Bitcoin is We’re heading right into a crucial interval The Financial institution of Japan is making ready what could possibly be its most vital coverage transfer in a long time. The central financial institution is extensively anticipated to boost rates of interest by 25 foundation factors to 0.75% at its December 18-19 assembly, the very best degree since 1995 and a transparent sign that Japan continues to maneuver away from ultra-easy coverage.

This upcoming occasion has sparked a number of conversations amongst crypto merchants. Related coverage strikes Assaults from Japan have a number of instances coincided with the start of the Bitcoin value crash.

Japan’s rate of interest hike and repeated Bitcoin decline sample

Crypto market observers are fast to spotlight disturbing patterns concerning cryptocurrencies. Bitcoin and the Financial institution of Japan. Since 2024, every time the financial institution has raised rates of interest, Bitcoin has skilled giant value fluctuations and comparatively fast corrections.

For instance, in March 2024, Bitcoin fell by about 23% after Japan raised rates of interest for the primary time since 2007. After an analogous charge hike in July, it fell by about 26%, however earlier than the January 2025 charge hike there was a major drop of greater than 30%.

Crypto Analyst 0xNobler categorical your concern, He famous that if this historic pattern repeats, Bitcoin may fall beneath the $70,000 degree instantly after the following December resolution. The chart he shared exhibits how every charge hike coincides with the native market’s high, adopted by a notable draw back. The consistency of those strikes has turned what may in any other case be dismissed as a coincidence into a knowledge level that many merchants at the moment are taking severely.

Japanese rate of interest

This stress extends past simply the crypto trade’s response. Japan is the biggest international holder of US authorities debt, and financial tightening by the Financial institution of Japan will impression international liquidity markets. As Japan’s rates of interest rise, the yen appreciates, thereby decreasing the quantity of surplus capital that may circulation into danger belongings.

One other crypto commentator referred to as AndrewBTC echoes this view. Identified the repetition of Bitcoin From 2024 onwards, it would fall by 20% to 31% each time the Financial institution of Japan raises rates of interest. He warned that December’s charge hike may have an analogous end result, and in addition famous that $70,000 could possibly be topic to the speed hike. Doable draw back goal If the sample repeats.

Bitcoin/USD. Supply: @cryptoctlt On X

Bitcoin breaks above long-term help: not everyone seems to be bearish

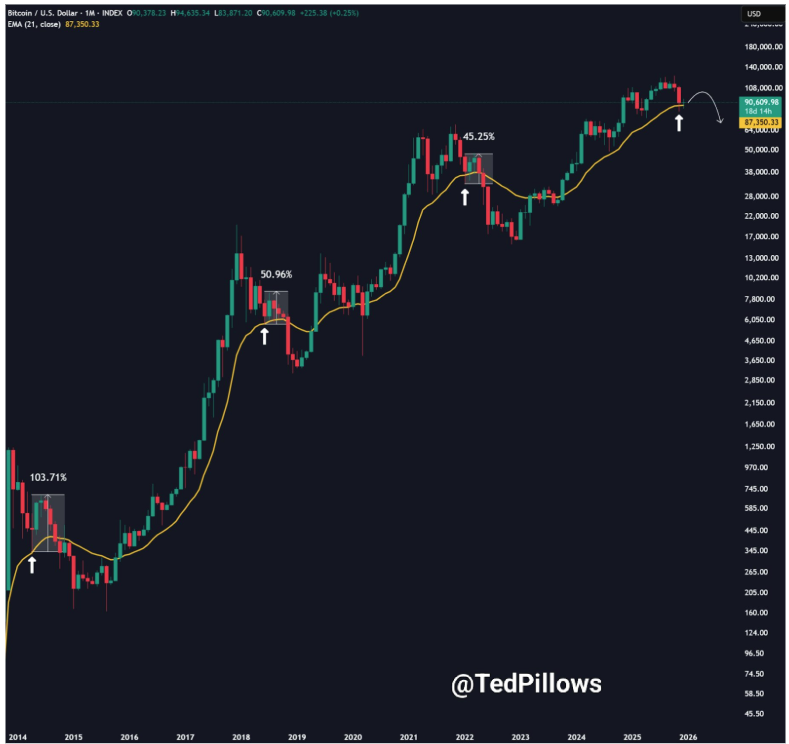

Regardless of rising considerations concerning the Financial institution of Japan’s rate of interest hike, the outlook for Bitcoin shouldn’t be completely damaging. For instance, analyst Ted Pillows believes that Bitcoin is at the moment speaking The month-to-month EMA-21 is a degree that has at all times served as a launching pad in earlier cycles.

Primarily based on this construction, Pillows predicted that Bitcoin may nonetheless soar to the $100,000 to $105,000 vary within the quick time period earlier than additional value declines happen.

Because the December assembly approaches, Bitcoin finds itself caught between a troubling sample and resilient technical help. Whether or not Japan’s subsequent rate of interest hike results in a direct additional decline or permits for a brief rally might decide how Bitcoin and different crypto markets finish the yr.

Bitcoin/USD. Supply: @TedPillows by X

Featured picture from Unsplash, chart from TradingView