Bitcoin was beneath sturdy promoting strain for a number of days, dropping to the $85,000 zone earlier than trying a modest restoration. This drawdown has shaken market confidence, however the violent capitulation presently being seen from Bitcoin holders suggests the market could also be forming a backside.

Costs are stabilizing round key psychological ranges, however this stabilization has come on the expense of widespread holder abandonment, a basic backside sign.

Bitcoin merchants and traders are letting go

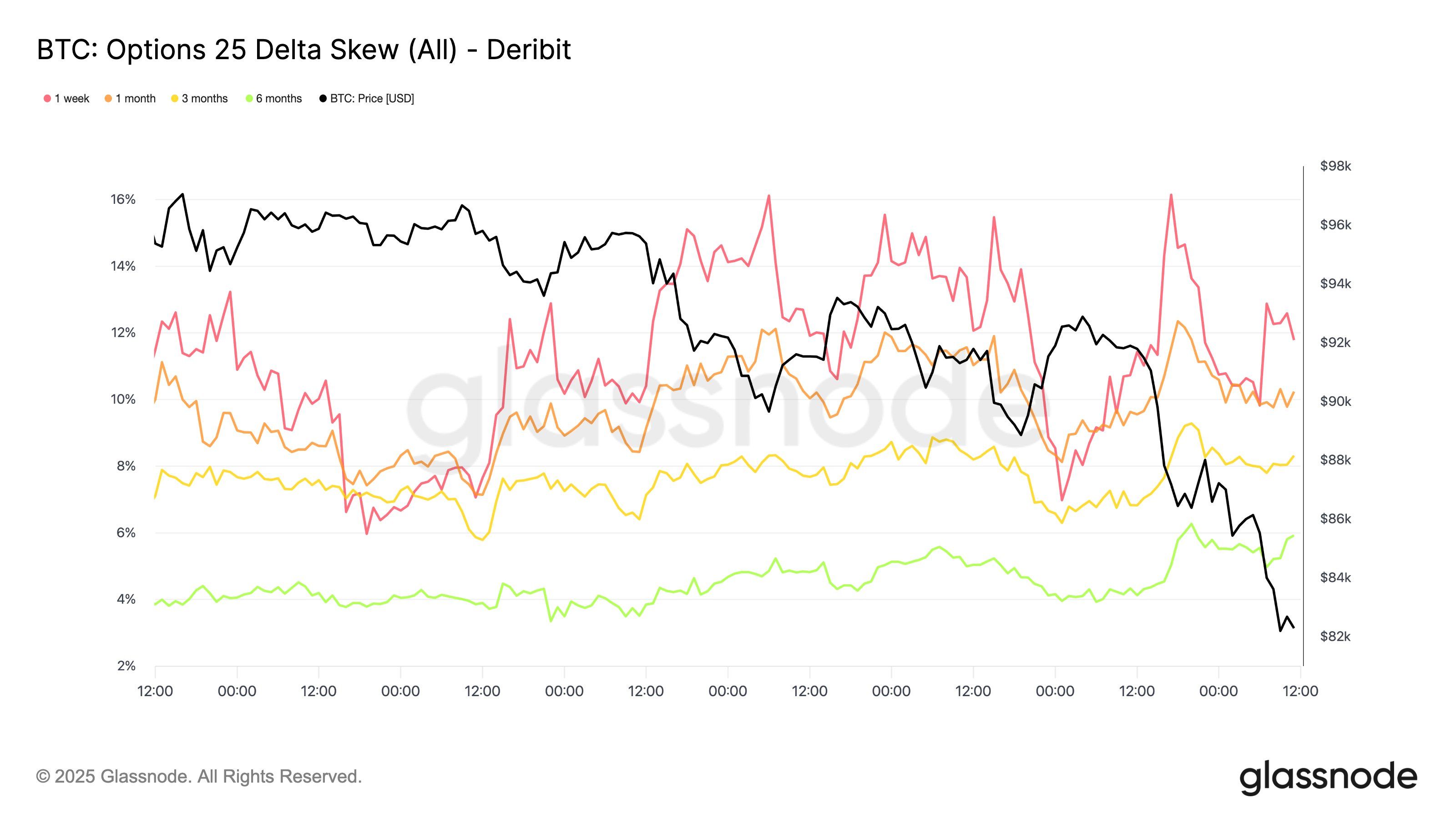

Macro momentum indicators point out that the Bitcoin market threat forecast is actively altering. The 25 delta skew is pushing deeper into put territory throughout all maturities, indicating that merchants are more and more paying for draw back safety. Brief-term choices stay probably the most skewed, however the notable change is the longer expiration dates.

The 6-month put has elevated by 2 volatility factors in only one week, highlighting a transfer in the direction of structurally bearish positioning. Merchants are actually pricing in each instant draw back threat and the potential for an excellent greater decline.

