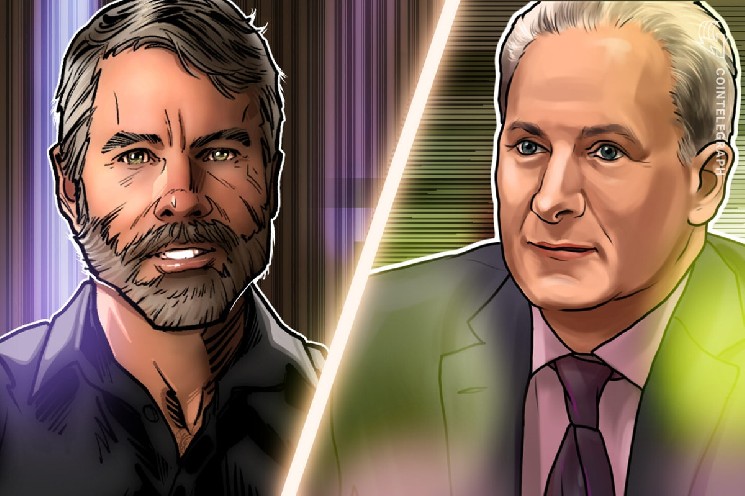

Gold investor Peter Schiff on Sunday known as the enterprise mannequin of Technique, which created the world’s largest Bitcoin (BTC) treasury firm, a “fraud” and challenged the corporate’s founder, Michael Saylor, to a debate.

Schiff, one of many harshest critics of cryptocurrencies and Bitcoin and an ardent defender of gold, challenged Saylor to a debate at Binance Blockchain Week in Dubai, United Arab Emirates (UAE) in December. In one other X submit, Schiff claimed:

“MSTR’s enterprise mannequin depends on income-focused funds shopping for the corporate’s ‘high-yield’ most popular inventory. Nevertheless, the marketed yield is rarely really paid. As soon as fund managers notice this, they may exit the popular inventory.”

sauce: peter schiff

If this occurs, Schiff continued, Technique might be unable to situation any extra bonds, setting off a “loss of life spiral.”

Schiff’s problem and destructive outlook for Bitcoin and the broader crypto trade comes amid a common downturn within the crypto treasury sector, with Bitcoin falling beneath the $99,000 stage and gold recovering to cost ranges above $4,000.

Gold stays above key help at $4,000 whereas Bitcoin and Methods wrestle

BTC’s worth has fallen greater than 20% from its all-time excessive of over $125,000 in October, simply days earlier than the October 10 flash crash that wiped tens of billions of {dollars} of worth from the cryptocurrency market.

Gold worth actions proven by the blue line and Bitcoin worth actions proven by conventional worth candlesticks. sauce: TradingView

In accordance with the corporate, Technique’s mNAV, a number of to internet asset worth, or financial premium over underlying BTC holdings mirrored within the firm’s inventory worth, fell beneath 1 in November, however has recovered to 1.21 on the time of writing.

Regardless of the modest rebound, mNAV 1.21 continues to be comparatively low. Buyers consider {that a} wholesome mNAV for a monetary firm is 2 or larger. Technique inventory has fallen greater than 50% since July, buying and selling at round $199 on the time of writing.

Gold, alternatively, regardless of briefly falling beneath this psychological help stage, has managed to defend the $4,000 per ounce stage and is buying and selling at round $4,085 per ounce on the time of writing.

Gold reached an all-time excessive of about $4,380 an oz in October, and its market capitalization ballooned to greater than $30 trillion, earlier than returning to its present worth.