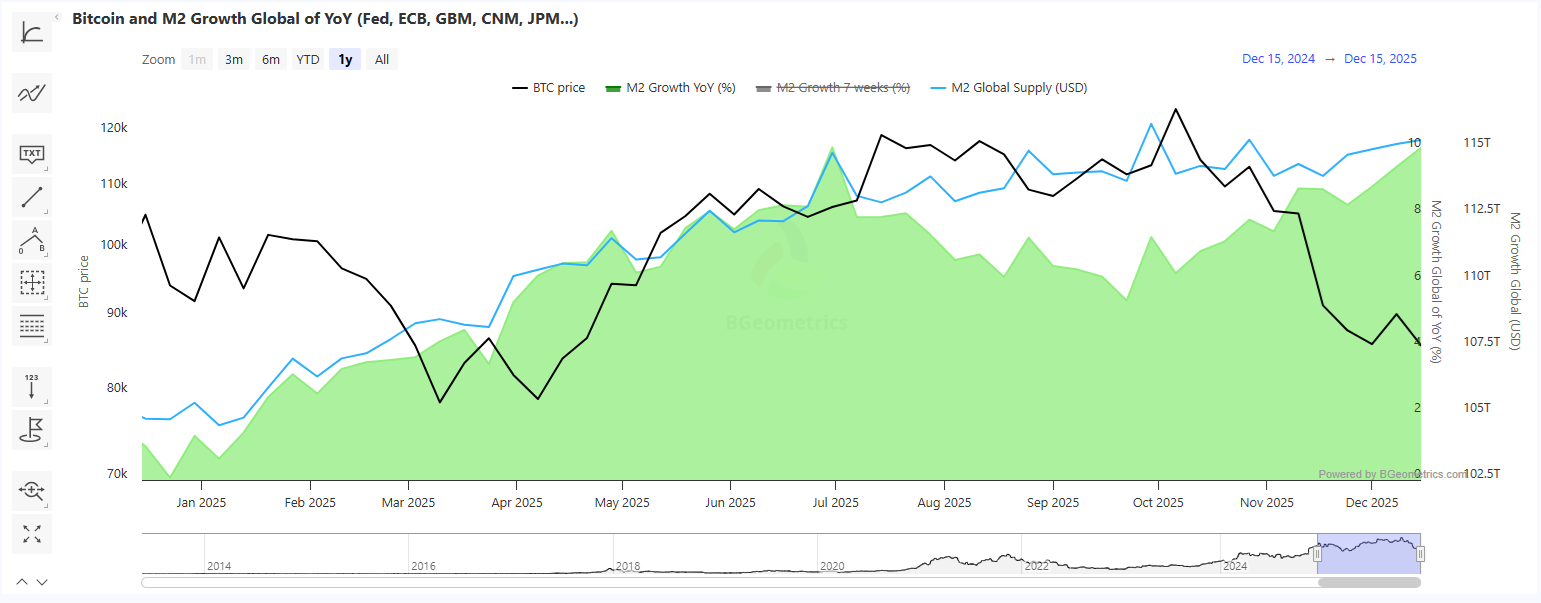

The narrative that BTC was tied to M2 cash provide growth broke in 2025. A sample has emerged by which BTC progress lags and is decoupled from the expansion of worldwide cash provide.

The growth in BTC worth didn’t observe the rise in international M2 cash provide. Over the previous 12 months, BTC has ended up with meager internet positive aspects, underperforming conventional belongings.

M2 cash provide expanded in 2025, however BTC was decoupled from progress as liquidity shifted to shares and treasured metals. |Supply: BGeometry

The M2 saga was a part of the cryptocurrency’s preparation for a year-end rally. Nonetheless, BTC stalled at $126,000 in October and fell to its lowest vary since then.

BTC rise in 2025 additionally lagged behind the tempo of M2 growth. Traditionally, BTC has rebounded after 3-6 months of economic growth, however this time different components broke the pattern within the fourth quarter.

M2 cash provide hits new file

Over the previous 12 months, the worldwide cash provide has expanded from $104 trillion to greater than $115 trillion, sooner than the tempo of earlier years. Provide progress exceeded the growth in 2024.

The tempo of progress was additionally just like the post-pandemic scenario in 2020. The US cash provide has additionally elevated over the previous 12 months, rising from $21.4 trillion in December 2024 to $22.5 trillion in October.

This time, progress in treasured metals, plus growth in AI and information heart shares, meant extra capital was not chasing crypto belongings.

BTC can be extra mainstream and has an extended worth historical past, so buying and selling in 2025 was carried out with extra warning and skepticism. BTC couldn’t break by way of anticipated Value ranges have been low over the previous yr, and the cryptocurrency market has not reached new all-time highs.

Can BTC get better the pattern?

The M2 cash provide story has primarily labored for BTC in earlier market cycles. This time, the extreme capital influx didn’t blindly observe BTC. Patrons and accumulations have been extra strategic.

China’s cash provide expanded additional final yr, rising by about 8% from 311 trillion yuan to 336 trillion yuan. Nonetheless, the nation didn’t instantly contribute to Bitcoin’s progress, and even Asian merchants remained cautious.

One hope is that BTC could meet up with the provision of M2. A catch-up rally units an much more bullish goal for BTC, probably pushing it above $220,000 per coin.

On the identical time, Bitcoin’s unwinding continues, with indicators of sell-offs and sell-offs by institutional traders at native highs. Bitcoin has been unable to rise above $90,000 for a number of weeks because it sells off each time it rises. Market restoration is anticipated to take a number of months, however destructive sentiment nonetheless must be overcome.