This sample sometimes seems close to the underside zone of a significant enterprise cycle, because the market overshoots downward earlier than returning to equilibrium.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

25D skew in Bitcoin choices. Supply: Glassnode

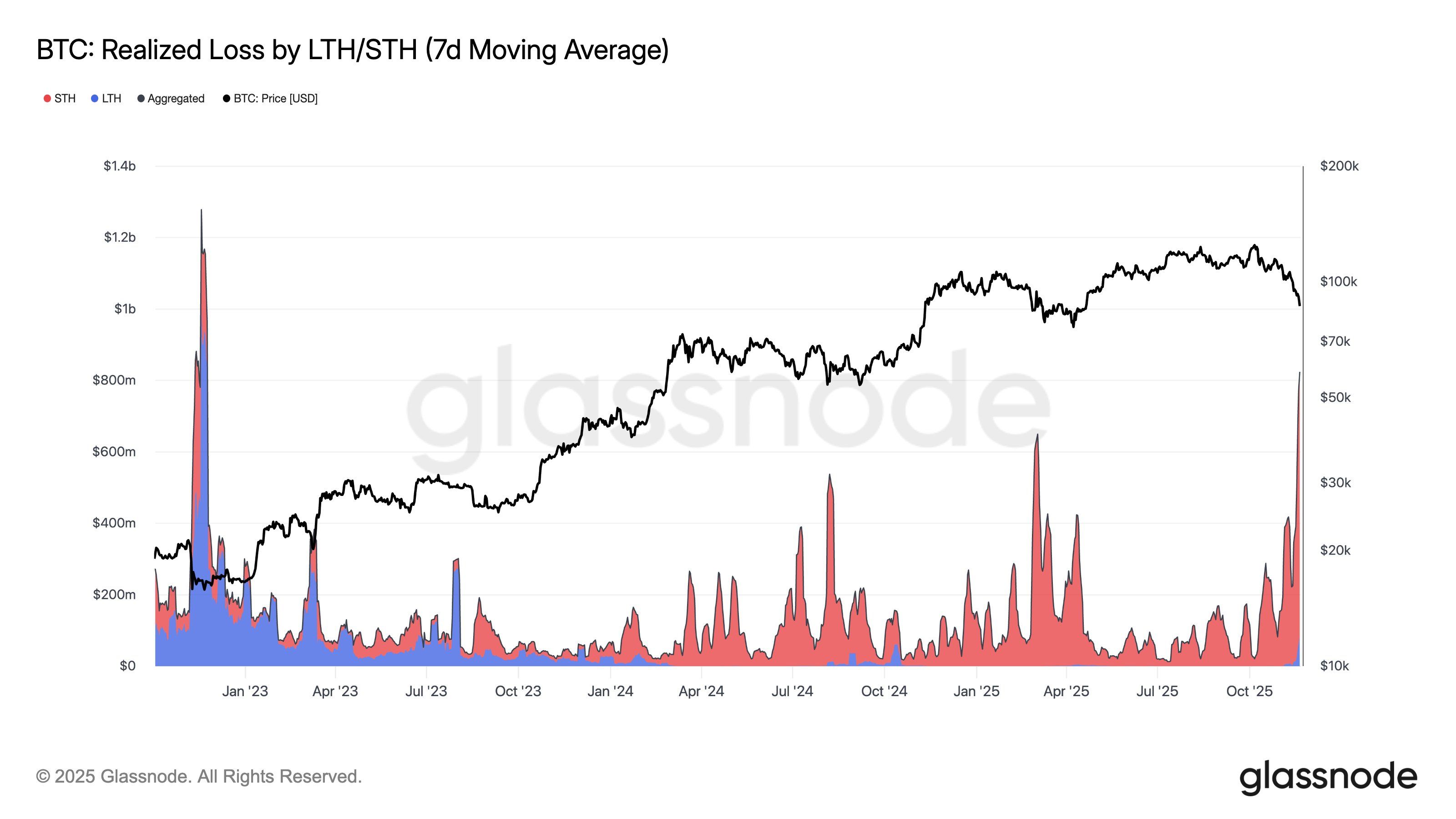

Realized losses for Bitcoin holders have soared to ranges not seen for the reason that FTX collapse. Most of this decline was pushed by short-term holders, reflecting current panic promoting by consumers that constructed up close to the highs. The magnitude and velocity of those realized losses point out that marginal demand has been utterly exhausted.

One of these aggressive deleveraging traditionally marks the ultimate stage of a recession. As soon as short-term holders launch their funds en masse, long-term holders sometimes step in and an accumulation zone begins to kind.

That is according to basic all-time low habits of capitulation earlier than restoration.

