Cipher Mining has expanded outdoors of Texas for the primary time with the acquisition of a 200-megawatt energy plant in Ohio referred to as Ulysses, getting into the PJM wholesale energy market, the biggest electrical energy market in the USA.

The 195-acre web site has secured energy capability from AEP Ohio, all mandatory utility contracts are in place and is anticipated to be energized within the fourth quarter of 2027, in accordance with Tuesday’s announcement.

Cipher mentioned the power is appropriate for Bitcoin (BTC) mining in addition to high-performance computing and information heart purposes. Monetary phrases of the deal weren’t disclosed.

The transfer is aimed toward assembly rising demand for information facilities from hyperscalers, main cloud computing firms reminiscent of Amazon Internet Companies and Google Cloud. “Hyperscalers are driving unprecedented demand for large-scale websites,” mentioned Cipher CEO Tyler Web page, including that the corporate’s new web site will give it further capability to develop its high-performance computing (HPC) internet hosting enterprise.

sauce: crypto mining

The deal follows intensive efforts by publicly traded Bitcoin miners to increase past conventional mining to energy, information heart, and manufacturing infrastructure.

For instance, Hut 8 just lately signed a 15-year lease price roughly $7 billion to offer 245 megawatts of AI information heart capability at its Riverbend, Louisiana campus. Infrastructure supplier Fluidstack would be the tenant, and Google will assist lease funds.

A couple of days later, Bitdeer leased roughly 188,000 sq. ft of land at its Sparks, Nevada, distribution facility to broaden its U.S. manufacturing footprint, in accordance with The Miner Magazine.

Associated: How Bhutan is constructing a inexperienced Bitcoin financial system from scratch

Bitcoin mining hash value places stress on miners

The hash value for Bitcoin mining, a key measure of miner income per unit of computing energy, has been beneath $40 since mid-November, a degree that many operators think about break-even. Margins throughout the sector stay underneath stress, and the recession is forcing mining firms to reevaluate their working fashions.

Bitcoin hash value over the previous 3 months. sauce: hash price index

Many miners want to diversify by way of the demand for AI and HPC, whereas others are turning to renewable vitality as a option to scale back prices and stabilize profitability.

Sanga Renewables just lately commissioned a 20-megawatt photo voltaic mining facility in Ector County, Texas, and Phoenix Group began a 30-megawatt hydropower undertaking in Ethiopia in November.

Individually, Canaan partnered with Soluna in September to convey mining capability to a wind farm in Texas and is creating an adaptive mining rig that makes use of AI to optimize vitality effectivity.

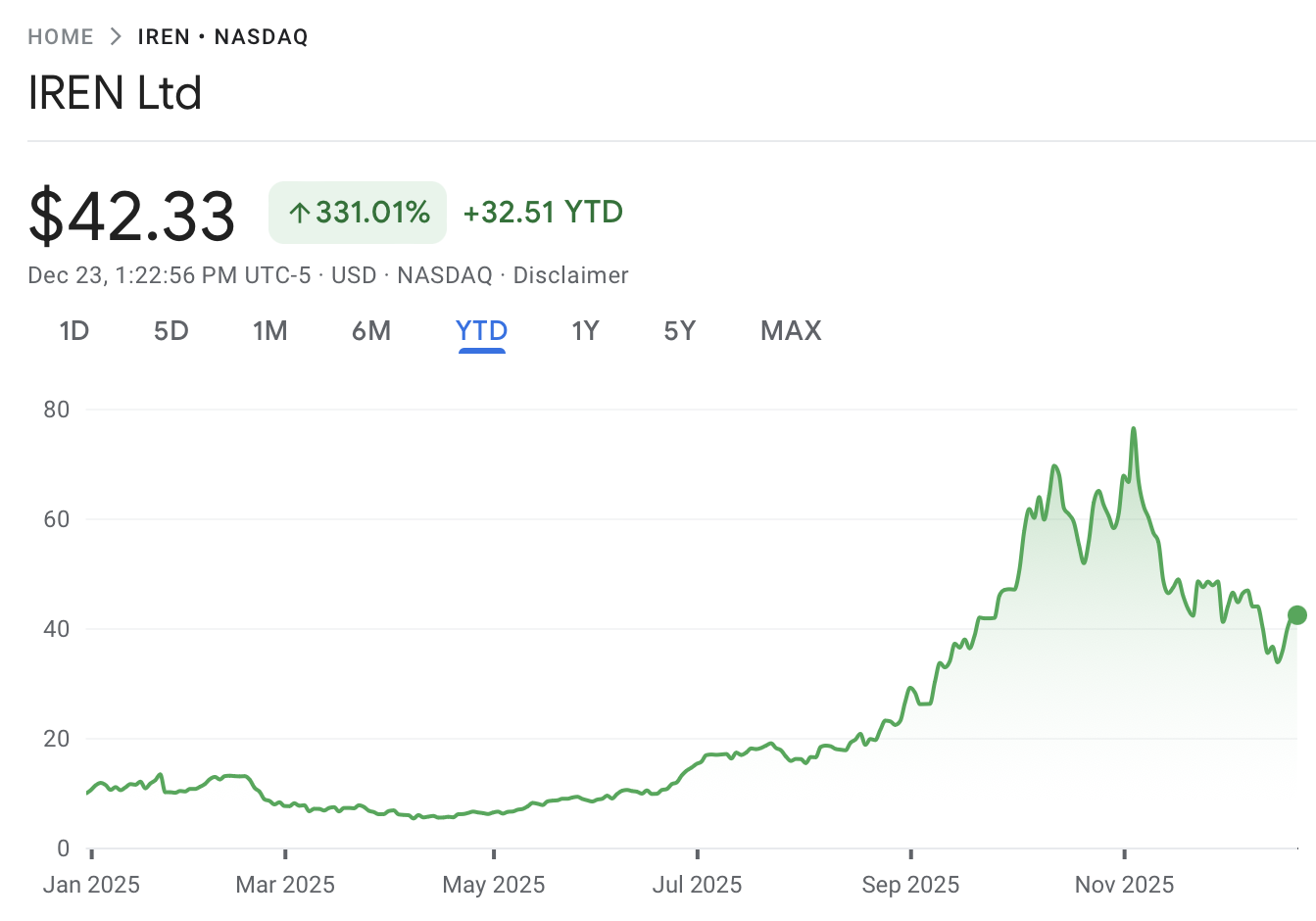

Regardless of growing stress on the mining financial system, Bitcoin mining shares have soared in 2025, exhibiting that public markets are more and more targeted on miners’ long-term strategic positioning, somewhat than simply short-term Bitcoin manufacturing.

Among the many prime 5 listed miners, IREN Restricted is up about 331% because the starting of the yr, adopted by Utilized Digital (246%), Cipher Mining (250%), Hut 8 (160%), and Riot Platforms (36%), in accordance with Google Finance information.

Iren Restricted year-to-date inventory value. sauce: Google Finance

journal: The massive query: Can Bitcoin survive a 10-year blackout?