In October 2025, the world’s prime Bitcoin miners marginally elevated manufacturing, and general prices and community problem reached all-time highs. On the similar time, some mining corporations have begun to shift their strategic focus to AI-related knowledge infrastructure.

The transfer was aimed toward diversifying income streams and decreasing dependence on Bitcoin value fluctuations.

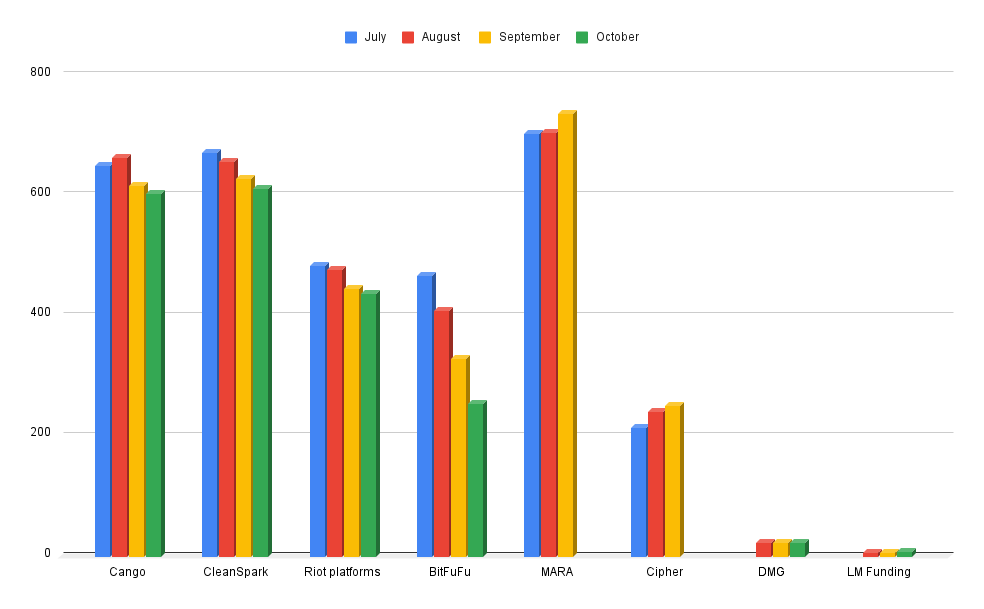

Bitcoin manufacturing quantity barely decreased, BTC gross sales quantity trending upward

Total Bitcoin (BTC) mining manufacturing in comparison with September Barely decreased, primarily because of elevated mining problem and unstable energy provide It spans a number of areas of North America.

Particularly, Cango Inc. mined roughly 602.6 BTC in October, bringing its complete Bitcoin holdings to six,412.6 BTC. CleanSpark reported comparable manufacturing to September, producing 612 BTC through the month.

Riot Platforms mined 437BTC, down from 445BTC within the earlier month. Complete Bitcoin holdings reached 19,324 BTC, a rise of 37 BTC from final month. Nevertheless, given manufacturing volumes, the information suggests the corporate doubtless offered among the Bitcoin it mined to handle money movement.

BitFuFu generated 253 BTC, bringing its complete holdings to 1,953 BTC, suggesting that it might liquidate BTC to optimize its capital.

Amongst small miners, the DMG blockchain mined 23 BTC, rising its complete holdings to 359 BTC. In the meantime, LM Funding America maintained steady manufacturing ranges. Regardless of their small measurement, these small entities assist maintain Bitcoin decentralized by distributing the worldwide hashrate extra evenly.

October Bitcoin mining manufacturing by some listed corporations. Supply: BeInCrypto

Marathon Digital Holdings (MARA) and Cipher Mining haven’t but launched their October Bitcoin manufacturing knowledge. Nevertheless, each corporations introduced constructive monetary outcomes for the third quarter of 2025, demonstrating operational resilience regardless of the September downturn.

Marathon maintained its trade management with file income of $123 million within the third quarter of 2025. In keeping with on-chain knowledge, MARA’s mining handle transferred 2,348 BTC (roughly $236 million) inside 12 hours, which can have been revenue taking following Bitcoin’s latest value improve.

Cipher Mining additionally reported stable quarterly outcomes with $72 million in income and introduced the issuance of $1.4 billion in high-yield bonds to fund knowledge middle initiatives along side Google.

Equally, TeraWulf expects third quarter 2025 income to be between $48 million and $52 million. The corporate raised $3.2 billion in senior secured notes to develop its U.S.-based infrastructure. These giant funding strikes spotlight broader trade tendencies. Main miners are repositioning themselves as suppliers of digital infrastructure, bridging Bitcoin mining and AI-driven high-performance computing (HPC).

