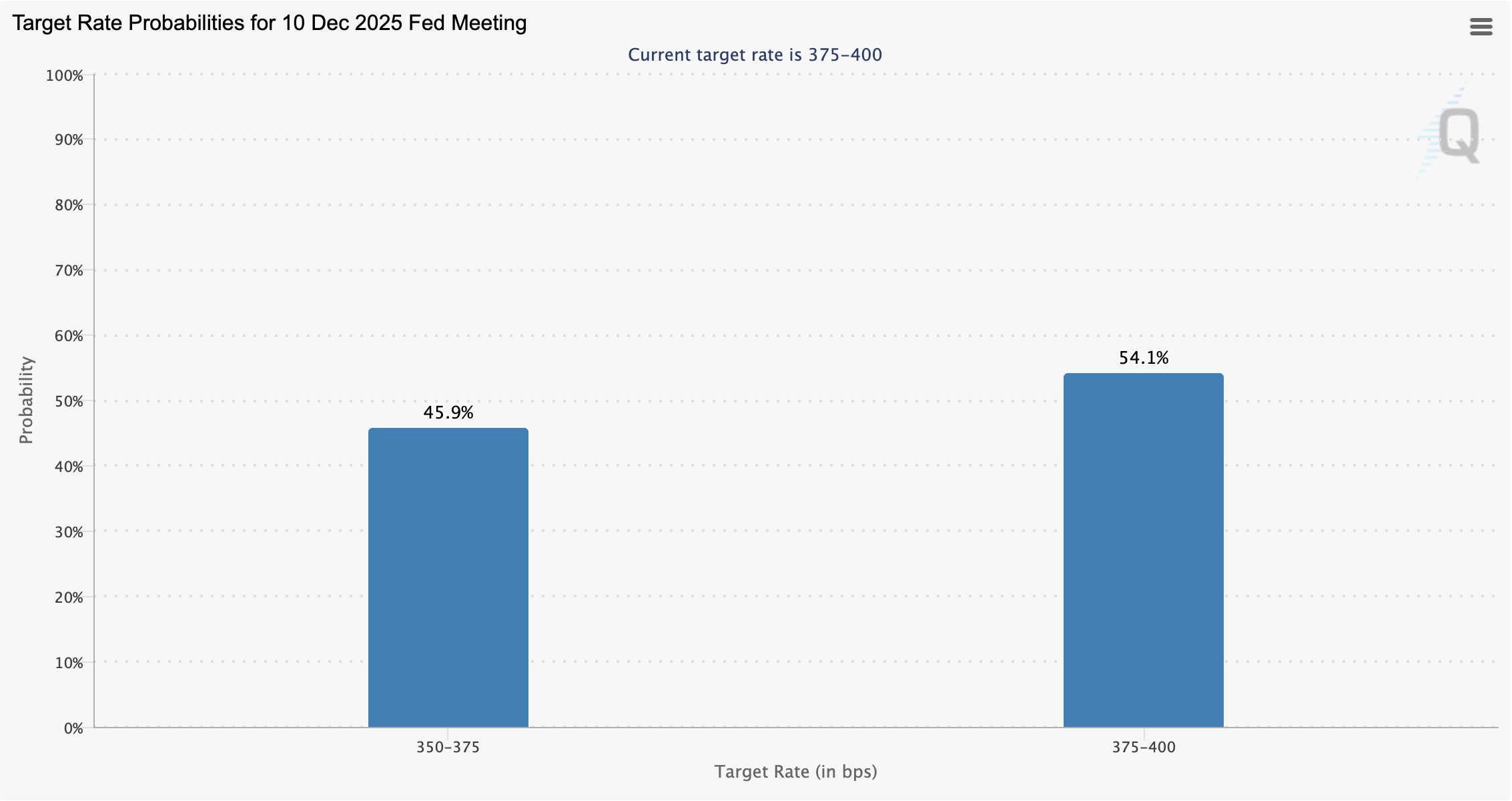

Amid declining market sentiment and a weak crypto market, solely 45.9% of traders anticipate an rate of interest minimize on the subsequent US Federal Open Market Committee (FOMC) assembly in December.

The likelihood of a 25 foundation level (BPS) price minimize in December was almost 67% as of Nov. 7, in response to knowledge from the Chicago Mercantile Trade (CME) Group.

In September, a number of banking establishments predicted at the very least two price cuts in 2025, with market analysts at funding financial institution Goldman Sachs and banking large Citigroup every predicting three 25 foundation factors cuts in 2025.

Rate of interest likelihood. sauce: CME Group

Rate of interest selections have an effect on the value of digital currencies. Decrease rates of interest will permit extra liquidity to stream into asset markets, supporting costs, whereas rising rates of interest will restrict liquidity and costs.

The decrease likelihood of a December price minimize is negatively impacting market sentiment and will sign extra near-term value ache for the crypto market till the Federal Reserve resumes price cuts.

