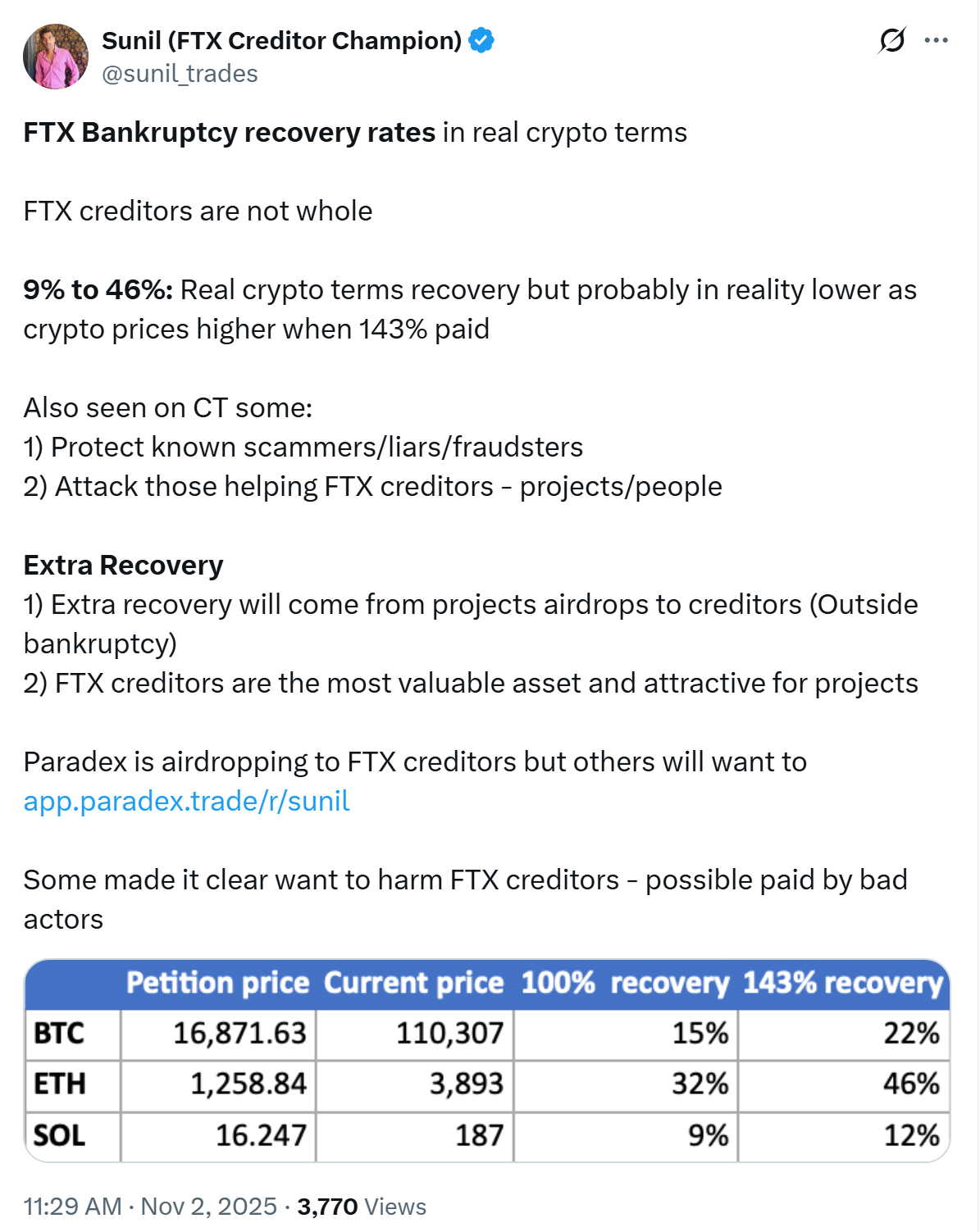

Sunil, a distinguished FTX creditor consultant, mentioned FTX collectors may obtain far lower than initially thought if funds are adjusted to match right this moment’s inflated crypto valuations.

In a Sunday submit to

“FTX’s collectors aren’t all,” he wrote, including that the change’s deliberate 143% compensation of fiat currencies doesn’t mirror losses denominated in cryptocurrencies.

In accordance with a desk shared in his submit, Bitcoin’s petition value was $16,871, in comparison with the present value of greater than $110,000. Which means a fiat cost of 143% equates to roughly 22% in actual BTC worth. Equally, Ether’s 143% restoration charge is successfully equal to 46%, whereas Solana’s restoration charge is simply 12%.

FTX collectors share the efficient restoration charge. sauce: sunil

Associated: Former FTX US head bets on conventional market “culprits”

FTX collectors may earn extra by means of airdrops

Sunil additionally pointed to the opportunity of “further recoveries” by means of airdrops from exterior initiatives concentrating on FTX collectors. He cited Paradex as one such initiative, noting that “FTX collectors are probably the most beneficial asset and enticing to the mission.”

The primary spherical of FTX creditor funds to recipients with claims of lower than $50,000 was distributed on February 18, totaling $1.2 billion.

In Could, the FTX Restoration Belief started making a second $5 billion cost to eligible collectors. The funds coated a number of declare classes, together with dotcom buyer rights claims (72%), US buyer rights claims (54%), and comfort claims (120%).

In the meantime, common unsecured and digital asset mortgage claims are scheduled to obtain a 61% distribution, with funds anticipated to achieve recipients inside 1-2 enterprise days by way of Kraken and BitGo.

Associated: Polymarket expects Sam Bankman Freed pardons to leap to 12%

Sam Bankman Freed’s attraction listening to scheduled for November 4th

Former FTX CEO Sam Bankman Fried, presently serving a 25-year sentence for fraud and conspiracy, is scheduled to look earlier than the U.S. Courtroom of Appeals for the Second Circuit on November 4, the subsequent step in efforts to overturn his conviction.

Bankman Freed’s legal professionals filed an attraction in September 2024, arguing that he was “by no means presumed to be harmless” and that prosecutors had misrepresented his dealing with of FTX buyer funds. The attraction challenges his 2023 conviction on seven felonies.

journal: Bitcoin OG Kyle Chasse is one shot away from being completely banned from YouTube