Bitcoin’s BTC$88,539.42 Wednesday’s sharp rejection at $90,000 was an instantaneous reminder to traders that treasured metals like gold and silver, not digital gold, are the true winners in groundbreaking trades, no less than for now.

Again in October, JPMorgan analysts mentioned that each gold and Bitcoin have benefited and can proceed to learn from so-called downgrade trades. They predict that BTC will observe gold and set a volatility-adjusted BTC value goal of $165,000 relative to gold.

Thus far, that concept has not come true.

BTC is down 30% from its early October file, hovering round $88,000, whereas gold is buying and selling close to all-time highs at round $4,350 an oz., and silver hit a brand new all-time excessive of over $66 on Wednesday, up 40% since October.

“Bitcoin lovers can not ignore the bull market in treasured metals that continues to soar,” mentioned Charlie Morris, founding father of ByteTree.

Why is BTC lagging?

Morris mentioned in a report on Wednesday that Bitcoin’s present weak point stems from its affiliation with danger property. Whereas inventory indexes are hovering close to all-time highs, probably the most speculative elements of the inventory market — investments in information facilities and synthetic intelligence infrastructure, and up to date IPOs — have seen vital declines over the previous few weeks.

There are additionally technical elements behind Bitcoin’s weak point in comparison with gold. The BTC-to-gold ratio has already peaked in late 2024 and is now in a bear market with a decline of greater than 50%.

BTC to gold ratio (TradingView)

In August, Bitcoin Gold confirmed indicators of shedding momentum and hit new highs, however has since reversed and hit new lows on Wednesday, its lowest in almost two years.

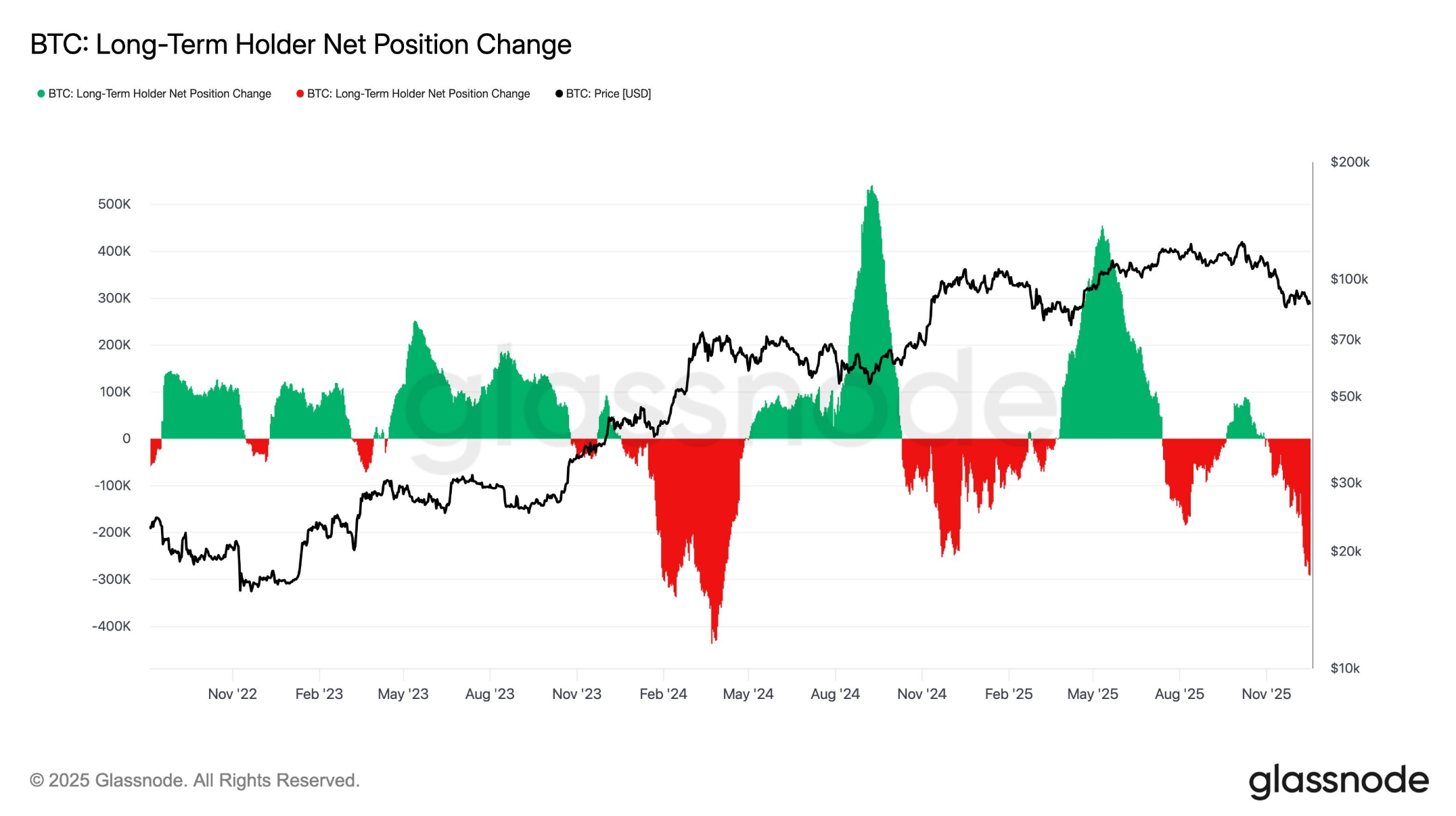

Structural promoting by long-term holders can be including to Bitcoin’s weak point. In line with a examine by Vettle Runde, head of analysis at K33, the availability of BTC held in UTXOs (unused buying and selling outputs) from greater than two years in the past has been repeatedly reducing, and about 1.6 million BTC have been reactivated since 2024. Individually, Glassnode’s information additionally exhibits that long-term traders are more and more promoting their holdings.

“This represents on-chain proof of considerable and sustained promoting strain from long-term holders,” Lunde mentioned.

Internet place change of long-term Bitcoin holders (Glassnode)

There’s additionally rising debate in regards to the dangers quantum computing poses to Bitcoin’s cryptographic safety. Whereas this concern stays principally theoretical, it creates extra uncertainty for traders.

Analyst: Silver rally could possibly be the stage for BTC

The silver lining for Bitcoin traders is that Bitcoin will ultimately take over the baton from gold because the yellow metallic’s rally cools.

Based mostly on historic patterns, gold’s peak usually precedes BTC’s rise by 100 to 150 enterprise days, Bitfinex analysts famous. They acknowledged that Bitcoin’s present market consolidation is a transitional interval and lays the inspiration for a catch-up in 2026.

BiteTree’s Morris expressed the same view.

“We stay bullish on silver, nevertheless it will not final endlessly,” Morris mentioned. “I feel Bitcoin will step in when the rally loses momentum.”