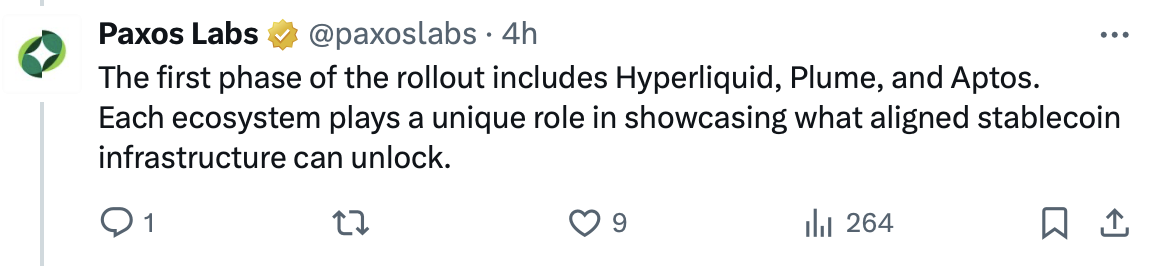

Paxos Labs launched USDG0, an omnichain extension of the regulated USDG stablecoin, bringing absolutely backed greenback liquidity to Hyperliquid, Plume, and Aptos by LayerZero’s OFT normal.

In response to an X publish from Paxos Labs on Tuesday, USDG0 will prolong USDG (USDG), a 1:1 dollar-backed stablecoin issued by Paxos and managed by the International Greenback Community, to a brand new chain with out making a separate wrapped model.

Utilizing LayerZero’s OFT normal, USDG0 could be moved throughout blockchains as a single native asset whereas sustaining the identical regulatory protections and backing as USDG on Ethereum, Solana, Ink, and X Layer.

sauce: Paxos Institute

Paxos Labs stated the preliminary deployment will reveal how totally different networks can hook up with the stablecoin financial system. At Hyperliquid, USDG0 will help yield-aligned buying and selling and new lending markets, whereas Plume and Aptos plan to make use of it to energy modular DeFi, tokenized yield, and enterprise-grade stablecoin rails.

USDG0 is designed to permit apps throughout all three ecosystems to embed greenback liquidity into their merchandise, earn yields tied to Treasury benchmarks, and switch worth between chains with out counting on conventional bridges.

The corporate stated the hassle represents “how regulated infrastructure meets the composability of DeFi and the way trusted cash can turn out to be actually borderless.”

Since 2018, Paxos has processed over $180 billion in tokenization exercise underneath international regulatory oversight. The corporate oversees three regulated dollar-backed stablecoins: USDP, PayPal’s PYUSD, and USDG.

Associated: Visa pilots fiat-funded stablecoin funds for U.S. companies

stablecoins all over the world

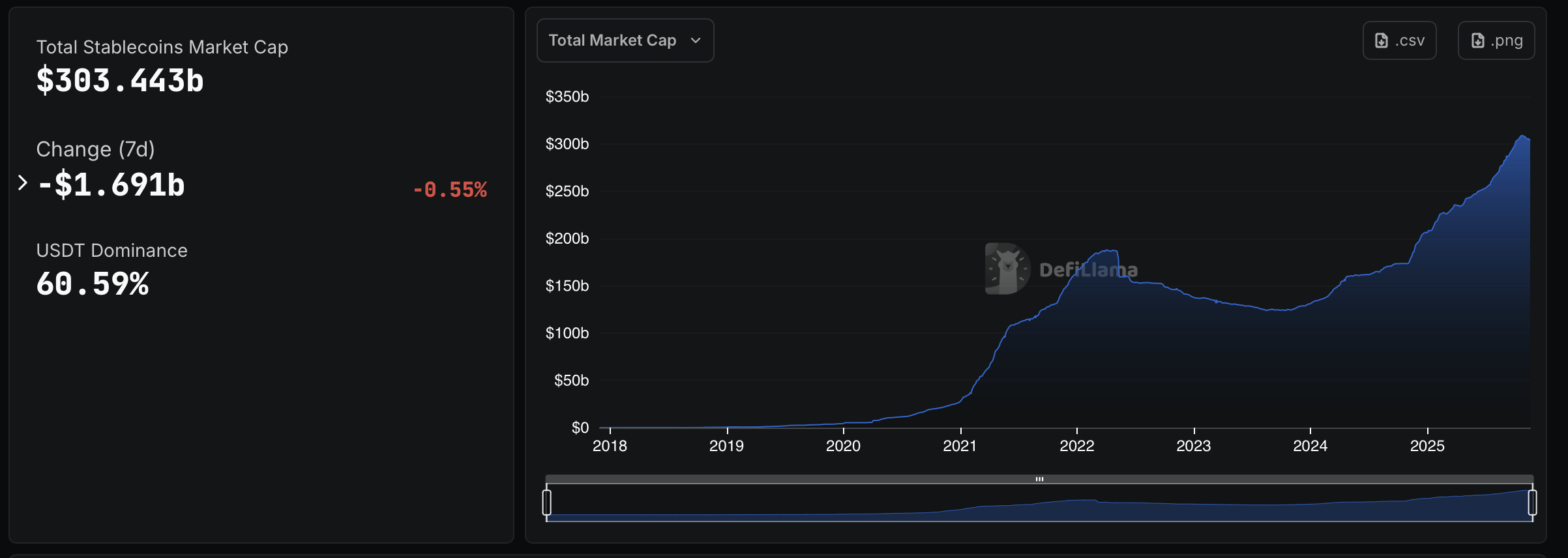

Stablecoin adoption is quickly growing because of regulatory readability within the US underneath the GENIUS Act and in Europe by the Marketplace for Cryptocurrency (MiCA) Framework. In response to information from DefiLlama, the stablecoin market capitalization is $303.44 billion, a rise of almost $100 billion because the starting of the 12 months.

Though the stablecoin market remains to be dominated by Tether Inc.’s USDt (USDT) and Circle Inc.’s USDC (USDC), a number of different gamers have entered the market from all over the world this 12 months.

Stablecoin market capitalization. sauce: Defilama

In October, Western Union introduced plans to launch USDPT, a USD-pegged stablecoin issued by Anchorage Digital Financial institution in Solana. The token is designed to attach the corporate’s digital and fiat fee rails and help international fund transfers and treasury operations.

In the identical month, Tokyo-based fintech firm JPYC launched Japan’s first yen-backed stablecoin, a 1:1 yen-pegged token backed by financial institution deposits and authorities bonds.

In Europe, a consortium of 9 banks introduced in September that it could difficulty a stablecoin pegged to the euro to counter the rise of dollar-backed stablecoins. The stablecoin is predicted to be launched within the second half of 2026.

journal: 2026 is the 12 months of sensible privateness in crypto: Canton, Zcash and extra