Brazilian solar energy producer Torpen is contemplating transferring to Bitcoin mining as a approach to take in extra power generated by the nation’s burgeoning renewable power sector, the corporate’s CEO advised native media outlet BN Americas.

Gustavo Ribeiro, CEO of Taupen and its majority shareholder Pontal Power, advised BN Americas that the corporate is contemplating increasing into Bitcoin (BTC) mining, in keeping with a report on Wednesday. Requested how Torpen plans to handle Brazil’s power glut, Ribeiro stated the corporate is mitigating the issue by diversification.

He added that the corporate is “additionally evaluating options corresponding to information facilities and Bitcoin mining close to the load to soak up regionally generated power.”

The assertion follows a Reuters report in early October that a number of crypto mining firms had been in talks with Brazil’s energy firms to faucet into the nation’s renewable energy surplus.

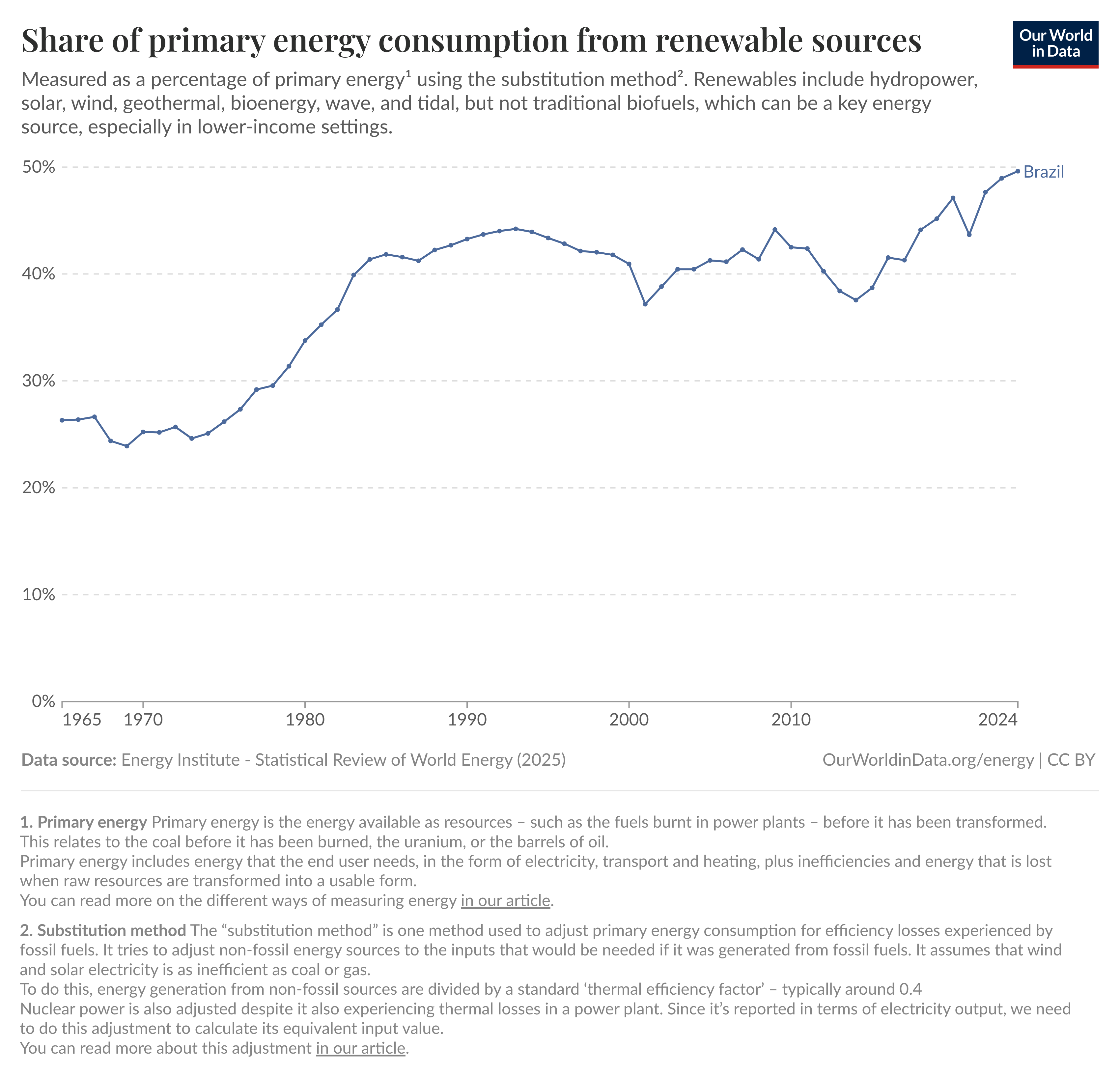

Graph of the proportion of renewable power in Brazil. sauce: our world information

Associated: Mid-tier Bitcoin miners emerge, reshaping competitors post-halving

Brazil’s power oversupply

Brazil is at present going through an oversupply of electrical energy because of its quickly rising renewable power business. In August, Reuters reported that the nation’s authorities plans to name for bids twice in 2026 for hydropower vegetation and fossil fuel-fired energy vegetation to make sure dependable power and cut back dependence on intermittent energy sources corresponding to wind and solar energy.

Brazil’s solar energy suppliers are going through energy provide cuts, limiting the quantity of power they will feed into the grid. Ribeiro stated reductions are a “problem for the sector” and believes changing power into capital by Bitcoin mining could possibly be an answer.

Associated: US Power Secretary Proposes Quicker Direct Grid Entry for AI and Cryptocurrency Miners

Power firms enter mining

Brazil isn’t the one nation the place firms working within the power business are discovering crypto mining profitable. Union Jack Oil, a publicly traded UK-based power firm, introduced over the summer time that it plans to transform pure fuel from its West Newton web site into electrical energy to energy Bitcoin mining in an “oil-to-crypto” monetization venture.

In June, Canadian agricultural firm AgriFORCE Rising Techniques launched an identical initiative. The corporate introduced that it’s going to use the stranded fuel to energy 120 Bitcoin mining rigs, with plans to develop additional.

journal: 7 explanation why Bitcoin mining is a horrible enterprise concept