Cryptocurrency spot buying and selling on main centralized exchanges (CEX) has rebounded up to now quarter, reversing the downward pattern that started in early 2025.

The entire spot buying and selling quantity of the highest 10 CEXs elevated by 30.6% within the third quarter of this 12 months to a internet worth of $4.7 trillion, crypto evaluation platform TokenInsight reported in its newest foreign money evaluation launched on Friday.

The soar marks a notable pattern reversal after CEX spot buying and selling volumes suffered two vital declines within the first half of this 12 months, and indicators renewed investor curiosity after Bitcoin (BTC) soared to new highs of over $123,000 in August.

Regardless of the surge within the spot market, derivatives buying and selling continued to dominate CEX, with buying and selling quantity rising by about 29% to $26 trillion from $20.2 trillion within the second quarter.

Binance tops spot market share with 43%

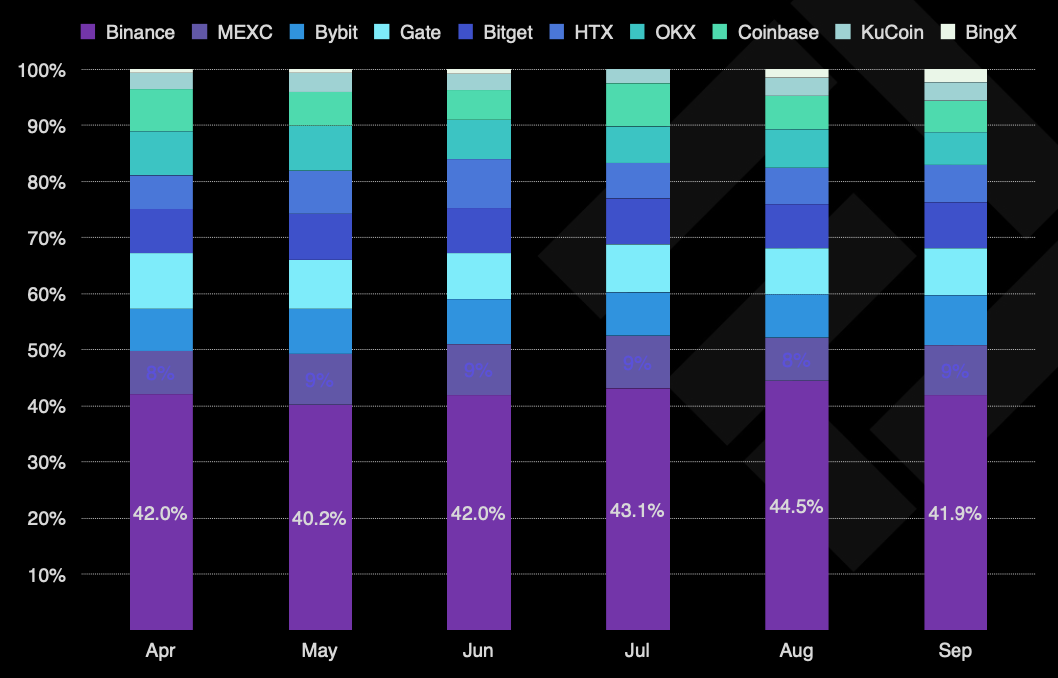

Binance, the world’s largest CEX by buying and selling quantity, remained the spot market chief in Q3 2025, accounting for about 43% of the market.

The change has constantly captured greater than two-fifths of all CEX spot buying and selling quantity, considerably outpacing rivals akin to MEXC and Bybit, which every held about 9%.

Quarterly buying and selling volumes for derivatives buying and selling and spot buying and selling on CEX for Q3 2025. Supply: TokenInsight

Binance additionally maintained its main place within the derivatives market within the third quarter, with its market share considerably rising to 31.3% in September, in line with TokenInsight information.

In the meantime, rival exchanges OKX and Bybit have seen a decline in market share over the previous quarter, however nonetheless preserve their second and third place positions, respectively.

Month-to-month spot market share of main CEXs since April 2025. Supply: TokenInsight

Amongst different exchanges, solely Gate, KuCoin and BingX have recorded vital development, highlighting their resilience amidst elevated market volatility, in line with Token Insights.

“Total, the derivatives market has entered a part of structural transformation. Though the foremost exchanges nonetheless preserve a dominant place, extra rivals are rising and market competitors is intensifying,” the report stated.

journal: Mysterious Mr. Nakamoto Creator: Discovering Satoshi Will Injury Bitcoin