Regardless of rising expectations that altcoin season is imminent, business insiders say cash is flowing again into Bitcoin and company crypto treasury corporations, calling into query conventional crypto market cycles.

Company digital asset vaults (DATs) have siphoned roughly $800 billion price of retail investor funds from the altcoin market, in response to cryptocurrency market intelligence agency 10x Analysis.

“Liquidity, momentum, and perception have all moved elsewhere, and the altcoin market has develop into eerily quiet,” 10x Analysis wrote in a weblog submit on Friday. “Our mannequin exhibits a decisive return to Bitcoin, at the same time as retail merchants in South Korea, as soon as the middle of altcoin hypothesis, have shifted their focus to US crypto shares.”

“Altcoins have underperformed Bitcoin by about $800 billion this cycle, and this shortfall would have primarily benefited retail buyers,” 10x mentioned, including that this has led retailers to hunt “alternate options for fast earnings.”

Bitcoin vs altcoin tactical mannequin. sauce: 10xresearch.com

Associated: Arthur Hayes asks for $1 million in Bitcoin as Japan’s new prime minister orders financial stimulus

Technical indicators counsel a rotation of crypto belongings into Bitcoin

Regardless of continued requires altcoin season, key altcoin metrics counsel buyers could also be looking for extra publicity to Bitcoin somewhat than smaller cryptocurrencies.

10x Analysis’s “Technical Altcoin Mannequin” means that crypto investments are returning to Bitcoin, displaying that the $19 billion crypto market crash destroyed the momentum beforehand gained by altcoins.

“The mannequin pivoted in direction of Bitcoin at a key second two weeks earlier than the altcoin crash on October 11, 2025,” 10x mentioned.

Associated: SpaceX strikes $257 million in Bitcoin, reigniting questions on cryptocurrency efforts

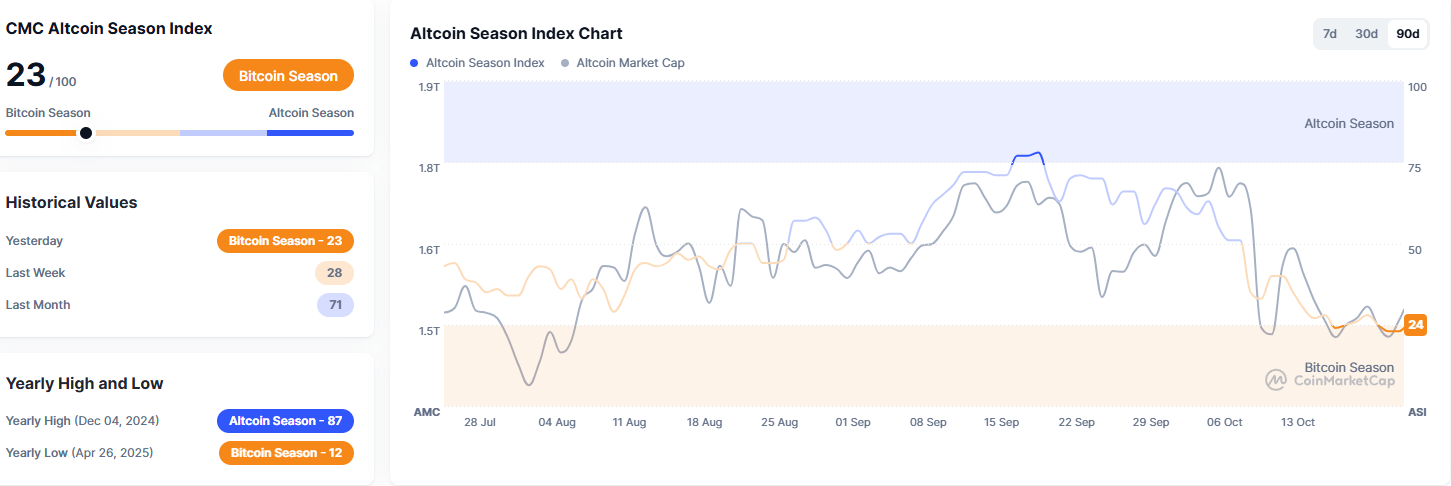

Regardless of rising expectations for altcoin season, most indicators are displaying indicators on the contrary.

Altcoin seasonal index chart. Supply: CoinMarketCap

CoinMarketCap’s altcoin season indicator is at the moment at 23, which nonetheless signifies “Bitcoin season” till the gauge crosses the 75 degree.

In a hopeful signal for a correction, Jeff Kendrick, International Head of Digital Asset Analysis at Customary Chartered, advised Cointelegraph that buyers could view the report $19 billion liquidation occasion as a momentum shopping for alternative that would push Bitcoin to $200,000 by the top of the 12 months.

journal: Bitcoin sees ‘one other large push’ to $150,000, ETH strain will increase