Bitcoin mining firm CleanSpark (CLSK) maintained excessive manufacturing ranges in November, displaying indicators of elevated income regardless of a difficult surroundings for crypto miners and the broader digital asset market.

The corporate reported Wednesday that it mined 587 Bitcoins (BTC) in the course of the month, an 11% enhance from October.

CleanSpark additionally expanded its contracted energy capability by roughly 11% to greater than 1.4 gigawatts. This is a crucial measure of the ability the corporate has secured to help future mining operations. The excessive energy consumption permits firms to deploy extra mining tools and develop manufacturing over time.

CEO Matt Schultz additionally reiterated the corporate’s $1.15 billion zero-coupon convertible debt providing, which gives long-term interest-free financing. The proceeds are meant to strengthen CleanSpark, Inc.’s steadiness sheet, fund infrastructure enlargement, and help its inventory repurchase program.

The mining replace follows CleanSpark’s 2025 monetary outcomes launch, the place income greater than doubled 12 months over 12 months to $766.3 million.

sauce: block area

Associated: CleanSpark secures second BTC-backed credit score line this week with no fairness dilution

The economic system of Bitcoin miners can be burdened.

CleanSpark is increasing its manufacturing capability amid rising monetary stress throughout the Bitcoin mining business. November was notably robust, as Bitcoin’s worth fell greater than 36% from its all-time excessive in mid-October, eroding miners’ revenues and margins.

As reported by Cointelegraph, the business entered one in every of its deepest recessions in November because of collapsing revenues and rising worth volatility.

Information from The Miner Magazine exhibits that the efficiency hole between the common miner and essentially the most environment friendly operators is widening, highlighting that scale and price effectivity will turn out to be more and more essential to outlive in a protracted downturn.

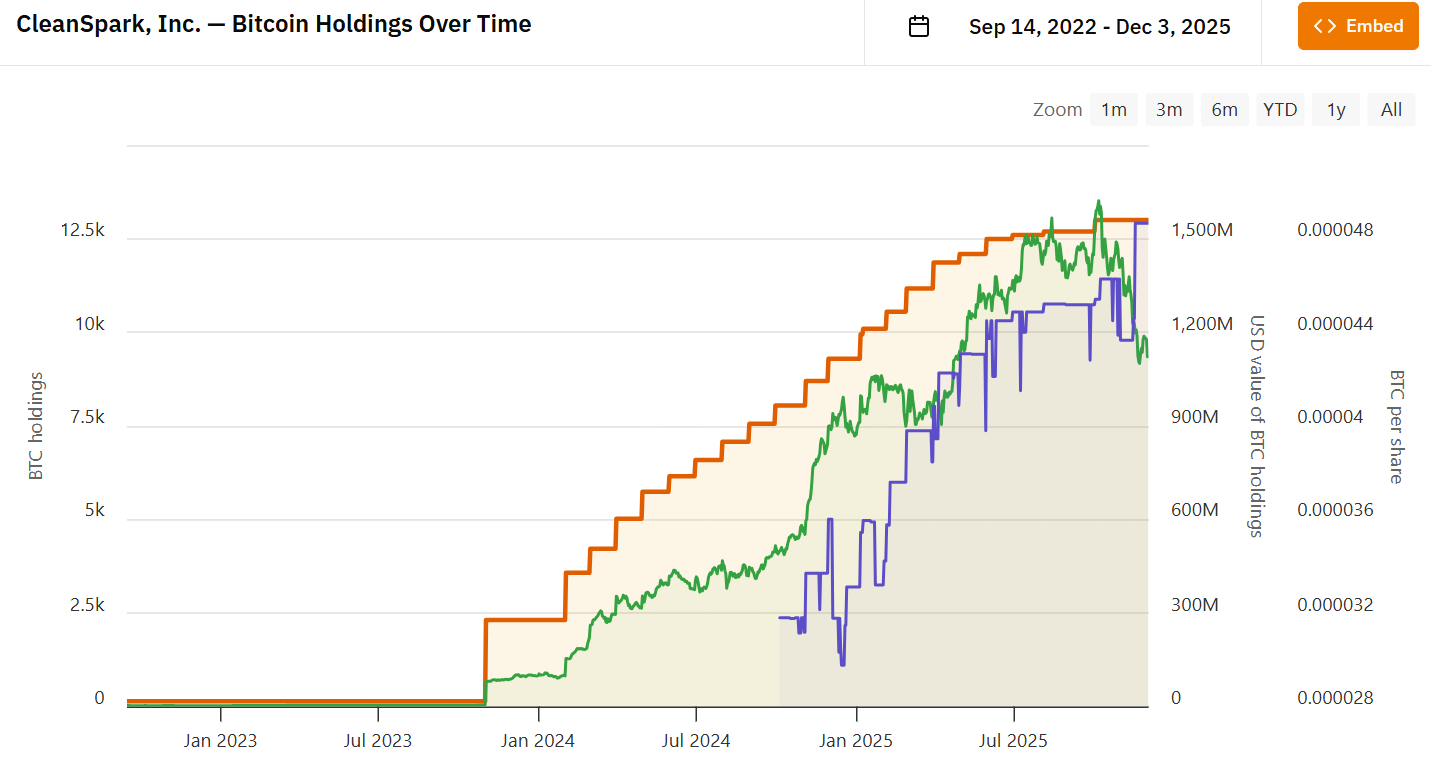

CleanSpark has accrued over 13,000 BTC on its steadiness sheet. sauce: BitcoinTreasuries.NET

In consequence, mining shares plummeted. Shares of MARA Holdings, Riot Platforms, and HIVE Digital Applied sciences are all underneath important strain.

CleanSpark has continued to function via the recession, however its inventory worth has additionally fallen greater than 30% since mid-October.

journal: 7 explanation why Bitcoin mining is a horrible enterprise concept