Bitcoin value is hovering round $110,970 at present, holding in a decent vary as merchants watch for a decisive transfer. The market is swirling inside a symmetrical triangle, with diminished compression between $108,700 and $112,400 on the 4-hour chart. Though momentum stays sluggish, this sample means that volatility may return quickly.

Consumers maintain the road close to $109,000

BTC value dynamics (Supply: TradingView)

Bitcoin value continues to keep up its triangle base round $108,773, the place the 0.236 Fibonacci retracement and the decrease Bollinger Band coincide. On the upside, the 20, 50, and 100 EMA ranges are concentrated between $111,400 and $112,400 and act as short-term resistance.

A detailed above $112,092 may open the best way to the 0.618 Fibonacci retracement at $114,700. Past that, the following pivot is round $117,500. If sellers regain management and break beneath $109,000, focus may shift to the important thing ranges from October’s strikes at $106,800 and $103,400.

BTC key technical ranges (Supply: TradingView)

The RSI on the 30-minute chart is round 54, indicating balanced momentum with a slight bullish pattern. The upper low construction helps the concept of gradual accumulation beneath resistance.

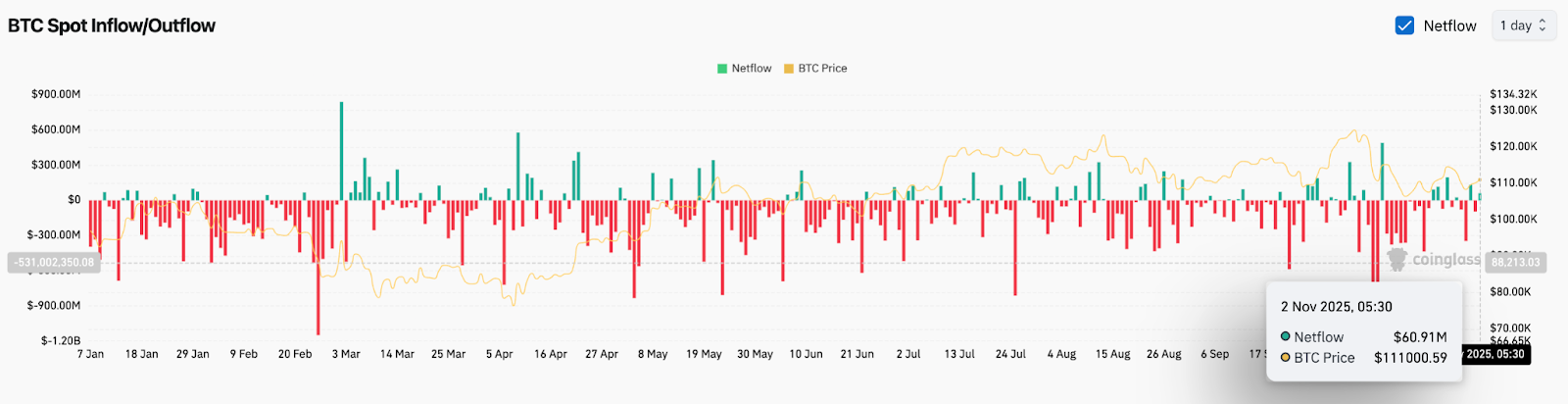

Spot information that displays the calmness earlier than transferring

BTC Netflows (Supply: Coinglass)

In line with Coinglass information, Bitcoin spot inflows on November 2 have been round $60.9 million, suggesting there was some gentle promoting, however not sufficient to interrupt the construction. Latest periods have seen alternating cycles of inflows and outflows, indicating an equilibrium between patrons and sellers.

Bitcoin value at present stays steady round $111,000 regardless of these inflows, which means demand continues to fulfill accessible provide. Though not aggressively accumulating, the tone stays impartial to barely constructive throughout main exchanges.

