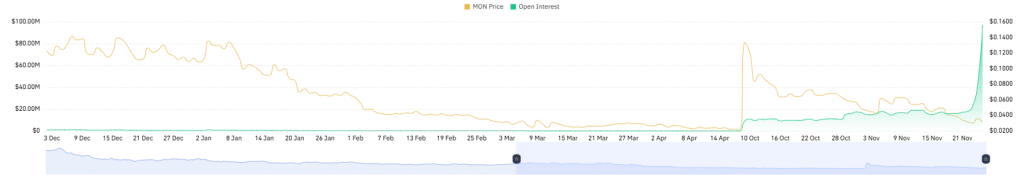

- MON fell to $0.020 as consumers intervened after its mainnet debut, earlier than its ATH surged to $0.038.

- Futures buying and selling quantity soared to over $850 million, and open curiosity hit a report excessive of $145 million.

- Staking yields reached almost 16%, and itemizing on main exchanges saved demand sturdy regardless of excessive volatility.

Monad’s MON token had probably the most abrupt turnaround available on the market this week, rising to an all-time excessive simply hours after falling to its lowest value since launch. In response to CoinMarketCap, this drop pushed MON to round $0.020, and inside hours, consumers had pushed the token’s ATH to $0.038.

On the time of this writing, MON is buying and selling at round $0.03306, a stable 14% day by day achieve, and a market valuation of almost $360 million. This restoration unfolded with a dramatic spike in buying and selling exercise, signaling renewed curiosity following Monad’s mainnet debut.

Why is the worth of MON rising at present?

Mainnet activation will increase preliminary community reliability

The sharp restoration adopted the Monad mainnet launch on November twenty fourth, which was anticipated by many within the developer neighborhood. In response to the report, the chain goals to realize 10,000 transactions per second whereas protecting charges low and sustaining compatibility with the Ethereum digital machine.

Greater than 100 initiatives are already in numerous phases of improvement on the community, together with integrations with Uniswap, MetaMask, and USDC. This activation offered the primary real-world demonstration of Monad’s long-promised efficiency roadmap.

With the early introduction of staking and yields hovering round 15-16% per yr, holders have a direct cause to maintain their MON in circulation. Builders, validators, and early adopters started interacting with the chain within the first 48 hours, creating momentum that possible performed a task in MON’s speedy restoration from its lows.

Public sale demand, change itemizing, and intraday excessive quantity flows

The second main issue within the token rally was the momentum carried over from Coinbase’s public sale, which attracted 85,820 contributors and raised $269 million at a sale value of $0.025 per token.

As well as, being listed on over 25 exchanges has elevated liquidity, with buying and selling quantity totaling over $450 million shortly after launch. This broad market entry allowed MON to soak up the preliminary decline and recuperate rapidly.

sauce: ×

The absolutely diluted valuation at inception was near $2.5 billion, sparking debate about long-term sustainability, however the intense and chronic deal confirmed that almost all contributors selected to have interaction slightly than exit.

Airdrop distribution and locked provide ease early promoting stress

The token launch additionally included a big airdrop, with 76,000 wallets claiming MON 3.33 billion, price roughly $105 million on the preliminary value. Some holders offered rapidly, however the market absorbed the availability with out destabilizing the token’s rebound. One cause would be the undertaking’s lengthy vesting schedule. 50.6% of MON’s whole provide stays locked till 2026.

This locked construction saved circulating provide tighter than many airdrop launches, limiting downward stress in moments of heightened volatility. It additionally seems that early customers who acquired allocations have been extra concerned within the ecosystem than on the primary day of buying and selling, decreasing the chance of a extreme promote chain.

Associated: SHIB rebounds from 10% drop: Will this restoration proceed?

Derivatives market reveals sturdy positioning by lengthy merchants

In the meantime, on-chain derivatives knowledge revealed a surge in speculative curiosity as MON rebounded. On the time of writing, MON’s open curiosity has soared to $100.45 million. Such sentiment sometimes means that market contributors are opening or sustaining positions slightly than closing them, a sign that’s typically related to expectations for short-term motion.

sauce: coin glass

Futures buying and selling quantity additionally reached report ranges, reaching greater than $850 million. This spike highlighted the size of speculative participation following MON’s excessive value actions.

sauce: coin glass

Funding charges strengthened this pattern. The weighted funding fee rose into constructive territory at +0.2901%, indicating that merchants with lengthy positions have been paying a premium to brief sellers to keep up their contracts. This displays the market’s bias towards bullish positioning as MON stabilizes.

In abstract, MON’s restoration unfolded towards the backdrop of sturdy buying and selling exercise, improved on-chain positioning, and powerful curiosity in new mainnets. With a lot of the availability locked up and liquidity nonetheless increasing, the token rebound reveals that traders will proceed to carefully monitor and have interaction with the ecosystem because it builds within the coming weeks.

Disclaimer: The knowledge offered by CryptoTale is for instructional and informational functions solely and isn’t to be thought of monetary recommendation. All the time do your personal analysis and seek the advice of knowledgeable earlier than making any funding choices. CryptoTale will not be accountable for any monetary loss arising from using the Content material.