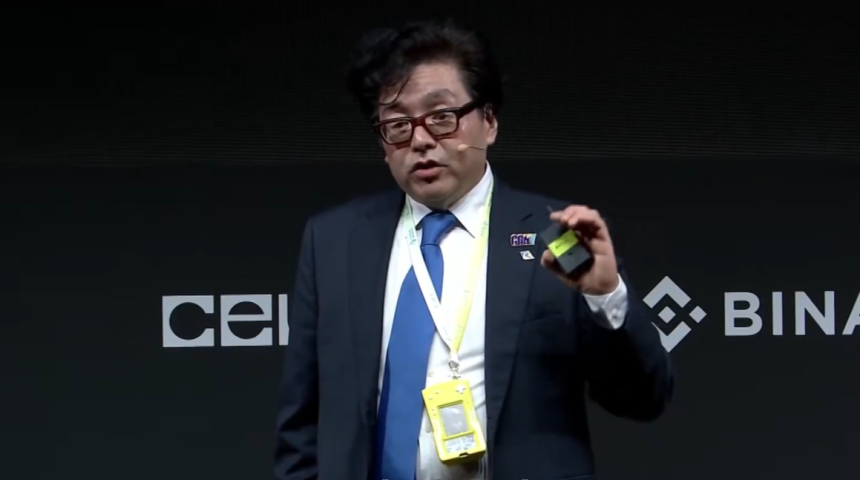

Reiterating that Ethereum is likely one of the most aggressive targets available on the market, Tom Lee informed attendees at Binance Blockchain Week on December 4 that ETH might finally commerce at $62,000 because it turns into the core infrastructure of tokenized finance.

“Now that we’ve talked about cryptocurrencies, let me clarify why Ethereum is the way forward for finance,” Lee stated on stage. He recognized 2025 as Ethereum’s “1971 second,” drawing direct parallels to when the U.S. greenback left the gold customary and sparked a wave of economic innovation.

Lee’s paper on Ethereum

“In 1971, the greenback went off the gold customary, and 1971 impressed Wall Avenue to create monetary merchandise that assured the greenback would grow to be the reserve foreign money,” Lee argued. “In 2025, every thing will likely be tokenized. So it is not simply the greenback that will likely be tokenized, however shares, bonds, and actual property.”

In his view, this modification positions ETH as the first settlement and execution layer for tokenized property. “Wall Avenue is as soon as once more profiting from that and attempting to create merchandise on high of sensible contract platforms. And the place they’re constructing that is on Ethereum,” he stated. Lee cited present real-world asset experiments as early proof, noting that “the overwhelming majority of them are constructed on Ethereum,” including, “Ethereum has received the sensible contract warfare.”

Lee additionally emphasised that ETH’s market conduct doesn’t but replicate its structural function. “, as I shaded right here, ETH has been range-bound for 5 years, nevertheless it’s beginning to get away,” he informed the viewers, explaining why he was “deeply concerned in Ethereum by making Bitmine an ETH treasury firm, as a result of I noticed this breakout coming.”

The core of his valuation case is expressed by the ETH/BTC ratio. Lee expects Bitcoin to skyrocket within the close to time period, saying, “I feel Bitcoin will attain $250,000 inside a couple of months.” From there, he derived two essential ETH situations.

First, if the ETH/BTC value relationship merely reverts to its historic common, he sees important upside potential. “If the value ratio of ETH to Bitcoin returns to its eight-year common, Ethereum will likely be at $12,000,” he stated. Second, a extra aggressive case during which ETH rises by 1 / 4 of Bitcoin’s value would convey his long-time goal of $62,000 to the floor. “If it is 0.25 in comparison with Bitcoin, that is $62,000.”

🔥 Tom Lee asks for $62,000 $ETH

“I feel Ethereum goes to be the way forward for finance, the way forward for cost rails. At 0.25 in comparison with Bitcoin, it is $62,000. Ethereum at $3,000 is grossly undervalued.” pic.twitter.com/VydvLou9IE

— CryptosRus (@CryptosR_Us) December 4, 2025

Lee connects these ratios on to the tokenization story. “If 2026 is about tokenization, meaning the utility worth of Ether ought to be rising. So we ought to be taking note of this ratio,” he informed the viewers, arguing that valuations ought to observe the rising demand for ETH block area and its function as a “future cost rail.”

He concluded with a scathing evaluation of present ranges. “After all, I feel $3,000 Ethereum is grossly undervalued.”

On the time of writing, ETH was buying and selling at $3,128.

Featured picture created with DALL.E, chart on TradingView.com