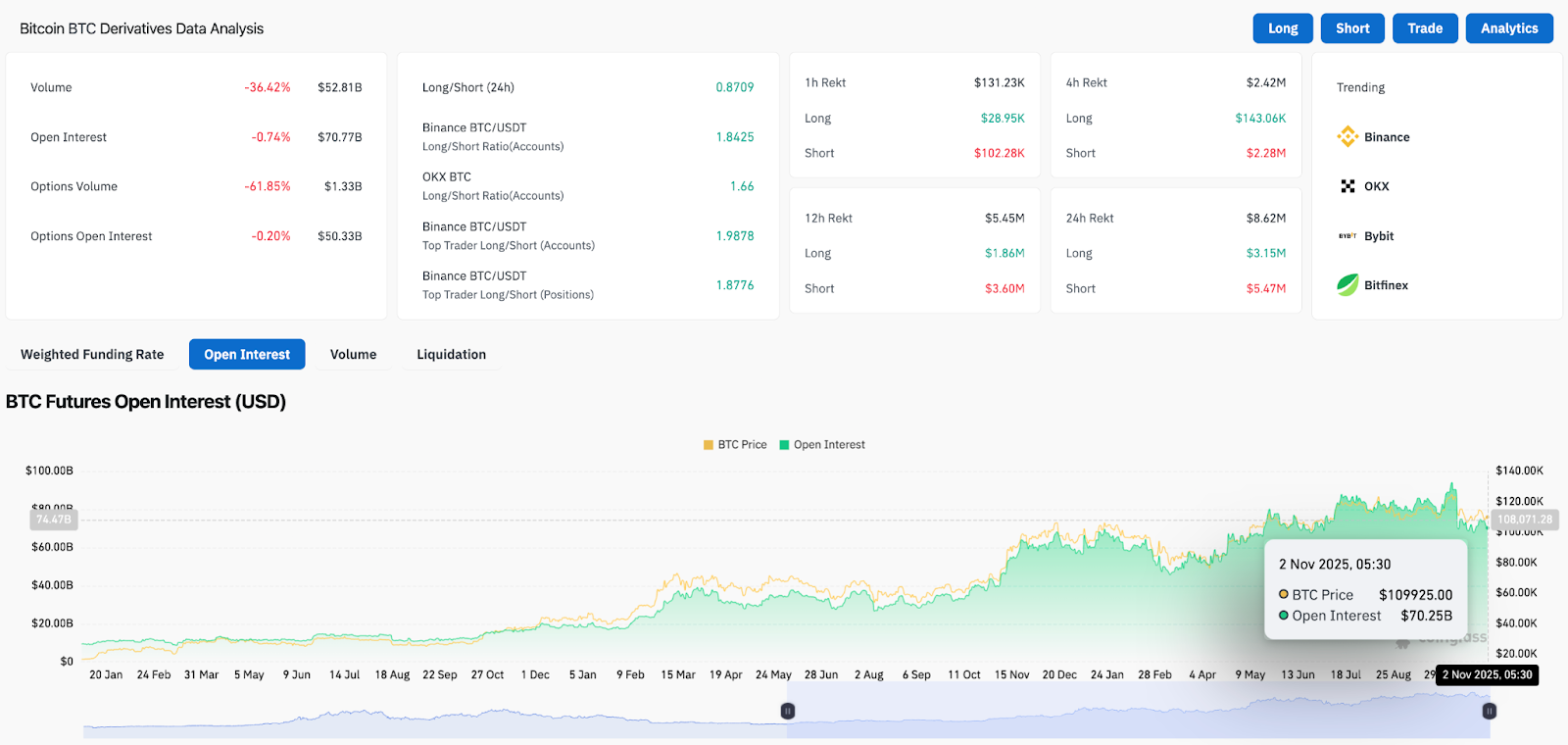

Futures and choices present impartial sentiment

BTC derivatives evaluation (Supply: Coinglass)

Open curiosity in Bitcoin futures was roughly $70.7 billion, down lower than 1% from the day prior to this. Choices quantity is down greater than 60%, indicating merchants are decreasing leverage and ready for clearer course.

Throughout main platforms, the lengthy/quick ratio is skewed in the direction of longs. Binance and OKX each have numbers near 1.8, suggesting cautious optimism amongst contributors. High merchants additionally stay web lengthy, reinforcing the view that the market as a complete is anticipating an eventual breakout.

This positioning may amplify the transfer as soon as value breaks free from its present construction. If the $112,000 resistance breaks, cease orders and new longs may speed up momentum in the direction of the $114,000-$117,000 zone.

Outlook: Will Bitcoin Rise?

Brief-term Bitcoin value predictions are balanced between warning and alternative. If the value closes above $112,400, the bullish path may lengthen to $114,700 after which $117,500. A sustained breakout from this construction may additionally result in new inflows and unwind quick positions.

If the value can’t maintain above $109,000, there’s a threat that the near-term construction will weaken and it’ll fall in the direction of $106,000. Nevertheless, so long as Bitcoin stays above $103,400, its long-term momentum stays intact.

The upcoming periods are prone to outline the following multi-week pattern. Market compression, impartial sentiment, and steady on-chain information all level to at least one conclusion. Bitcoin is poised for its subsequent decisive transfer, and merchants are conserving an in depth eye on who will give in first.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.