U.S. inflation rose to three.0% year-on-year in September, with futures markets nonetheless pricing in subsequent week’s Federal Reserve fee minimize.

The general CPI was 3.0% y/y and 0.3% m/m, whereas the core CPI was 3.0% y/y and 0.2% m/m. Gasoline costs rose 4.1% in comparison with the identical month, and the inflation fee for evacuation facilities remained round 3.6%. The Bureau of Labor Statistics launched the Social Safety Residing Bills on schedule regardless of the backdrop of the federal government shutdown.

Rate of interest merchants made little change within the wake of the report.

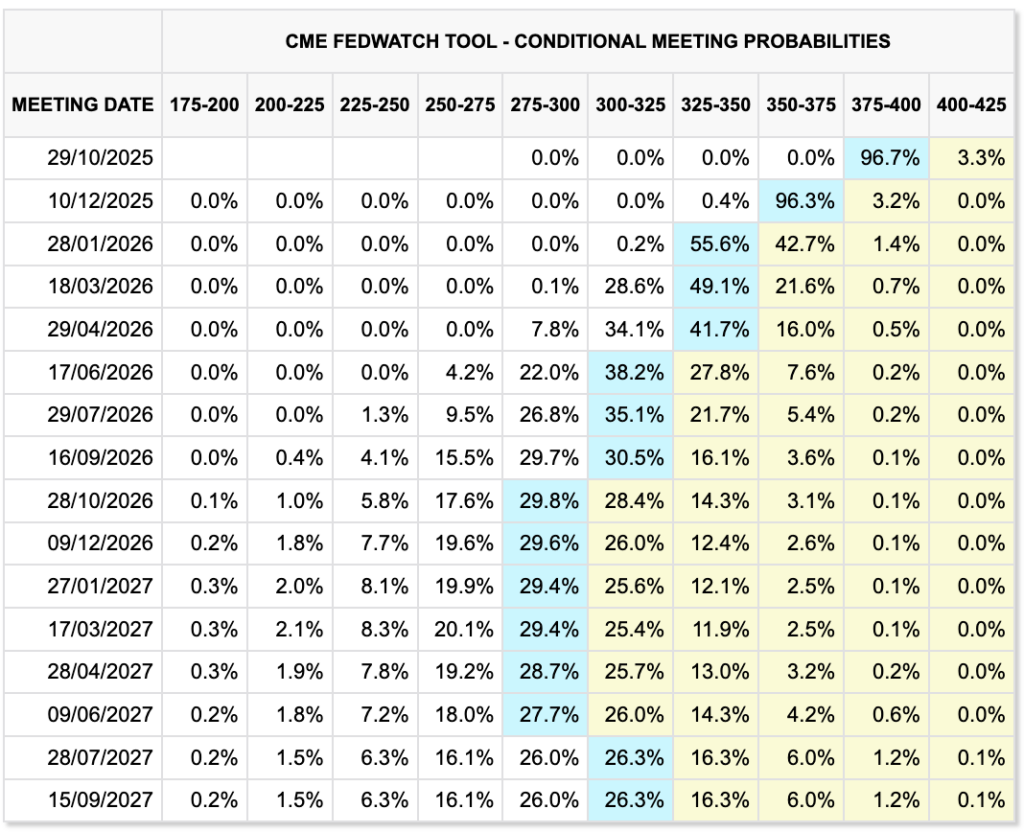

In line with CME Group’s FedWatch, futures markets have a greater than 90% probability of a 25 foundation level improve within the FOMC on Oct. 29, elevating the goal to three.50-3.75% from at the moment’s 3.75-4.00%.

Past the fast assembly, the identical FedWatch distribution may have the middle of the trail nearer to three% by this time subsequent yr.

For the October 28, 2026 assembly, the best chances vary from 2.75% to three.25%, with slight tails on both aspect.

The straightforward probability-weighted midpoint of this distribution is about 2.97%, which is according to a decline from present ranges to about 3% over the following yr.

