The cryptocurrency market is dealing with a pointy downturn as main property proceed to say no. Nevertheless, Solana-based meme coin Jelly-My-Jelly (JELLYJELLY) bucked that pattern and hit a brand new all-time excessive.

This document rally has drawn suspicion from blockchain evaluation platform Bubble Map, elevating issues about the potential of coordinated buying and selling and market manipulation.

JELLYJELLY soars to an all-time excessive because the cryptocurrency market plummets

The cryptocurrency market plummeted on November 4th, with Bitcoin (BTC) dropping under $100,000 at one level. In the meantime, Ethereum (ETH) fell to $3,000, its lowest stage recorded in July.

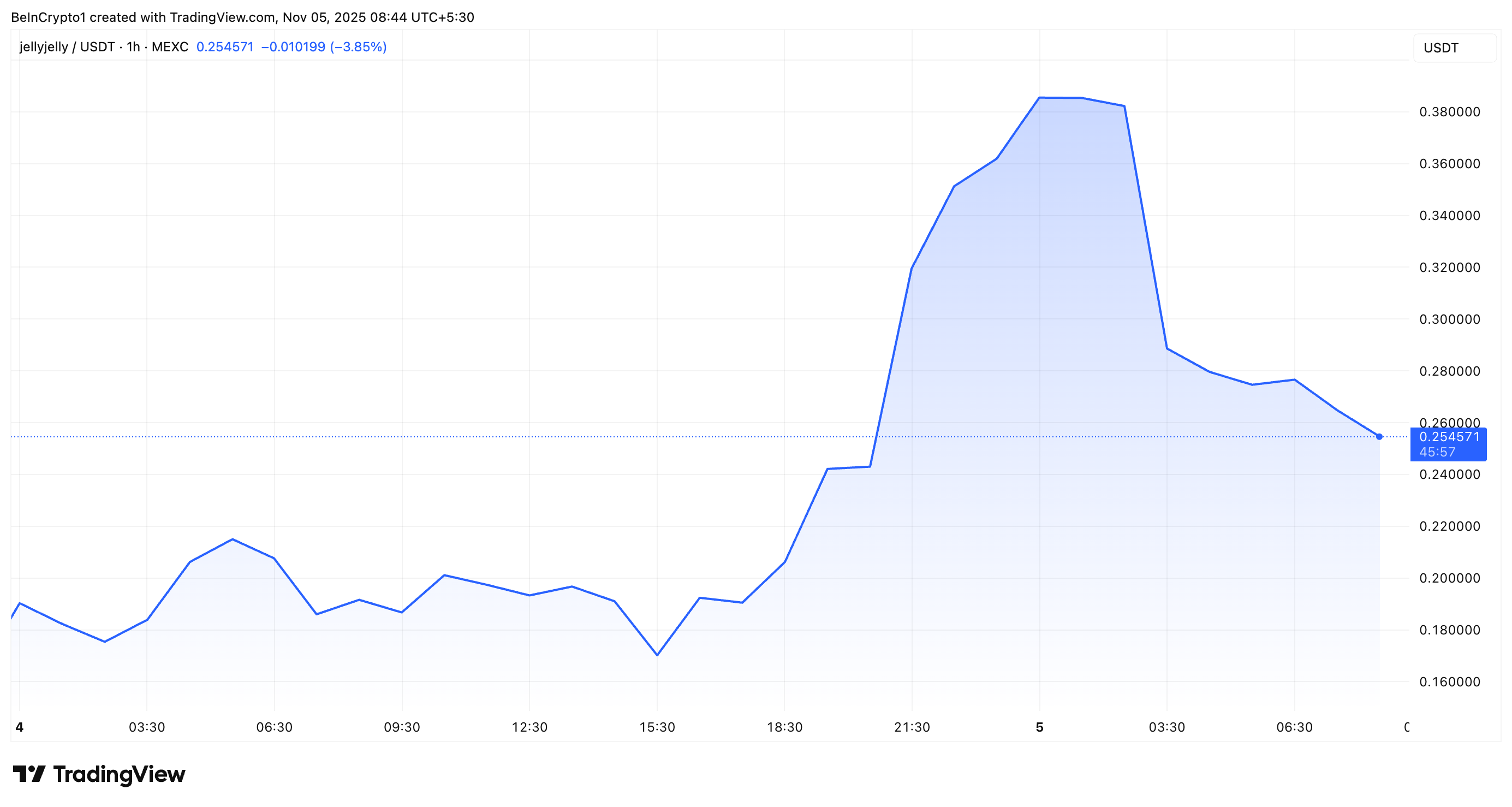

Regardless of the turmoil, JELLYJELLY emerged as an impressive performer. The token reached an all-time excessive of $0.5 on November 4th. Together with this rise, the market capitalization additionally jumped to $500 million.

However, the meme coin has since confronted a slight correction. As of this writing, JELLYJELLY is buying and selling at $0.25, nonetheless up 31.7% prior to now 24 hours.

JELLYJELLY’s price efficiency. Supply: TradingView

The market worth of meme cash was additionally adjusted to roughly $250 million. Nonetheless, buying and selling exercise remained robust. In line with CoinGecko knowledge, every day buying and selling quantity elevated by 96% to $462 million.

Is the JELLYJELLY token rally additionally an instance of cooperative buying and selling?

The hovering costs caught the eye of Bubble Map. The blockchain evaluation platform famous that previously 4 days, seven beforehand inactive wallets have withdrawn 20% of JELLYJELLY’s provide from Gate.io and Bitget.

“Shortly after these CEX withdrawals, JELLYJELLY soared +600% after falling 80% from its earlier excessive,” Bubblemaps posted.

This urged the potential of market manipulation, as a coordinated withdrawal of a giant portion of a token’s provide would probably restrict liquidity on a centralized change, making it simpler to push up costs. Such actions can create a false sense of market momentum.

In the meantime, this isn’t the primary time that JELLYJELLY has skilled collaborative actions. In March 2025, this token was on the heart of an incident involving decentralized change HyperLiquid.

Whales manipulated costs, inflicting a brief squeeze that threatened to end in losses of as much as $230 million to HyperLiquid’s HLP vault. Following this incident, the legal DEX delisted JELLYJELLY, refunded merchants, and strengthened safety by delisting and tightening open curiosity limits.

The submit JELLYJELLY hits $500 million market cap amid crypto crash, invitations scrutiny of operations appeared first on BeInCrypto.