Associated: Stablecoin demand is rising and will push rates of interest down: Fed’s Millan

Fed’s Jerome Powell questions December rate of interest minimize

“There have been very completely different views on easy methods to proceed in December,” Federal Reserve Chairman Jerome Powell stated in October. “Additional cuts in rates of interest on the December assembly usually are not a foregone conclusion, removed from a conclusion. Coverage just isn’t in a predetermined path.”

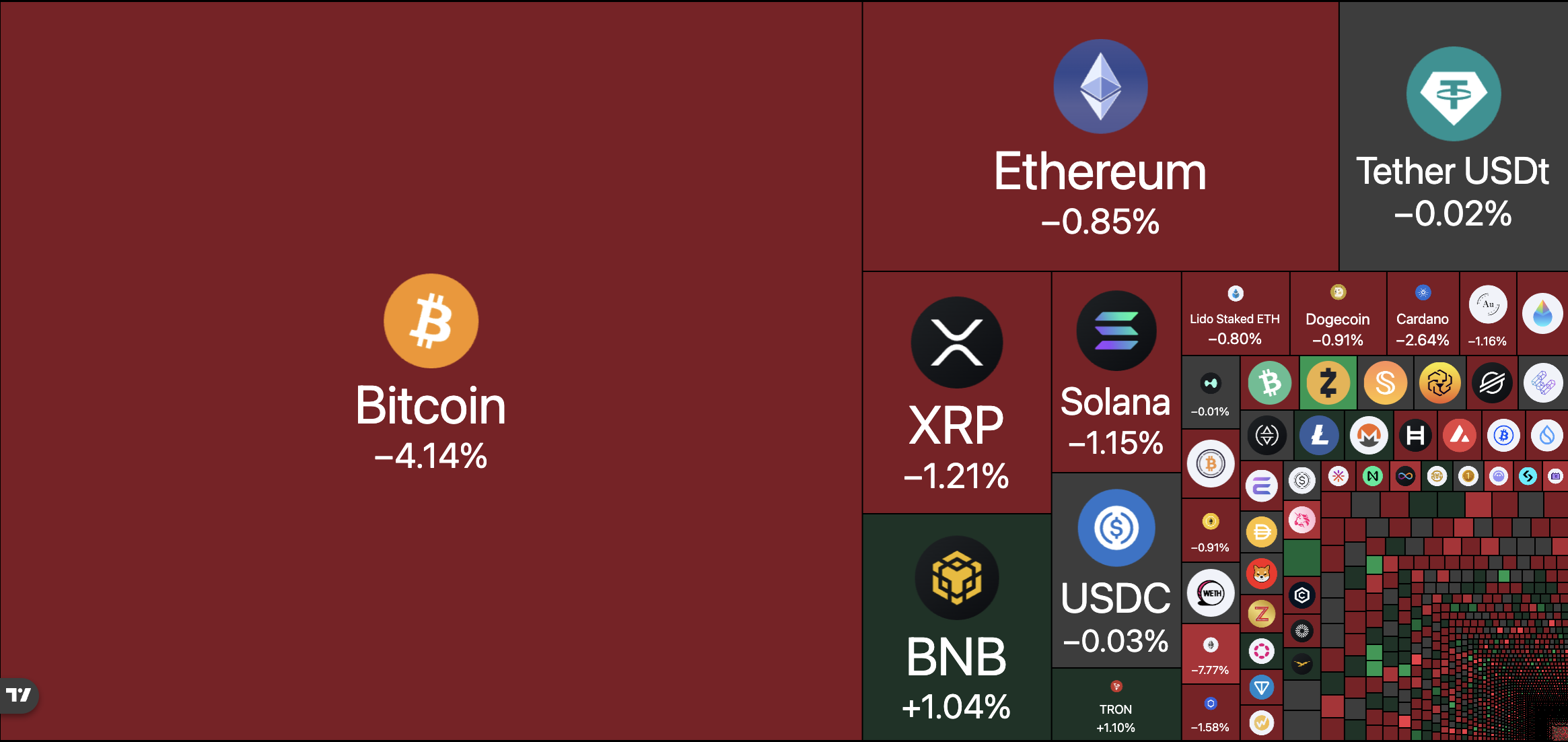

As anticipated, the Fed minimize rates of interest by 25 bps in October. Nonetheless, cryptocurrency costs widened their decline as a result of rate of interest cuts.

The hemorrhaging within the cryptocurrency market continues, with the autumn even wider in October. sauce: TradingView

Traders had been “absolutely pricing in” an October price minimize, stated Matt Mena, a market analyst at funding agency 21Shares, who had been extensively anticipating a price minimize for months.

Economist and former hedge fund supervisor Ray Dalio warned that the Federal Reserve is slicing rates of interest to file excessive asset costs, comparatively low unemployment and low credit score spreads, calling it a historic anomaly.

Dalio stated in November that the Federal Reserve is probably going steering the financial system right into a bubble, including that it is a typical function of a debt-laden financial system headed for hyperinflation and foreign money collapse.

journal: If the crypto bull market is ending… it is time to purchase a Ferrari: CryptoKid