Simply as gold costs entered correction territory, flows into BTC and gold diverged. BTC held above $113,000 in cautious buying and selling, outperforming valuable metals.

As anticipated, BTC is exhibiting indicators of shifting inflows from gold. The valuable metallic entered correction territory after falling beneath $4,000 per ounce. Whereas inflows to BTC ETFs have began to get well, gold inflows have declined over the previous week.

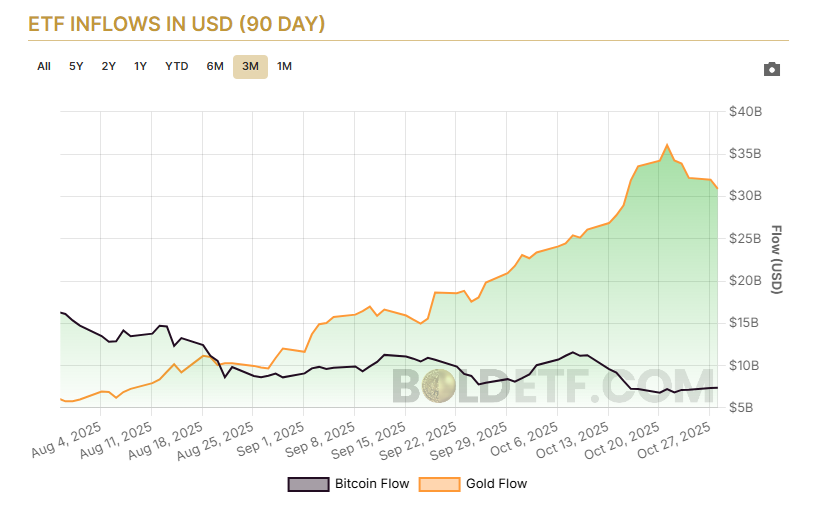

Whereas BTC inflows step by step elevated, gold ETF inflows modified route on October twenty first, leading to one of many greatest gold market corrections in over a decade. |Supply: Daring Report

Gold reached its peak in ETF inflows on October twenty first and has since skilled declining liquidity over the previous week. As a cryptopolitan reported Beforehand, gold was consolidating and making ready for a transfer within the subsequent route.

Spot gold fell to $3,997.32, which is seen as correction territory. Treasured metals took a step again as the main focus shifted to the worth of the US greenback and future Fed rate of interest choices. Gold additionally fell as a result of shift to risk-on property.

BTC turns right into a risk-on asset

This time, BTC has proven that it’s not functioning as “digital gold” and has expanded its beneficial properties by shifting extra intently to tech shares and risk-on property. BTC has proven that it may develop below various kinds of funding situations, switching between protected and hedged or risk-on property.

BTC held regular in opposition to gold over the previous day, shopping for between 28 and 29 ounces of gold. After its latest restoration, BTC traded at $113,590, exhibiting indicators of a rebound in inflows from each crypto insiders and mainstream patrons by way of ETFs.

Latest modifications in liquidity have led to expectations for additional beneficial properties in Bitcoin because the asset is believed to be undervalued in comparison with gold.

ETF influx As a result of BTC has began to rise over the previous few days, coinciding with gold’s decline. For now, BTC purchases have been extra cautious, however on the similar time ETF patrons are taking dangers on Ethereum in hopes of additional development from the community.

12 months-to-date, BTC nonetheless leads gold

BTC has lowered its annual acquire to 56.3% however nonetheless leads gold. Plesios metals are up a internet 45% for the 12 months, and silver is up a internet 40%.

The correlation between gold and BTC is at the moment at a comparatively low degree of 0.59. The following strikes for each gold and BTC will decide how the correlation develops. Gold exhibits indicators of shedding help and is anticipated to fall.

BTC trades primarily based on a special set of things associated to each the crypto native and ETF demand. The digital asset can be taking a look at its efficiency in relation to the price halving cycle, elevating the query of whether or not the present bull market is nearing an finish.

The Bitcoin Worry and Greed Index recovered to 51, indicating impartial habits for merchants. Lately, the BTC market moved in excessive worry, however shortly recovered its earlier exercise degree.

Gold sentiment can be impartial, with 50% of merchants lengthy gold and 50% brief gold, betting on a forex restoration within the US greenback. Gold may ease additional if the Fed alerts quantitative easing.