Ethereum is buying and selling beneath the $3,000 stage as promoting strain continues to weigh on the general crypto market. After weeks of risky worth fluctuations, ETH has did not regain key psychological and technical ranges, reinforcing the delicate market construction.

Sentiment stays decidedly bearish, and worry and even apathy are beginning to dominate dealer conduct. Volatility is shrinking, participation is declining, and plenty of analysts are more and more pointing to a long-term bear market situation lasting till 2026.

This lack of perception shouldn’t be restricted to retailer members. In keeping with information shared by Lookonchain, two massive whales launched a mixed 14,000 ETH (equal to roughly $40.82 million) in simply the previous two hours. Such aggressive promoting in an already depressed setting places additional strain on property which are struggling to draw sustained demand.

Though remoted whale exercise itself doesn’t outline broad tendencies, timing is vital. Massive distributions in periods of low liquidity typically amplify draw back worth actions and reinforce damaging sentiment available in the market as an entire.

Ethereum whale vendor faces lengthy sentence

Arkham information shared by Lookonchain reveals new proof of an enormous sell-off as Ethereum trades underneath sustained strain. Deal with 0x2802 offered 10,000 ETH value roughly $29.16 million by means of the decentralized trade at a mean worth of $2,915.5.

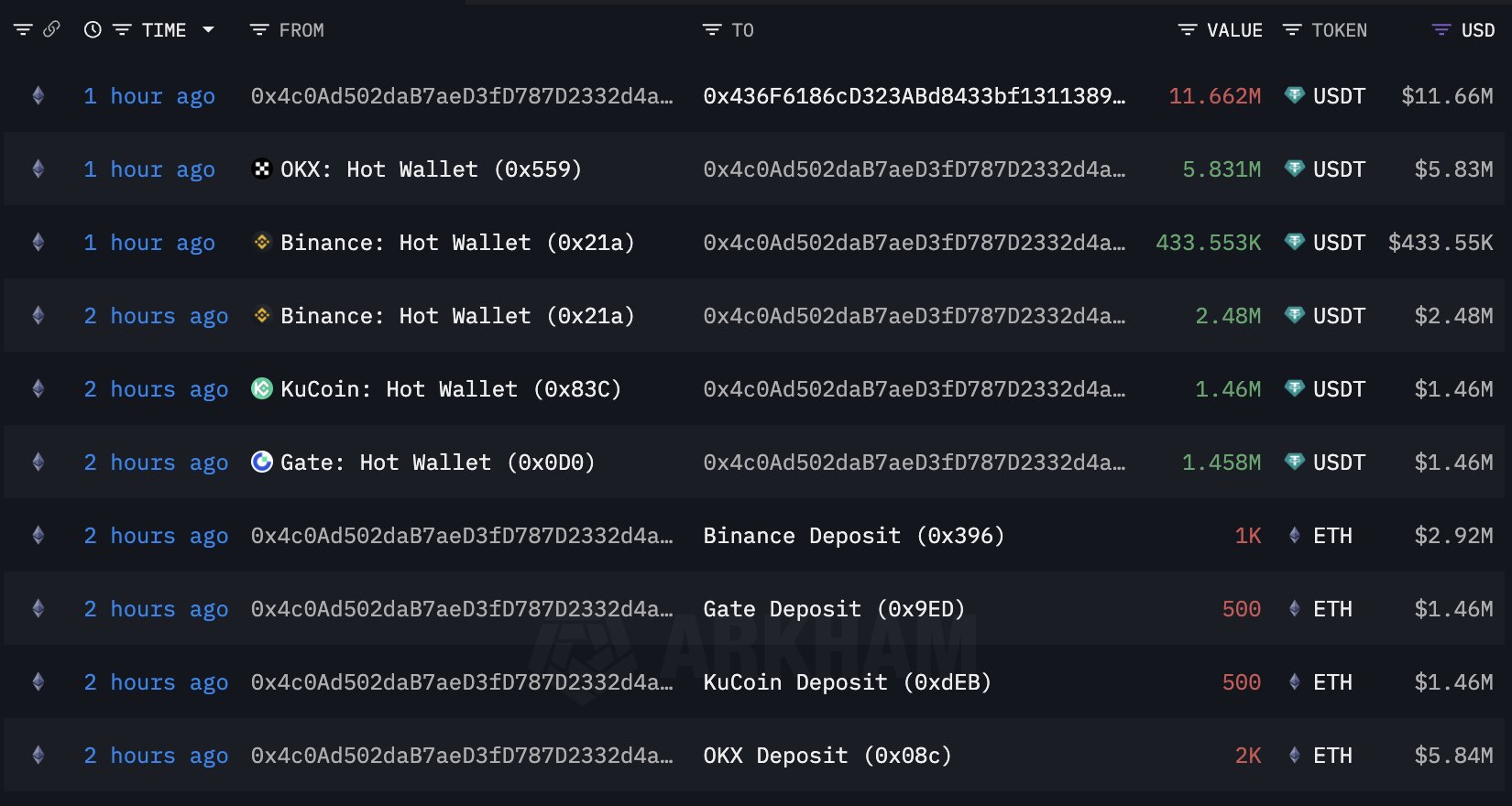

Shortly after, one other whale, 0x4c0A, offloaded 4,000 ETH value roughly $11.66 million and unfold the gross sales throughout a number of centralized venues together with OKX, Binance, KuCoin, and Gate. The timing and correction of those strikes reinforces the present bearish tone, particularly as liquidity stays skinny and broad market sentiment is defensive.

Within the quick time period, this exercise will increase downward strain and will increase uncertainty amongst small buyers. Small buyers typically interpret whale promoting as a sign of additional weak spot going ahead. Nevertheless, worth actions and sentiment alone do not inform the entire story. Regardless of the drawdown, Ethereum’s fundamentals proceed to strengthen at a tempo hardly ever seen earlier than. Institutional adoption is accelerating fairly than slowing down.

Most notably, JPMorgan not too long ago introduced that it’ll launch its first tokenized cash market fund utilizing Ethereum, a milestone that confirms its rising confidence in Ethereum as a funds and monetary infrastructure layer. Whereas markets might stay bearish within the quick time period, the disconnect between worth sentiment and basic developments is changing into more and more troublesome to disregard.

Ethereum worth struggles to carry key weekly assist

Ethereum continues to be underneath strain on the weekly chart, with the worth at present hovering round $2,950 after a pointy pullback from the $3,200-$3,300 space. This space beforehand served as an vital pivot zone, however has now clearly become a resistance power. Its incapability to get better confirms that the vendor continues to manage the medium-term construction.

From a pattern perspective, ETH is consolidating round its 200-week shifting common (crimson line), a traditionally vital stage that can decide whether or not the correction continues cyclically or develops right into a deeper bearish part. Up to now, this shifting common acts as dynamic assist and prevents a extra aggressive breakdown. Nevertheless, momentum stays weak and follow-through on the upside is proscribed.

The 50- and 100-week shifting averages (blue and inexperienced strains) are beginning to flatten and converge, reflecting indecision and lowering pattern power. Quantity additionally stays subdued in comparison with earlier growth phases, suggesting that neither robust accumulation nor capitulation is happening at present ranges.

Structurally, ETH stays inside a variety between $2,500 and $3,300. A weekly shut beneath the $2,800-$2,900 space will expose the draw back in direction of the decrease finish of that vary. Conversely, it will must regain $3,300 to reestablish bullish momentum. Till then, Ethereum stays technically weak regardless of its long-term fundamentals.

Featured picture from ChatGPT, chart from TradingView.com