aPriori, a liquid staking mission making ready to hitch Monad, has raised $30 million from Tier 1 VCs. However now one firm is dealing with accusations that it used 14,000 related addresses to assert greater than 60% of the airdrops.

The revelations rattled the market and raised new questions on Airdrop’s design and on-chain verification.

On-chain photographs behind a priori: what occurred?

aPriori (APR) introduced its billing portal on October twenty third, however its public window and cut up billing mechanism (early vs. ready) seem like tricked by clustered wallets.

Airdrop software is legitimate.

Test eligibility and claims at https://t.co/4Za759QdSz.

Select inside 21 days:

• Early billing: lowered partly.

• Watch for Monad mainnet: unlock most of it laterPlease select fastidiously. This will likely be your last selection. pic.twitter.com/HceXoCPH0m

— aPriori ⌘ (@aPriori) October 23, 2025

In truth, Bubble Map, a visible analytics platform for on-chain transactions and analysis, flagged an unusually dense cluster of latest wallets claiming aPriori’s October twenty third airdrop.

In response to Bubblemaps, the mission has raised $30 million from Tier 1 VCs. Nevertheless, 60% of that airdrop was requested by a single entity over 14,000 connections or clustered addresses.

In response to experiences, this cluster operation concerned a pockets that had round 0.001 BNB of latest funds injected into it over a brief time frame by way of the Binance change. They then routed the APR to a brand new tackle, suggesting an organized billing and redistribution operation slightly than an natural, decentralized billing course of.

3/ Nevertheless, 14,000 related addresses received over 60% of the $APR airdrop

These addresses are:

> New funding by way of Binance

> Obtained 0.001 BNB every in a slender time-frame

> Ship $APR to new tackle to type second tier in cluster https://t.co/Sb9qI8nyDJ pic.twitter.com/TInEA0QEUU— Bubblemaps (@bubblemaps) November 11, 2025

Mission messaging and timing

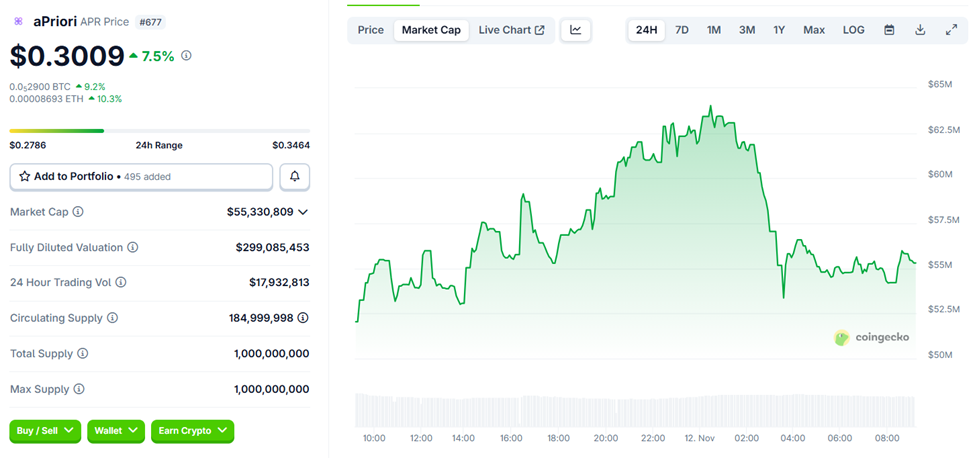

The affect was speedy, with a pointy drop following cluster exercise. Equally, APR market capitalization decreased considerably instantly after launch.

aPriori (APR) value and market cap efficiency. Supply: CoinGecko

A barrage of airdrop claims can wipe out neighborhood confidence and trigger value spikes earlier than a mission reaches mainnet, particularly if claimers rapidly flip their tokens.

Why It Issues — Incentives, Validation, and Fame

Crypto airdrops purpose to decentralize token possession and bootstrap community results. Three issues come up when a single actor captures the vast majority of distributed tokens.

- Incentive misalignment the place token provide is successfully centralized

- Financial threat. Giant, concentrated holders can dump costs and destabilize them.

- Injury to fame. Partnerships and future funding could also be in danger.

For aPriori, touted as “one of many largest initiatives to return to Monad,” reputational threat now threatens its personal rollout and associated ecosystem occasions.

In the meantime, this scandal comes at a time when Reiter is being hailed as a mannequin for institutional-grade DeFi progress. Layer-2 DEX not too long ago raised $68 million with a give attention to velocity, scalability, and clear on-chain execution, with weekly perpetual buying and selling quantity exceeding $73 billion.

Lighter is pursuing a zero-knowledge orderbook mannequin to draw critical liquidity suppliers. In distinction, the aPriori airdrop problem is a reminder to traders of how simply tokenomics will be compromised by automation and inadequate validation.

Equally, airdrops just like the aPriori Sybil assault spotlight vulnerabilities in token distribution mechanisms which can be nonetheless widespread in DeFi.

Bubblemaps stated it contacted the aPriori staff however didn’t obtain a response. The mission has not publicly disputed the cluster evaluation.

Because the investigation continues and on-chain forensics deepens, aPriori’s path to Monad mainnet and associated MON gross sales will likely be carefully monitored and evaluated primarily based on on-chain proof and, in some instances, developer communications.

The put up Did a whale steal the a priori airdrop? The put up 14,000 Wallets Elevate Huge Questions appeared first on BeInCrypto.