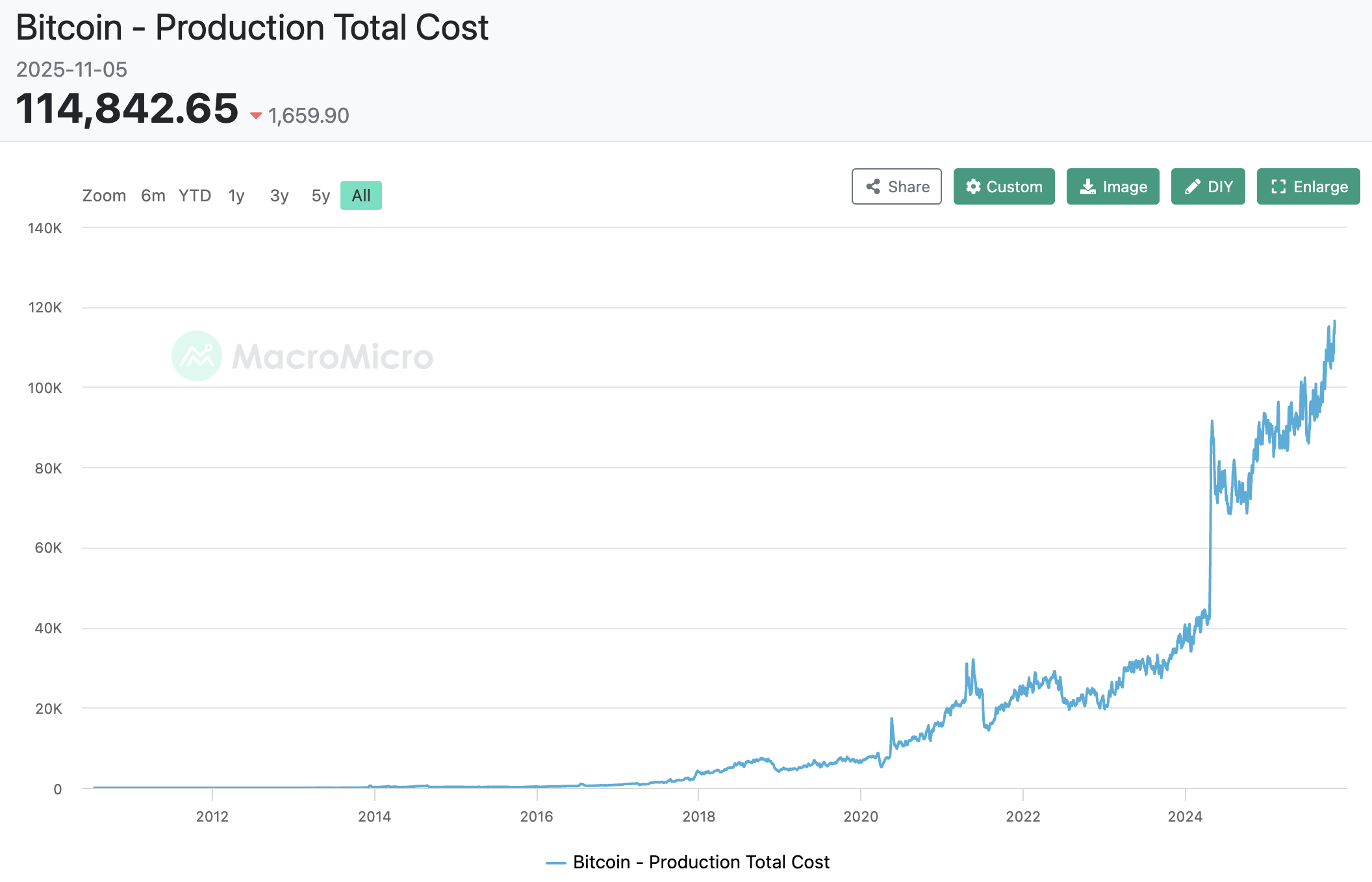

Manufacturing prices are at an all-time excessive, and trade competitors is intensifying

In keeping with MacroMicro, the common price to generate 1 BTC has soared to $114,842, hitting an all-time excessive degree. In the meantime, Bitcoin mining problem elevated by 6.31% to 155.97T, setting a brand new all-time excessive for the community. Bitcoin’s market value is hovering round $102,000, and the widening hole between market worth and break-even level is placing stress on revenue margins, particularly for small companies.

Common manufacturing price per BTC. Supply: Macro Micro

In response, miners are beneath stress to extend power effectivity, put money into next-generation ASICs, and scale their operations to make sure profitability. Trade leaders equivalent to Cipher, TeraWulf, and CleanSpark are experimenting with hybrid fashions that mix Bitcoin mining and HPC for AI workloads. As price pressures improve, this technique is more and more seen as inevitable.

On the similar time, governments and sovereign wealth funds are getting into the Bitcoin mining sector to strengthen their management of strategic power and knowledge property. This elevated “nationalization” of mining might reshape international energy constructions as some nations leverage their surplus power assets to mine Bitcoin extra effectively, thereby decreasing their dependence on personal operators.

October 2025 marks the start of a big structural change within the Bitcoin mining trade. Solely corporations with robust know-how capabilities, monetary stability, and long-term imaginative and prescient are prone to survive.

As power prices and mining problem proceed to rise, 2026 might see the largest wave of mergers and consolidation in trade historical past, paving the best way for a world hybrid mannequin that integrates Bitcoin mining and AI knowledge computation.

The submit October BTC Mining: Excessive Prices, Tight Margins, and AI Transformation appeared first on BeInCrypto.