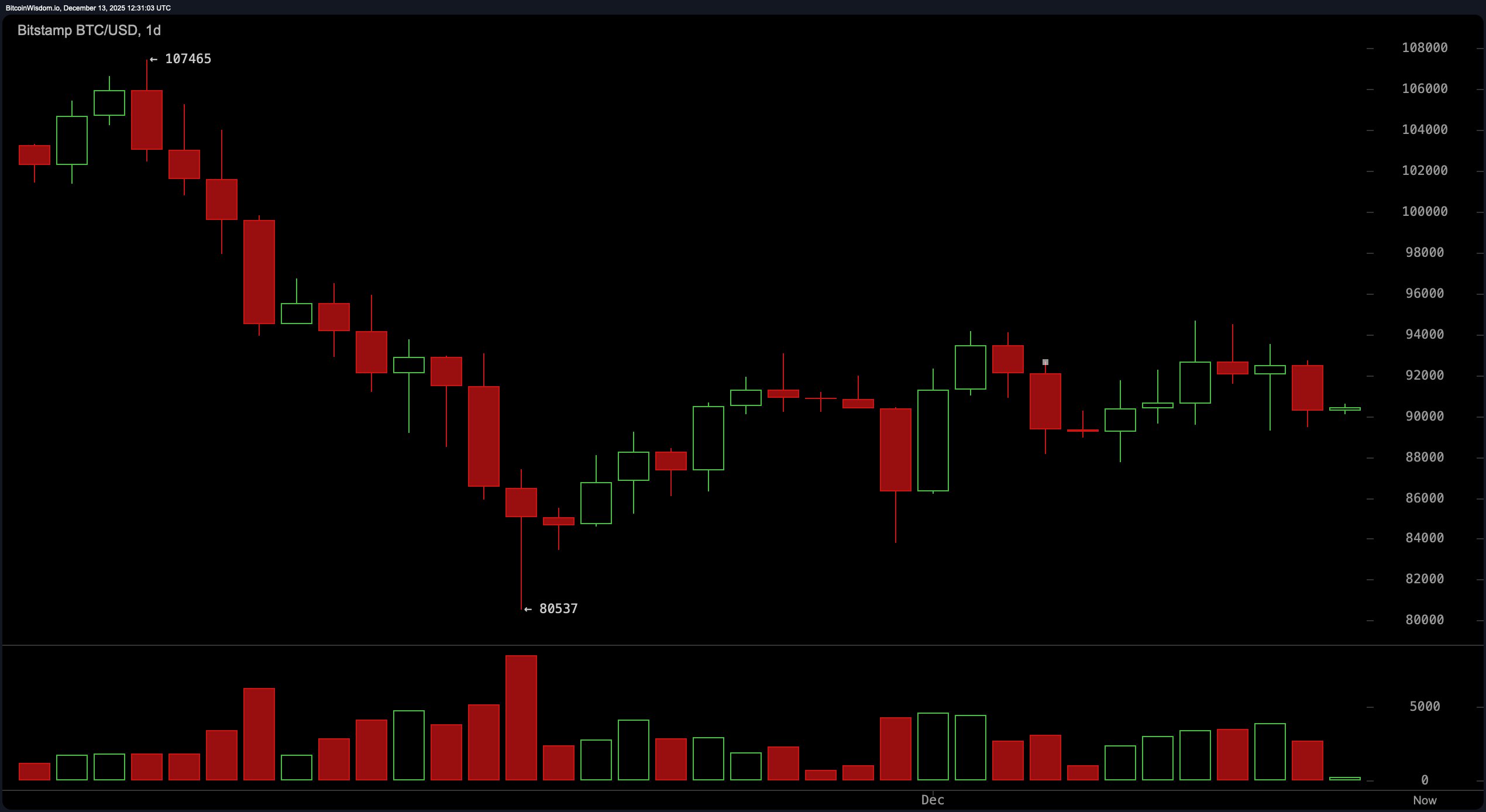

Wanting on the every day chart, Bitcoin seems to be dancing between the $88,000 and $96,000 consolation zone after a troublesome rejection close to $94,000. The asset has cooled from its excessive of $107,465 and is again to sideways worth motion. This type of market indecision smells like a consolidation, particularly with quantity truly fizzling out after a spike close to the $80,537 backside. It is a clear signal that main firms have purchased on the spur of the second. Nonetheless, with out new shopping for stress, Bitcoin dangers reverting to earlier assist ranges.