Bitcoin realized losses. Supply: Glassnode

BTC worth might rebound

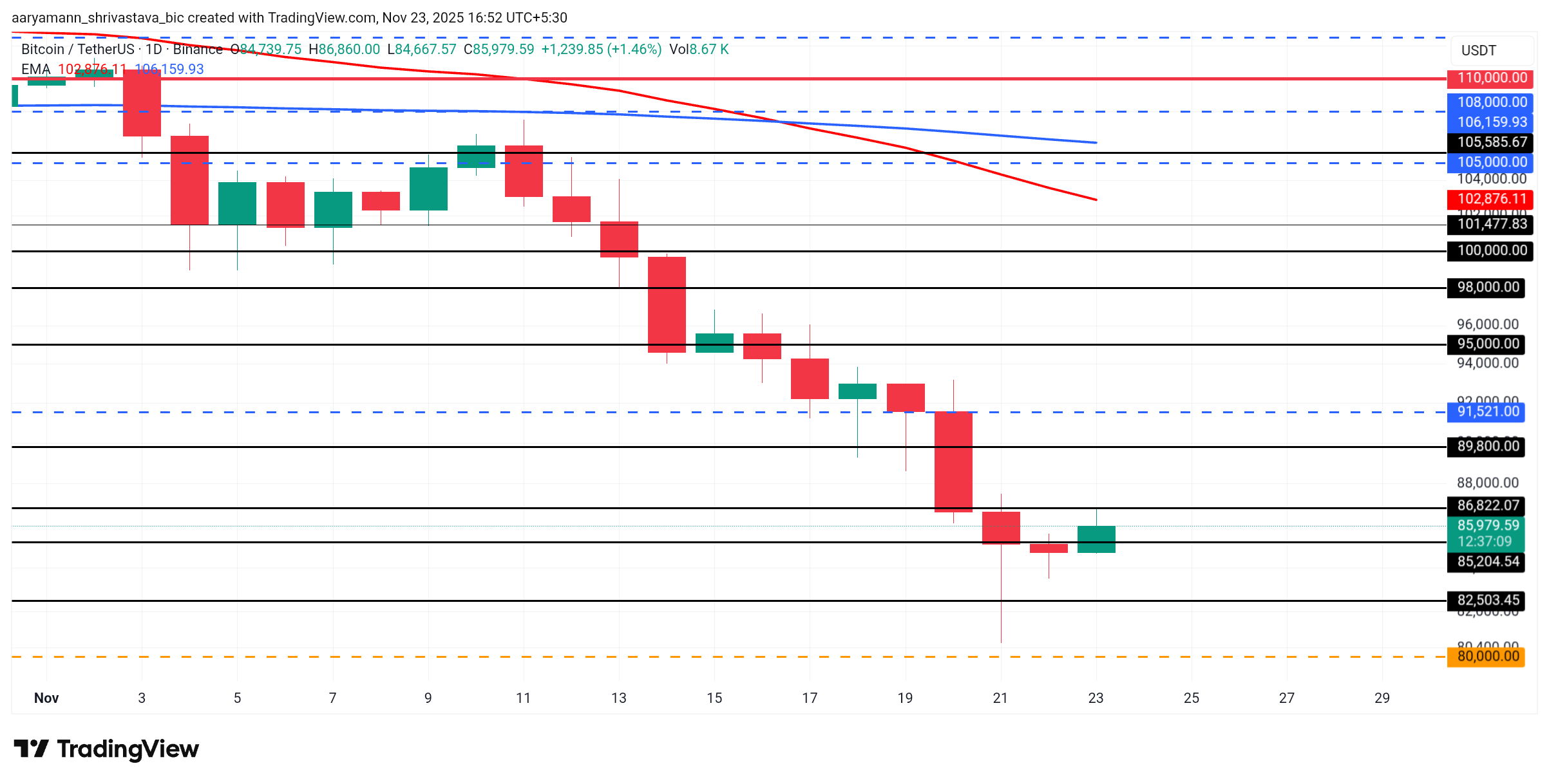

On the time of writing, Bitcoin is buying and selling at $85,979, above the $85,204 help stage and throughout the psychological flooring of $85,000. The mix of capitulation, bearish bias, and huge realized losses suggests {that a} market backside is close to or has already shaped.

If this backside is confirmed, Bitcoin may rebound and break by the $86,822 resistance. Above that stage, it may rise to $89,800 after which $91,521. Clearing these limitations may revive bullish sentiment and push BTC nearer to $95,000 within the quick time period.

Bitcoin worth evaluation. Supply: TradingView

Nonetheless, if bearish strain will increase and the macro atmosphere doesn’t enhance, Bitcoin may fall beneath $85,204. A decline beneath $82,503 may trigger the worth to fall additional in the direction of $80,000, invalidating the bullish concept and delaying the restoration.

The publish Has Bitcoin bottomed out? What the information says in regards to the rebound appeared first on BeInCrypto.