Libra’s worth soared greater than 30% on Wednesday, at the same time as Argentina’s Congress launched a stunning 200-page report accusing token organizers and political allies of orchestrating a scientific rug-pulling.

This explosive discovery despatched shockwaves via the nation’s crypto and political areas, turning LIBRA into the week’s most controversial token.

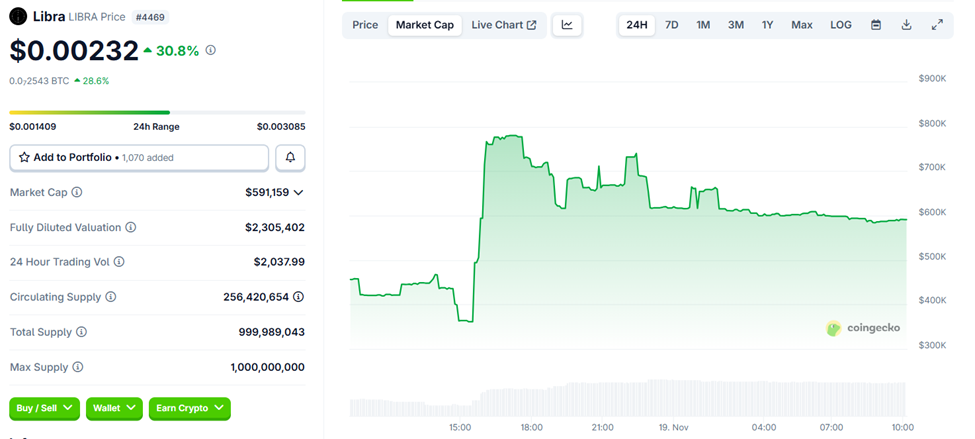

LIBRA rises over 30% amid scandal

As of this writing, LIBRA is buying and selling at $0.00232, marking a rise of virtually 31% prior to now 24 hours. The sudden worth spike got here in tense moments simply hours after Argentina’s LIBRA investigation reached its climax.

Libra worth efficiency. Supply: CoinGecko

Hours earlier, the fee formally submitted its closing report back to the Home of Representatives, concluding that “LIBRA shouldn’t be an remoted incident,” in keeping with Chair Maxi Ferraro.

The report relies on months of testimony, blockchain forensics, skilled evaluation, and greater than 2,000 pages of paperwork.

LIBRA Investigation Committee Chair Maxi Ferraro stated in a public assertion that the proof exhibits a constant “sample of conduct and accountability” throughout a number of earlier token schemes, together with the $KIP operation in 2024.

Maxi Ferraro, LIBRA Investigation Committee Chair

The Fee asserts that LIBRA adopted the identical method, citing:

- deceptive advertising;

- speedy hype,

- Insider positioning and

- Organized exit.

LIBRA was a textbook rug, investigators say

Based on experiences, LIBRA, which was launched on February 14th, was designed to be a basic rug pull. Investigators declare the president’s tweets, listed within the report because the “figuring out issue” behind the spike in Libra costs, created a surge in liquidity that was excellent for insiders to money in.

The handle of the contract was first revealed within the president’s personal put up on X (Twitter) and was instantly made obtainable to the general public, permitting for a surge of retail merchants.

This rush turned out to be devastating, because the fee discovered that:

- Within the 22 seconds main as much as Mirei’s put up being revealed, 87 wallets traded insider data.

- Of these, 36 wallets generated greater than $1 million in income every.

- Greater than 114,000 particular person buyers have been worn out.

These findings forged additional doubt on Milay’s denial on tv of widespread losses after preliminary experiences listed greater than 1,300 Argentines affected by the Libra crash.

Monetary hyperlinks and pre-arrangements

Investigators say they traced monetary and operational ties between the first organizers, consisting of Novelli, Terrones Godoy, Hayden Davis and Sergio Morales, and the earlier token scheme.

These connections have been “judicially confirmed,” the report stated, establishing continuity between LIBRA, KIP, and different earlier tasks promoted or expanded by politicians.

Ferraro harassed that the president can not keep away from political accountability, citing prior conferences with organizers, disregard for warnings, and repeated makes an attempt to impede legislative oversight.

Deputy Sabrina Selva echoed this conclusion, saying that LIBRA was by no means a real funding challenge, however fairly a coordinated operation wherein a couple of folks made off with thousands and thousands of funds.

$LIBRA was not an remoted incident. Mirei had a pre-existing relationship with $LIBRA’s managers and promoted $LIBRA as an funding challenge that did not exist earlier than.

Few folks obtained thousands and thousands of {dollars}, however the president assured him in a Feb. 14 tweet that this might occur.

🔗 The… pic.twitter.com/CRD37oPE9Q

— Sabrina Selva (@SabriSelva) November 19, 2025

Disruption and arranged silence

The report outlines alleged systematic obstruction by administrative businesses, together with the Ministry of Justice, UIF, CNV and OA, who allegedly refused to supply paperwork or testimonies.

Karina Millay was additionally cited for giving organizers entry to Casa Rosada and refusing to look earlier than the fee.

Investigators additionally accuse the judiciary of undermining Congress’ oversight by denying them entry to key case supplies.

Regardless of the avalanche of allegations, Libra’s worth rise highlights how speculative crypto markets behave in moments of political drama.

Regardless of the token being on the middle of a nationwide scandal, merchants seem like betting on volatility fairly than fundamentals.

The discharge of the parliamentary report has elevated stress on Argentina’s political management. So Libra’s story is probably not over but.

President Milais has but to publicly touch upon the matter.

The put up LIBRA worth rises 30% as investigators uncover political bombshell appeared first on BeInCrypto.