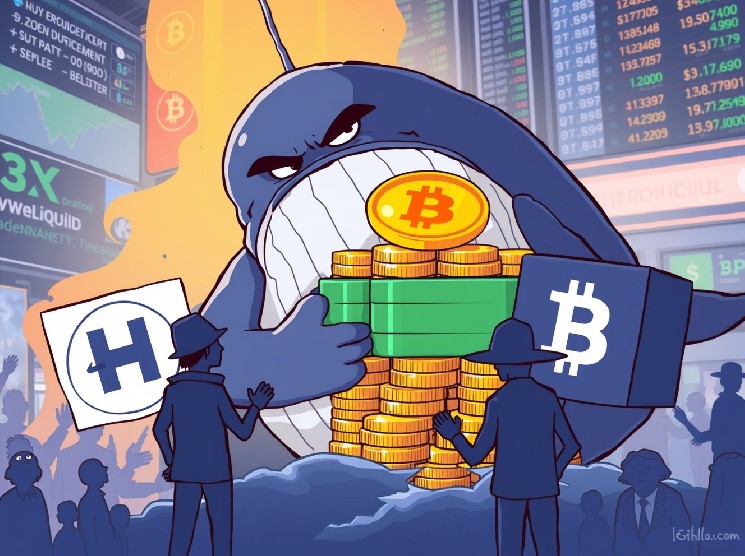

This stunning occasion despatched ripples by the crypto neighborhood, inflicting intense hypothesis and concern. mysterious tremendous liquid whale It reportedly moved a staggering $326 million in USDC to Binance, elevating eyebrows and fueling allegations of insider buying and selling. This huge-scale stablecoin switch is greater than only a large-scale transaction. This is a crucial market sign and deserves shut consideration, particularly by these eager to grasp market dynamics.

What induced this tremendous liquid whale to sound the alarm?

The primary individual to sound the alarm was on-chain analyst ai_9684xtpa, who had been intently monitoring the actions of this massive crypto entity. The information reveals: tremendous liquid whale initially withdrew 36.41 million USDC from the Hyperliquid platform and later consolidated a large 326 million USDC deposit into Binance.

- This huge capital motion instantly attracted the eye of market members.

- These large-scale strikes are notable as a result of they usually precede important market occasions or adjustments in buying and selling technique.

The sheer measurement of this deal alone is sufficient to warrant scrutiny. Nonetheless, it’s the circumstances surrounding the pockets’s earlier exercise that truly increase the insider buying and selling suspicions, prompting a deeper investigation into this explicit individual’s actions. tremendous liquid whale.

Unraveling insider buying and selling suspicions

On the coronary heart of the controversy is the suspicion that this explicit act passed off. tremendous liquid whale They might have profited from insider data. Though particular particulars of the alleged insider buying and selling haven’t been made public by analysts, the timing and measurement of the deposits counsel potential upside.

Insider buying and selling in conventional markets includes utilizing nonpublic data for private achieve. Though such conduct is troublesome to show within the flippantly regulated cryptocurrency trade, it will probably have a major impression on market well being and investor confidence.

- The analyst’s observations indicate patterns of habits that point out privileged data.

- Such actions undermine the ideas of honest and clear markets, that are vital to the long-term adoption and investor confidence of cryptocurrencies.

Why is depositing stablecoins on exchanges so necessary?

Whereas many merchants open futures positions immediately on platforms like HyperLiquid, transferring such a big stablecoin to a centralized change like Binance sends a special and probably stronger message. As analysts have identified, this transfer could possibly be a extra necessary market sign than merely opening an on-chain futures place.

Why was there such a big deposit? tremendous liquid whale Necessary:

- Making ready for giant trades: Giant stablecoin deposits usually point out an intention to have interaction in large-scale shopping for and promoting exercise on an change. This may increasingly embrace spot buying and selling, getting into new positions in derivatives, or making ready for large-scale liquidations.

- Market impression: Such sudden inflows of capital can have an effect on the order guide, particularly for illiquid belongings, and trigger value fluctuations.

- Liquidity administration: Whales could also be deploying funds for arbitrage alternatives, anticipating massive market strikes, or just diversifying their stablecoin holdings throughout platforms to enhance liquidity administration.

This strategic operation tremendous liquid whale This implies a calculated transfer slightly than an informal switch, and hints at doable future market motion.

What are the broader implications for the crypto market?

a single highly effective entity, esp. tremendous liquid whalecan ship ripples all through the cryptocurrency ecosystem. This occasion highlights a number of necessary elements of the market that require consideration.

- Transparency challenges: On-chain information supplies unparalleled transparency into transactions, however figuring out the true id behind giant wallets stays a significant problem.

- Regulatory investigation: Incidents akin to these have led to requires elevated regulation and oversight within the cryptocurrency area, notably relating to market manipulation and insider buying and selling.

- Investor confidence: Allegations of unfair conduct can undermine the arrogance of particular person buyers and make them much more hesitant to take part in a selected platform or the market as an entire.

The crypto neighborhood is watching intently, anticipating what transfer this whale will make subsequent on Binance and the way it could impression market stability.

USDC deposit of big $326 million because of suspected insider buying and selling tremendous liquid whale A submit on Binance is greater than only a headline. This can be a stark reminder of the complexity and potential vulnerabilities of the decentralized finance surroundings. Though the final word objective of deposits stays a thriller, their significance as a market sign can’t be overstated. This occasion highlights the persevering with rigidity between on-chain transparency and anonymity that usually protects giant gamers, prompting continued vigilance and debate about market integrity.

Steadily requested questions (FAQ)

Q1: What’s tremendous liquid whale?

A “whale” in cryptocurrency refers to a person or entity that holds a considerable amount of a selected cryptocurrency or asset on a selected platform and has nice affect over market actions. Hyperliquid whales maintain important belongings or buying and selling volumes, notably on the Hyperliquid decentralized change.

Q2: What’s USDC?

USDC (USD Coin) is a stablecoin pegged to the US greenback. That’s, its worth is meant to stabilize at 1.00 USD. It’s backed by a reserve of USD-denominated belongings, offering a steady medium for buying and selling and storing worth in unstable crypto markets.

Q3: Why is depositing stablecoins on an change an necessary market sign?

Depositing a considerable amount of a stablecoin like USDC on a centralized change usually signifies an intention to buy different cryptocurrencies, enter a big derivatives place, or take part in important buying and selling exercise. This implies a strategic transfer to deploy capital, which may impression market costs.

This autumn: What’s the impression of allegations of insider buying and selling in digital currencies?

Suspicions of insider buying and selling can undermine investor confidence, impair market equity, and trigger important value fluctuations. This usually results in requires elevated regulatory oversight, damages the reputations of the platforms concerned, and will impression the widespread adoption of cryptocurrencies.

Q5: Who’s ai_9684xtpa?

ai_9684xtpa is an on-chain analyst recognized for monitoring and reporting on necessary cryptocurrency actions and market exercise, usually offering perception into giant pockets traits and potential market traits.

Keep up to date on necessary market actions and share this evaluation together with your community. Your participation will assist foster a extra clear and aware cryptocurrency neighborhood, contributing to a more healthy ecosystem for everybody.

For individuals who need to know extra in regards to the newest data cryptocurrency market Learn articles on key developments shaping traits cryptocurrency value motion.

Disclaimer: The data offered doesn’t represent buying and selling recommendation. Bitcoinworld.co.in takes no accountability for investments made primarily based on the knowledge offered on this web page. We strongly advocate impartial analysis and session with certified professionals earlier than making any funding choices.