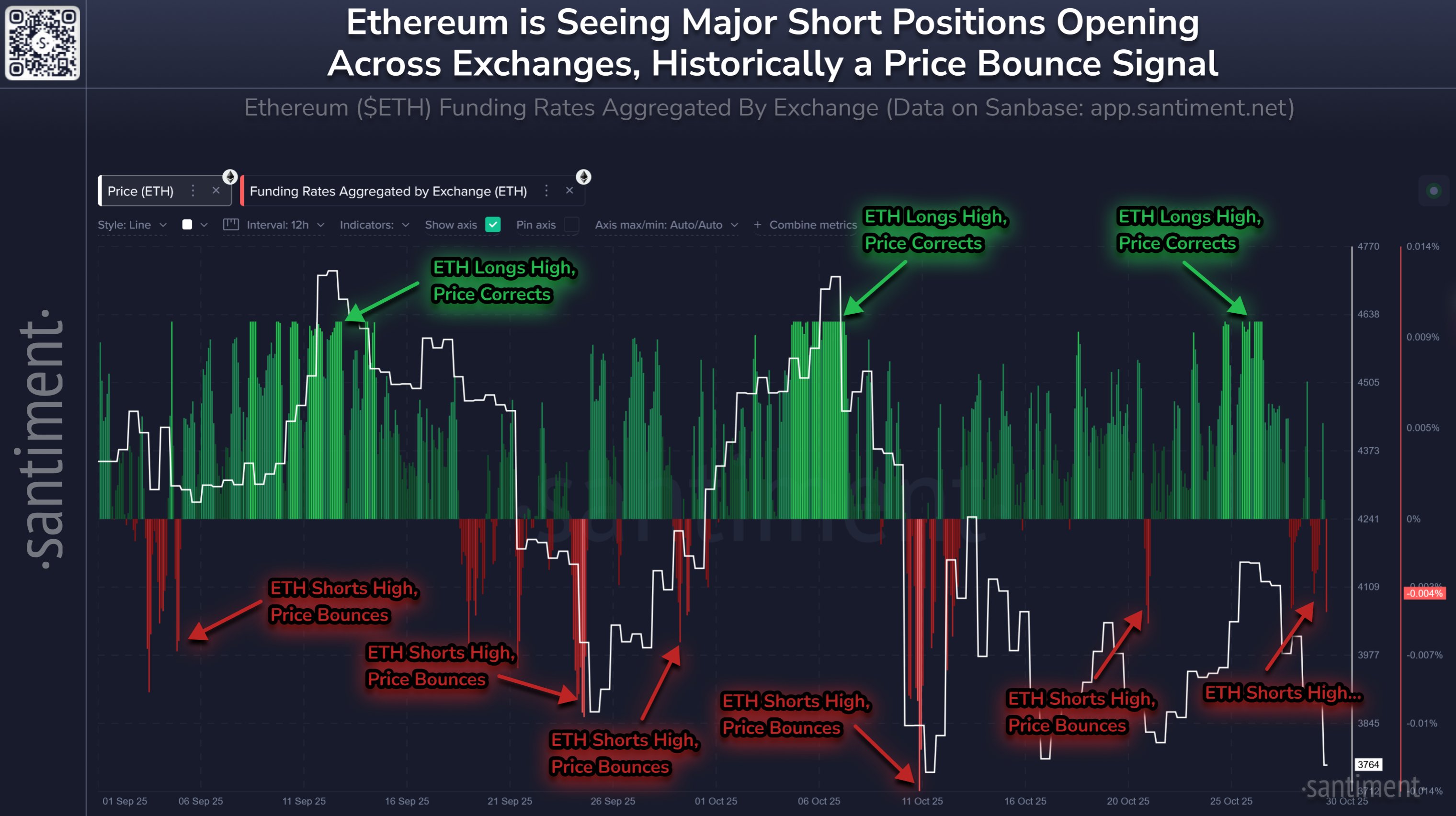

Information reveals that Ethereum’s funding charge has fallen into the destructive zone. This is what has sometimes adopted this development over the previous two months:

Ethereum funding charge suggests merchants are at present bearish

As evaluation agency Santiment defined in a brand new publish on X, shorts at present dominate the Ethereum derivatives market. The indicator of relevance right here is the ‘funding charge’, which measures the quantity of recurring charges that merchants trade with one another on numerous derivatives platforms.

A optimistic worth of this indicator implies that lengthy holders are paying a premium to holders with quick bets to carry their positions. Such a development implies that bullish sentiment is predominant.

However, the indicator falling beneath the zero mark means that derivatives merchants general could also be harboring bearish sentiment as quick positions outweigh lengthy positions.

Right here, the chart shared by Santiment reveals the development of Ethereum funding charges throughout all exchanges over the previous two months.

Appears like the worth of the metric has been destructive in current days | Supply: Santiment on X

As proven within the graph above, the Ethereum funding charge has just lately witnessed a decline into the destructive zone, which implies that the stability of the derivatives market is shifting in direction of bearish positions.

Nevertheless, the purple market sentiment might not truly be destructive for the worth of cryptocurrencies. Within the graph, the analytics agency highlighted the sample that belongings adopted in response to this indicator over the previous two months.

It appears like ETH is trending towards the funding charge on this window. That’s, a big optimistic degree will result in a worth correction, and a destructive degree will result in a worth rebound.

The reason behind this development might lie in the truth that the dominant facet of the market is extra prone to be caught up in a liquidation squeeze. Such occasions are usually violent and contain a cascade of liquidations that feed again into worth actions.

Ethereum’s funding charge is within the purple, nevertheless it stays to be seen whether or not it’s going to proceed this time as its worth just isn’t as destructive because the earlier lows that triggered the quick squeeze.

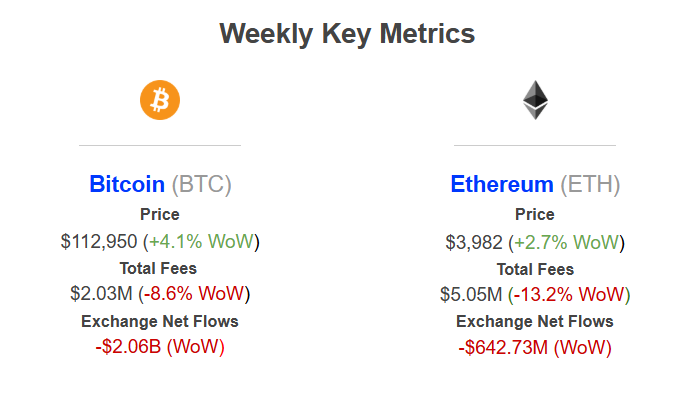

In different information, institutional DeFi options supplier Sentora revealed on XPost that Ethereum has seen important web forex outflows of roughly $643 million over the previous week.

The outflows BTC and ETH have seen in the course of the previous week | Supply: Sentora on X

Bitcoin noticed even bigger trade withdrawals of over $2 billion. “This can be a robust bullish sign regardless of market uncertainty, as buyers are transferring cash into personal vaults for long-term holding,” Centra defined.

ETH worth

As of this writing, Ethereum is buying and selling round $3,850, up over 2% up to now 24 hours.

The worth of the coin seems to have been happening over the previous few days | Supply: ETHUSDT on TradingView

Featured photographs from Dall-E, Santiment.web, Sentora.com, charts from TradingView.com