BTC/USD 1-day chart by way of Bitstamp for December 13, 2025.

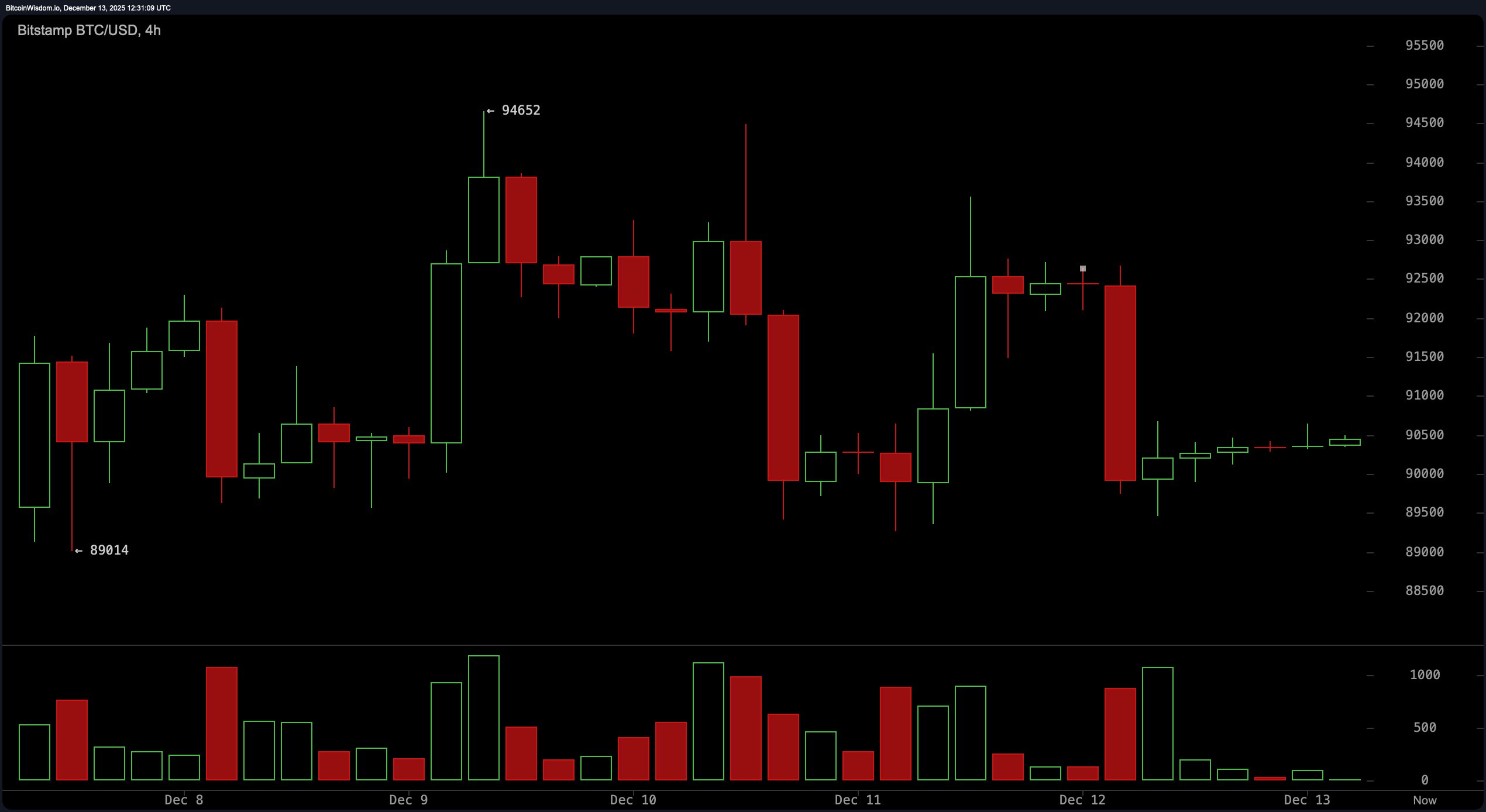

Should you zoom in on the 4-hour chart, the image turns into much more unstable. Bitcoin lately fell from $92,500 to $89,000 in a single huge crimson candlestick. At the moment, a swimsuit with the grace of a weary swimmer prices about $90,500. Some Doji candlesticks are hinting at uncertainty, and the thinning quantity appears ripe for squeeze. A break above $92,500 might unlock a short-term up leg, assuming quantity isn’t on trip. Nonetheless, if Bitcoin hits a double high at $94,500, the rejection could possibly be vital.

BTC/USD 4-hour chart by way of Bitstamp on December 13, 2025.

Should you’re searching for certainty, hourly charts aren’t very useful. It is all tight candlesticks and side-eyes from merchants, reflecting a market mired in decision-making paralysis. The worth construction is compressed simply above $90,000, with growth occurring in both course normally. Should you can clear $91,000 with enthusiasm, it’s possible you’ll quickly see $92,500. In any other case, a fall under $89,000 might result in a revisit to the $88,000 flooring with none ceremony.

BTC/USD 1-hour chart by way of Bitstamp on December 13, 2025.

Oscillators do not precisely throw events. The Relative Power Index (RSI) is 45, indicating it’s impartial. The stochastic oscillator reveals 67 and continues to be inconclusive. The Commodity Channel Index (CCI) is hovering at -2 and the Common Directionality Index (ADX) is displaying a sleepy 26. The good oscillator is at -433, clearly unimpressed, whereas the momentum is at -3,080, indicating sustained weak spot. Nonetheless, the Transferring Common Convergence Divergence (MACD) stays a bit bullish at -1,236. That is the one optimist in a room stuffed with wallflowers.

