PayPay, a cost service operated by Japanese funding holding firm SoftBank Group, is integrating a brand new cost rail into Binance Japan following an funding within the platform.

Binance Japan and PayPay have launched a brand new collaborative service with PayPay Cash, an digital cash service that enables free peer-to-peer transactions between PayPay customers.

With this integration, Binance Japan customers can not solely buy crypto belongings utilizing PayPay Cash funds, but in addition withdraw their crypto holdings straight into PayPay Cash.

The transfer follows PayPay’s acquisition of a 40% stake in October and marks Binance Japan’s first enlargement past financial institution transfers in Japanese yen.

You possibly can deposit and withdraw from as little as $7

PayPay Cash permits Binance Japan shoppers to carry out each deposits and withdrawals in a single click on when shopping for and promoting crypto belongings on the spot buying and selling platform.

Based on PayPay, the minimal quantity for these transfers begins at 1,000 yen (roughly $6.50) and transactions can be found 24 hours a day.

To proceed with the cost, Binance Japan customers should full identification verification on each the Binance Japan app and the PayPay app and conform to account linking.

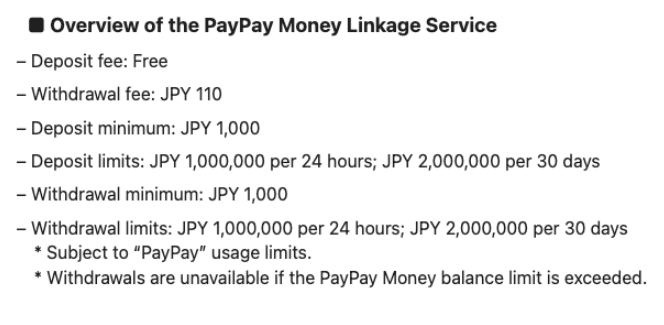

PayPay Cash price for Binance Japan remittance. Supply: PayPay

The preliminary deposit price is free, however the withdrawal price is fastened at 110 yen ($0.60). Deposit limits are restricted to 1 million yen ($6,380) per day and a couple of million yen ($12,760) monthly, and comparable limits apply to withdrawals.

The announcement additionally states that withdrawals will not be attainable if the PayPay Cash steadiness restrict is exceeded.

Associated: Metaplanet considers elevating $135 million via new Class B shares to gas additional Bitcoin purchases

SoftBank is a significant Japanese monetary firm that has been actively searching for funding alternatives in cryptocurrency ventures.

Amongst notable crypto investments, SoftBank is backing Twenty One Capital. Twenty One Capital is among the world’s largest publicly traded firms with Bitcoin (BTC) publicity, holding roughly 43,500 BTC ($3.7 billion).

Twenty One Capital, backed by SoftBank, is among the many high 10 listed firms that maintain Bitcoin (as of November 6, 2025). Supply: CoinGecko

The most recent Binance Japan merger comes as SoftBank continues to push for a PayPay itemizing within the U.S., with traders reportedly anticipating the corporate to be valued at greater than 3 trillion yen ($20 billion) in a U.S. preliminary public providing that might happen as early as December.

journal: Bitcoin whale metaplanet is “underwater” however regulate extra BTC: Asia Categorical