Former biotech firm ETHZilla (ETHZ) is doubling down on its push into real-world asset markets, buying a 15% stake in digital mortgage lender Zippy to supply manufactured house loans on-chain. The deal marks the corporate’s second acquisition prior to now week.

Based on Wednesday’s announcement, ETHZilla can pay $5 million in money and $16.1 million in inventory for a 15% stake in Zippy, a U.S.-based lender based in 2021 that originates its own residence loans by means of a digital platform.

The businesses plan to hyperlink Zippy’s mortgage origination and AI-powered techniques with ETHZilla’s tokenization stack to allow on-chain distribution of manufactured house property loans, together with the opportunity of forward-flow gross sales to institutional buyers.

As a part of the transaction, ETHZilla will acquire a seat on Zippy’s board of administrators and safe a 36-month exclusivity interval that requires Zippy to conduct all blockchain infrastructure, digital asset issuance and tokenization by means of ETHZilla’s platform.

ETHZilla, the No. 6 Ether (ETH) treasury agency in response to CoinGecko information, stated the funding builds on its intensive foray into the true asset (RWA) market.

High Ethereum monetary firm. sauce: CoinGecko

The announcement comes per week after ETHZilla acquired a 20% absolutely diluted stake in auto finance startup Karus for $10 million in money and inventory.

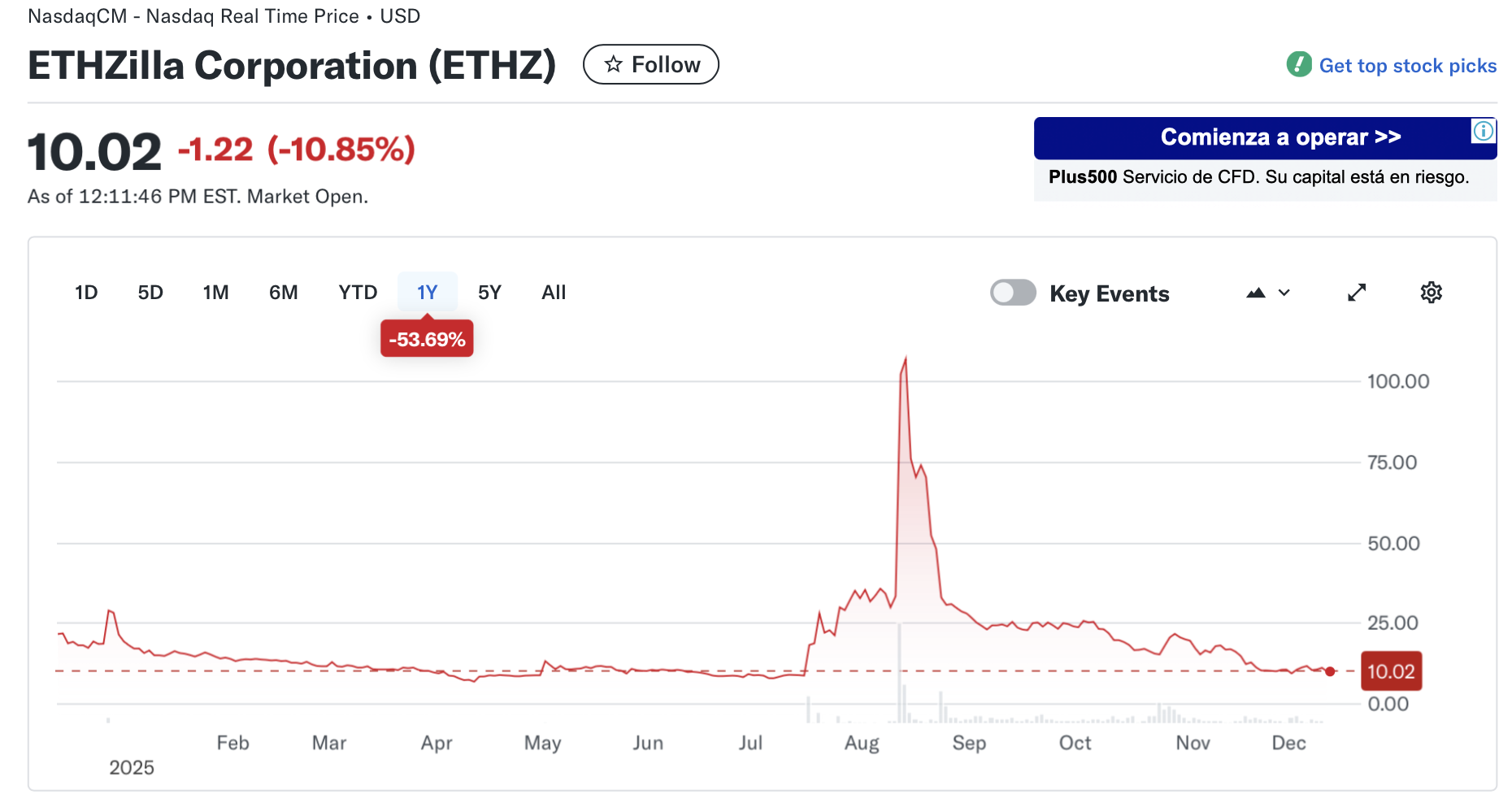

ETHZilla inventory was down about 10% on the time of writing, in response to Yahoo Finance information.

sauce: Yahoo Finance

Associated: Ethereum rises to $3.3 million, backside revealed: Will 100% ETH rise subsequent?

Ether authorities bond shares face sharp decline

A number of publicly traded corporations that adopted Ether as a steadiness sheet asset this yr have skilled sharp reversals of their inventory costs as token costs have fallen from their peaks, together with ETHZilla.

ETHZilla (previously generally known as 180 Life Sciences Corp) introduced its transformation into an ether treasury firm on July 29. The corporate’s inventory value rose from a gap value of $45 that day to a closing value of $107 by August thirteenth. Nonetheless, the inventory value has fallen about 91% since then and is buying and selling at about $10 as of this writing.

Sharplink Gaming launched its Ethereum monetary technique in Might, naming Ethereum co-founder Joseph Rubin as chairman, alongside a $425 million personal placement that included ConsenSys as an investor.

The corporate’s inventory value rose greater than 130% to $79.21 on Might 29 on the information, in response to Yahoo Finance information, however has since fallen sharply, buying and selling round $11.77 on Wednesday.

sauce: Yahoo Finance

Bitmine Immersion, an ether finance firm led by Fundstrat co-founder Tom Lee, has additionally struggled in latest months. The corporate’s inventory hit an all-time excessive of $135 in July, however has since fallen to round $40 as of this writing.

sauce: Yahoo Finance

In August, Komodo Platform chief know-how officer Kadan Stadelmann instructed Cointelegraph that corporations using ETH treasury methods face structural dangers, warning that market downturns may pressure liquidations and amplify promoting stress on the token.

Ether is presently buying and selling at $3,365, down from its all-time excessive of $4,946.05 on August 24, in response to CoinGecko information.

journal: Introducing on-chain crypto detectives who battle crime higher than the police