Is it a shifting common (MA)? It does not do Bitcoin any favors proper now. All main exponential and easy shifting averages from 10 days to 200 days are firmly within the “downward resistance” class. The ten-day exponential shifting common (EMA) and easy shifting common (SMA) are at the moment hovering round $90,986 and $90,968, respectively, barely above the value and below stress. As for the 200-day EMA and SMA of $103,348 and $108,667, Bitcoin would wish wings to succeed in these ranges in the meanwhile.

Conclusion: Bitcoin is within the field, with neither the bulls nor the bears in command of the narrative, stabilizing at simply above $90,000. The chart is hinting at a breakout, or breakout, however it isn’t reacting in both course. It is a ready recreation and the subsequent large candle could possibly be what breaks the stalemate.

Bullish verdict:

If Bitcoin maintains its grip above $90,000 and quantity helps a breakout above $91,000-$92,500, momentum might tilt upwards towards the $94,000-$96,000 resistance zone. Search for a strong transfer backed by rising quantity and strengthening of the one oscillator at the moment displaying optimism, the Transferring Common Convergence Divergence (MACD).

Bear verdict:

If Bitcoin loses its footing under $89,000 attributable to elevated gross sales quantity, the subsequent cease could possibly be at $88,000, which might retest the $80,500 assist if bearish momentum accelerates. With all main shifting averages tilting in the direction of the value and downward momentum, the draw back path affords much less resistance than bulls want to admit.

Often requested questions ❓

- What’s the present worth of Bitcoin? Bitcoin is buying and selling at $90,398 as of December 13, 2025.

- What’s Bitcoin’s market capitalization at this time? Bitcoin’s market capitalization is $1.8 trillion.

- Is Bitcoin at the moment in an uptrend or a downtrend? Bitcoin is holding regular after its current drop from $94,000.

- Which worth ranges ought to Bitcoin merchants deal with at this time?The important thing ranges to observe are assist at $88,000 and resistance at $94,000.