Solana Digital Asset Treasury (DAT) DeFi Growth Corp. (DFDV) has expressed help for a sweeping proposal geared toward accelerating the community’s deflation schedule.

On Tuesday, DFDV turned the primary Solana Treasury to publicly endorse Solana Enchancment Doc (SIMD)-0411. The doc proposes to double Solana’s annual inflation charge from 15% to 30%, thereby lowering projected future emissions by greater than SOL 22 million over the following six years.

“Whereas this proposal might come as a shock to some, its timing is sensible,” DFDV wrote. “The ecosystem has develop into more and more vocal about Solana’s present inflation schedule and its influence on SOL’s worth.”

Based on knowledge from the Solana Strategic Reserve, DFDV owns roughly 2.2 million Solanas (SOLs), valued at roughly $300 million on the time of this writing. This makes the corporate the third largest company holder of the SOL token.

DFDV’s help provides organizational weight to the high-stakes debate, however different DATs similar to Ahead Industries and Solana Firm should not concerned within the topic.

sauce: As a result of Mumtaz

Proposal seeks to speed up deflation in Solana

Builders at Helius Labs launched SIMD-0411 on Saturday, making it some of the important financial coverage proposals since Solana’s launch.

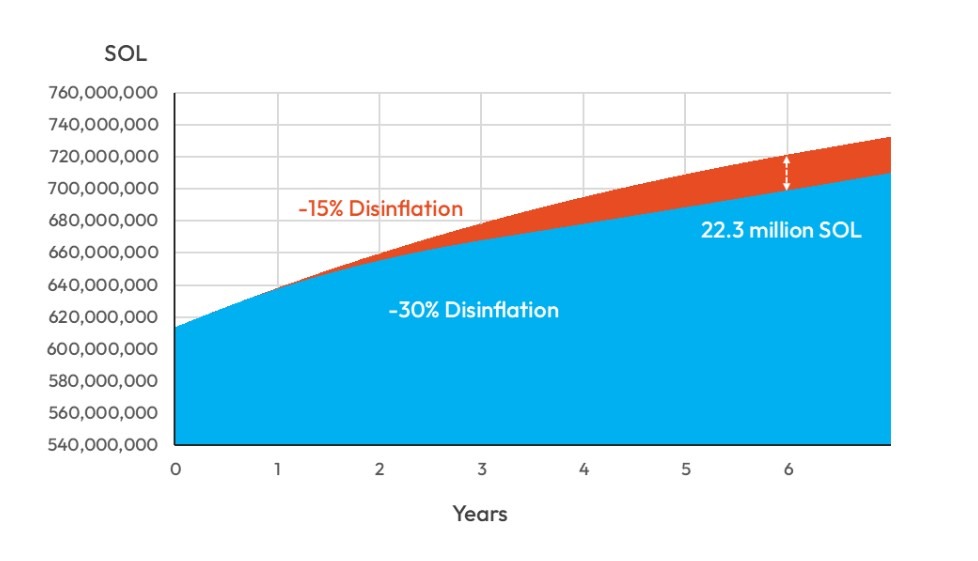

The draft proposal recommends doubling Solana’s annual disinflation charge from 15% to 30%, which might permit the community to achieve its long-standing 1.5% closing inflation charge in simply three years as a substitute of six.

The proposal is geared toward accelerating the deflation of Solana. Supply: GitHub

Based on the mannequin shared within the proposal, this alteration is predicted to scale back emissions by roughly 22 million SOL tokens (equal to roughly $3 billion) over six years.

The builders said that the present inflation curve not displays the maturity of the community, however as a substitute refers to community income, consumer exercise, and decentralized finance (DeFi) throughput.

Proponents stated lowering issuance would permit the community to scale back structural promoting strain and extra intently align with what institutional traders anticipate from trendy crypto belongings.

Associated: Solana ETF raises $369 million in November as traders concentrate on high-yielding belongings

Solana worth slide places strain on DAT

Based on knowledge from CoinGecko, SOL has fallen 30% up to now month, from $197 on October 26 to $136 on the time of writing. The talk over inflation has develop into much more tense because the sharp financial downturn has left some shareholders of huge firms with important losses.

Based on CoinGecko, Ahead Industries, the biggest company SOL holder, faces roughly $646.6 million in unrealized losses, representing a 41% decline from the whole buy worth.

Upexi, the fifth-largest firm holder, can also be within the pink with unrealized losses of about $31 million and is down 10% from its entry worth.

DFDV, which publicly supported the proposal, stays worthwhile. Based on CoinGecko knowledge, the corporate has gained about $62 million in SOL purchases thus far, reflecting an unrealized achieve of 26.6%.

journal: Ethereum’s Fusaka fork defined to freshmen: What precisely is PeerDAS?