Bitcoin (BTC) has been risky over the previous few months, and prediction markets aren’t utterly satisfied that the flagship cryptocurrency will hit a brand new all-time excessive (ATH) by December thirty first.

So, in keeping with information from crypto-based prediction market Polymarket as of December 9, only one% of people betting on the platform at the moment imagine Bitcoin can rise to $130,000, above the $126,000 ATH it reached in October of this 12 months.

However curiously, the 1% who imagine the inventory might attain a brand new peak are betting practically $10 million on the $130,000 value goal. Additionally price noting is the 3x wager that Bitcoin value will crash to $65,000. This value hasn’t been seen since October of final 12 months, however solely $392,000 has been wagered right here.

Nearly all of merchants (61%) assume Bitcoin will rise to at most $95,000 by the top of the 12 months, however wager quantity is decrease once more, approaching $581,000.

Information means that among the extra bullish Bitcoin bets started to say no quickly simply earlier than November, when the final rays of hope for the “Uptober” started to fade.

For instance, the cryptocurrency market set odds of Bitcoin charging $130,000 on October twenty seventh at 56%, which on the time was solely 8% decrease than when betting started. However by the point this text was printed, they’d plummeted to nearly negligible ranges.

Bitcoin value outlook

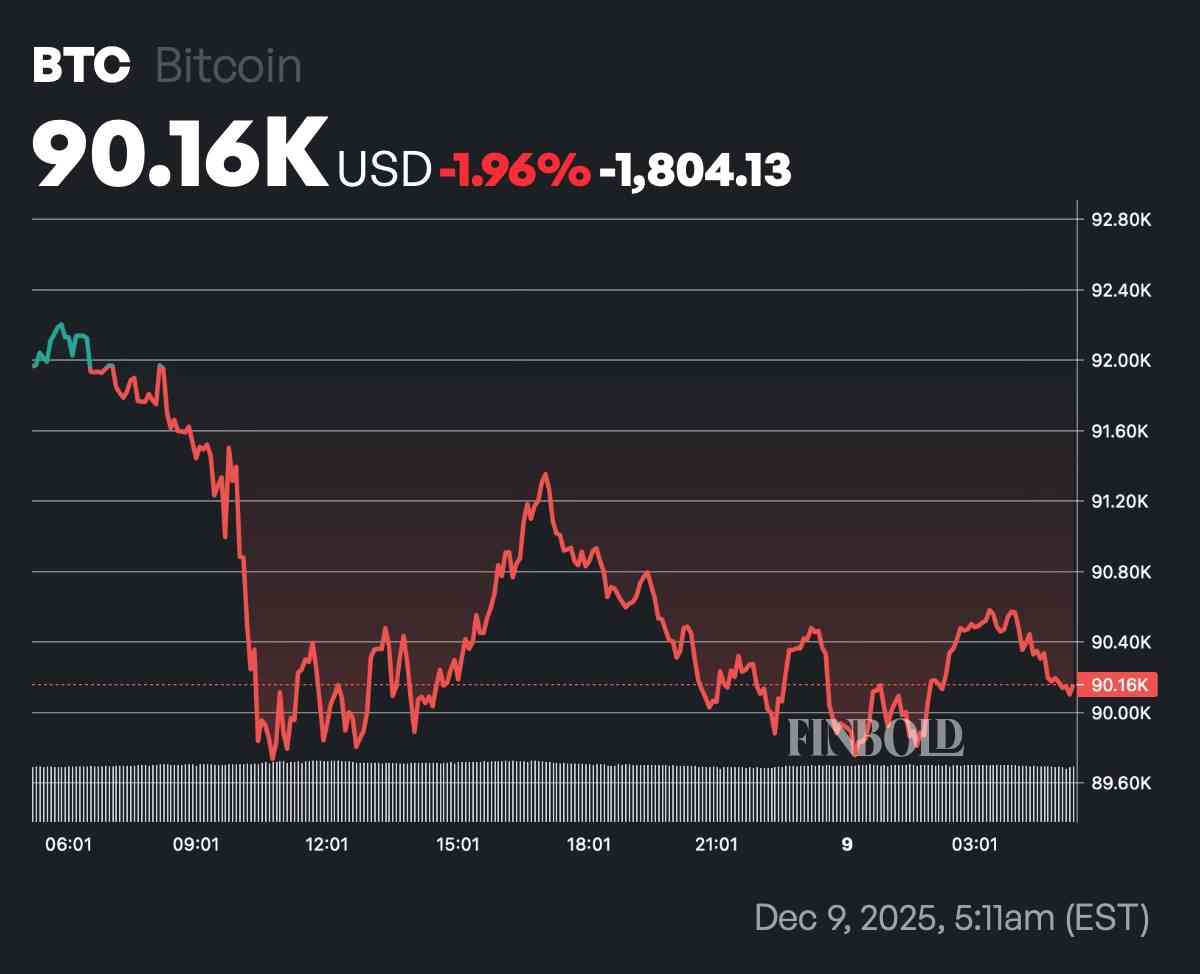

On the time of writing, Bitcoin is down practically 2% on the day by day chart, however stays above $90,000.

The broader crypto market additionally fell 1.85% forward of tomorrow’s Federal Reserve determination and a technical decline in “digital gold.” Polymarket The wager seems rather more cheap.

The asset fell under its 30-day easy transferring common (SMA) of $92,383 and was rejected on the 50% Fibonacci retracement stage close to $94,044, suggesting weakening momentum.

Failure to get well $92,000 might affirm a bearish pennant sample in the direction of the $86,000 goal and even under $80,000, with a 31% chance primarily based on the information reviewed above.

Featured picture through Shutterstock