HyperLiquid goals to rebuild the place of the HYPE native token, which has sunk under $40. The newest assist comes from Paradigm’s staking deposits, revealing the fund’s giant reserves.

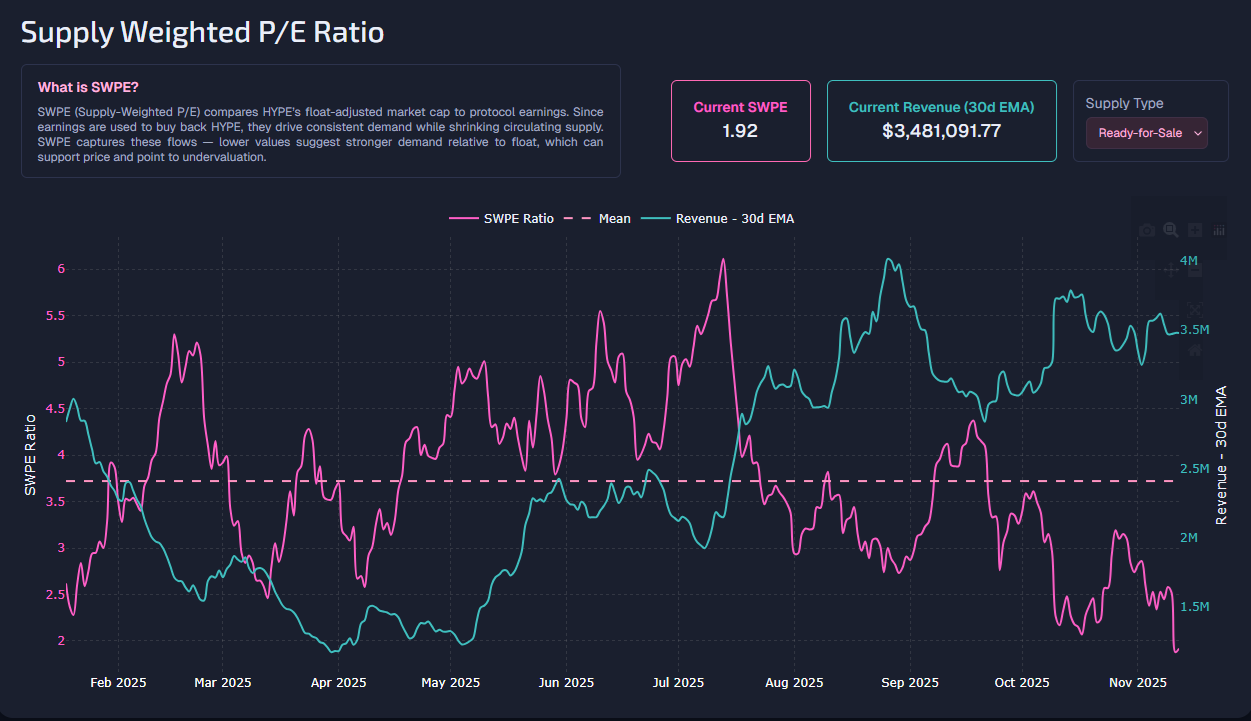

Paradigm, one of many largest holders of HYPE, lately parked a big portion of its holdings for staking. HYPE depends on possession dedication to develop into the muse of the Hyperliquid staking economic system. On account of the newest HYPE transfer, the SWPE indicator of demand totally free provide has hit a brand new low, suggesting HYPE is gaining strong assist.

HYPE’s supply-weighted P/E ratio has hit a brand new low, suggesting strong demand for the token throughout the ecosystem. |Supply: Skuga.

On-chain knowledge reveals that Paradigm is definitely the biggest HYPE holder. Till lately, funding Hyperliquid’s scenario was not clear as Perp DEX revealed a single non-public funding spherical.

In contrast to different VC-backed initiatives, there was restricted consciousness of who supported the platform and what their intentions have been with the token. Nonetheless, HYPE continued to develop after the airdrop and was not offered instantly.

Paradigm has revealed itself as maybe the largest backer of the venture, proudly owning roughly 1.91% of the availability.

Paradigm shift of HYPE inventory to Sonet finance

On-chain knowledge reveals paradigm is locked $581 million Staking includes delegating a portion of your tokens to safe the community. Paradigm stored 1.4 million HYPE in its spot stability, however the majority of the remainder was moved to the Anchorage validator.

Token switch is sonnet biotherapy Merger and creation of HYPE Monetary Firm. Paradigm has additionally contributed, and HYPE’s newest transfer might be associated to playing treasuries for passive earnings. Opposite to preliminary intentions, HYPE discovered that the newly locked tokens additional diminished promoting strain.

Following the information, Sonet inventory traded round $4.60, close to the midpoint of its vary over the previous six months. Whereas DAT firms have misplaced their preliminary attraction, Sonnet continues to be buoyed by Hyperliquid’s success as a number one perpetual DEX and a rising ecosystem of facet initiatives. HYPE continues to safe HyperEVM networks and permits proxy assist for Sonnet.

HYPE goals to get better above $40

HYPE is buying and selling just under $40, making an attempt to rebound from current lows. After the deleveraging occasion on October eleventh, the token recovered to $39.34 as HyperLiquid continues to be rebuilding exercise and open curiosity.

HYPE’s open curiosity stays comparatively weak at $1.36 billion; 70% Variety of merchants going lengthy. About Hyperliquid itself and its environment 67% whale is lengthy the token. Nonetheless, the biggest place in HYPE is a brief sale with a notional quantity of over $61 million.

Over the previous month, Hyperliquid has re-injected $80 million To purchase again HYPE. Decrease costs result in extra buybacks and the token can discover a backside comparatively rapidly. Nonetheless, buybacks should not occurring close to the ceiling, and the worth has not reached a brand new all-time excessive.

Nonetheless, HYPE expects it to finally break above $100 based mostly on demand throughout the ecosystem. HYPE could also be required to create a third-party perpetual DEX with completely different buying and selling phrases and charges.