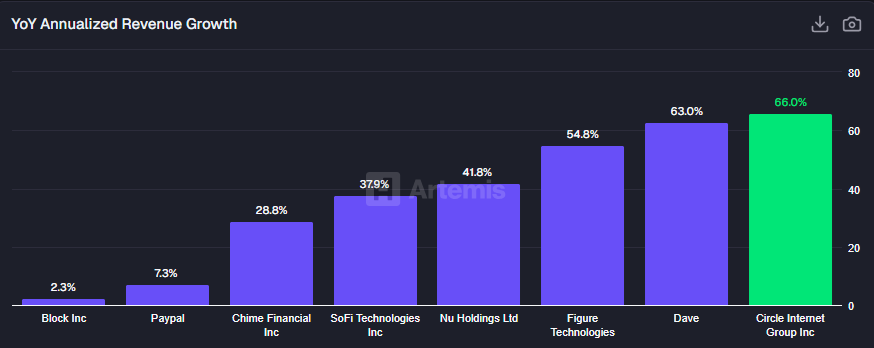

Circle has had a tough yr attributable to fast development and monetary headwinds. Circle Web Group Inc. achieved income development of over 66% in 2025.

Circle Web Group Inc., the issuer of the USDC stablecoin, recorded a income improve of over 66%. The group has emerged as a development chief amongst different crypto-friendly fintech corporations.

Though Circle has achieved the best development fee amongst fintech corporations, its income stays comparatively small for a mature fintech firm. |Supply: Artemis

Circle’s primary income comes from its position as a stablecoin issuer. The corporate retained most of its charges and achieved income of $2.93 billion. Based on knowledge from DeFi Llama, Circle’s every day charges have grown extra quickly over the previous 12 months.

In consequence, Circle generated greater than $8 million in charges via the tip of 2025, step by step doubling its every day income. Circle developer good contract It was one of many busiest on Ethereum previously yr. Moreover, Circle has considerably expanded its provide on Solana, turning into an integral a part of DEX buying and selling and lending.

Circle combines crypto-native makes use of with fintech enhancements

Circle’s USDC token has gained significance each to cryptocurrency insiders and as a fintech device. Like a significant cost firm grasp card We have now additionally adopted stablecoins as cost gateways obtainable in chosen markets.

USDC token has been added as a cost device via: world pay. Stripe, Finastra, and FIS have additionally added stablecoin choices.

USDC and different Circle property grew to become key to the US and European markets, which launched new stablecoin legal guidelines, calling into query the dominance of USDT. USDC maintained its benefit as a totally compliant token and expanded its affect in 2025 after establishing a brand new regulatory framework over the previous few years.

Are circles overrated?

All through 2025, it has been a tumultuous yr for Circle buying and selling. CRCL inventory began within the $81 vary and rose to a excessive of $293. The inventory value was simply above $82, ending the yr with its first web loss since its IPO.

All through 2025, Circle additionally had excessive enterprise worth to gross revenue and enterprise worth to web revenue ratios.

Circle remains to be a rising firm, that means its present gross and web earnings are comparatively small in comparison with market valuations. Extra mature fintech corporations like PayPal have double the ratio of enterprise worth to annual income.

In Circle’s case, this ratio is over 25x, that means the corporate’s worth is comparatively giant in comparison with its complete income. Moreover, the corporate has an enterprise worth to web earnings ratio of 35 instances.

Circle at present depends on income from stablecoin adoption and operations to bridge the hole to post-IPO valuation. The corporate’s market capitalization stays at over $18 billion, making it one of many prime 5 fintech corporations.

Regardless of the general improve in stablecoin provide and utilization, Circle faces headwinds as each fintechs and cryptocurrencies re-evaluate their use instances. To keep away from being trapped in a shrinking market, USDC could must pivot away from crypto insider actions and develop into a worldwide funds gateway.