Highway highway maps and rules-based estimates present helpful cross-checks. Goldman Sachs expects three fee cuts in 2025 and two extra in 2026, with fund charges within the vary of three.00% to three.25% by late 2026.

The Cleveland Fed’s Easy Financial Coverage Rule Dashboard exhibits a median rule path within the low 3s for 2026, relying on set forecasts, a reminder that sticky components of inflation may push coverage charges above the trail urged by futures. If core disinflation stagnates, the hole between futures and guidelines creates hawkish dangers for the three% end-nation.

The context of the curve helps body how a lot easing will impression monetary circumstances.

The 2-year bond yield is hovering round 3.4% to three.5%, and the 10-year bond yield is hovering round 4%, whereas the break-even inflation fee for 2030 is near 2.25%.

Lengthy-term rates of interest are anticipated to stay regular round 4.1% to 4.2% over the following six to 12 months as time period premiums and financial strains fall, in accordance with a Reuters survey of strategists.

If the entrance finish declines whereas the again finish stays sticky, the curve will steepen and the extent to which coverage cuts will “ease” broader monetary circumstances might be weakened.

For digital property, the hyperlink to coverage channels is now by way of each actual yields and capital flows. In line with CoinShares, weekly inflows into international crypto ETPs reached a file excessive of $5.95 billion in early October as Bitcoin hit a brand new excessive of almost $126,000, however continued to see outflows, primarily from Bitcoin, throughout the next week amid heightened volatility, reaching almost $946 million. Liquidations of greater than $19 billion additionally occurred after US President Donald Trump introduced extra tariffs on China and altered macro forecasts.

Spot Bitcoin is consolidating round $108,000 to $111,000 within the CPI and FOMC home windows. These circulation pulses are necessary to how macro impulses are transmitted to cost, as demand for the ETF at the moment accounts for almost all of extra purchases.

Within the quick time period, a 25 foundation level fee minimize mixed with cautious steerage will doubtless ease the entrance finish whereas the 10-year stays close to 4%. If the dot plot and assertion pave the best way for a transfer in December, front-end easing may turn into extra obvious and the greenback soften on the margin.

If the committee disagrees and front-end actual rates of interest rise as an alternative, danger property sometimes reverse till new knowledge resets the trajectory.

The composition of the CPI ensures that the Fed stays on monitor for its first fee minimize, as gasoline was the principle driver for the month, and a retrace in pump costs in October or November would assist the headline tales align with a narrative of gradual deinflation.

For October 2026, the distribution implied by futures and guidelines consists of three paths.

Within the base case of delicate disinflation, there is no such thing as a labor shock, core inflation continues to development downward, the coverage rate of interest stays at round 2.75% to three.25%, and actual yields decline because the entrance finish declines.

A persistent inflation path will preserve the core close to or above 3%, a extra cautious Fed, a stronger greenback and intermittent retightening of financial circumstances according to the Cleveland Rule bias, and funds charges will stabilize round 3.25% to three.75%.

The expansion concern path results in front-loaded easing from 2.25% to 2.75% and greenback weak point after an preliminary risk-off section.

In both case, the actual yield stays central from Bitcoin’s beta, and the ETF circulation channel provides convexity as circumstances ease.

International crosswinds preserve the scenario in steadiness. The ECB has paused after chopping rates of interest in early 2025, and main banks don’t anticipate additional fee cuts in 2025, limiting the euro-led fall within the greenback.

With UK inflation nonetheless above goal, the Financial institution of England is easing extra cautiously. Within the US, the Chicago Fed Nationwide Monetary Circumstances Index and the 10-year TIPS yield stay helpful indicators of Bitcoin’s macro beta, as tracked by FRED.

The short-term set off is subsequent week’s FOMC resolution. In line with futures, a 25 foundation level fee minimize is priced in with confidence, with market-implied closing costs clustered round 3% by October 2026.