Shares in Jack Dorsey’s block fell about 12% in after-hours buying and selling Thursday after third-quarter income fell in need of analysts’ expectations.

The crypto-friendly fintech firm earned 54 cents per share within the third quarter, 14% under the 63 cents anticipated by analysts. In the meantime, gross sales for the third quarter have been $6.11 billion, a rise of two.3% year-on-year, however fell in need of expectations of $6.33 billion.

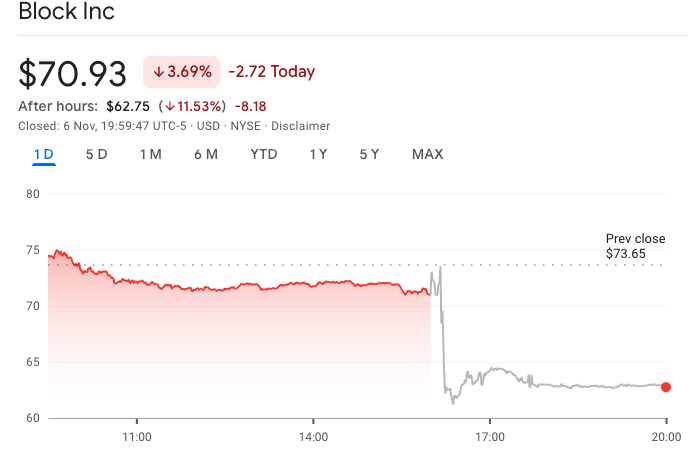

Block Inc. (XYZ) inventory fell 3.7% to $70.93 in after-hours buying and selling, after closing at $62.75.

Brock’s inventory value fell after the bell and continued to fall throughout Thursday’s buying and selling hours. sauce: Google Finance

This provides to the decline in Block’s inventory value, which has fallen 18.24% up to now by way of 2025.

Regardless of the sharp market response, sure metrics in Block’s third-quarter outcomes confirmed robust development for the corporate.

The corporate mentioned gross revenue rose 18% yr over yr to $2.66 billion, and that it expects 2025 income to achieve $10.24 billion, an annual improve of 15%.

Block’s peer-to-peer funds arm, Money App, accounted for a lot of the revenue, with $1.62 billion representing a 24% annual improve. Block’s service provider funds enterprise, Sq., accounted for a 9% improve to $1.018 billion.

Associated: Bitcoin “$68,000 is just too low” versus gold, JP Morgan says BTC, inventory value falls once more

When it comes to general revenue after accounting for working bills, Block’s working revenue totaled $409 million, a rise of 26% year-over-year.

Block Bitcoin Mining Enterprise

Block Chief Monetary Officer Amrita Ahuja mentioned on a convention name with buyers that the corporate’s Bitcoin mining arm, Proto, is beginning to see outcomes.

“We generated the primary income and planted the seeds of what might be the subsequent main ecosystem,” Ahuja mentioned. “We have now monetized Proto’s improvements in {hardware} and software program by way of {hardware} gross sales throughout ASICs, mining hashboards, and full mining rigs that present most of the key superior elements for mining Bitcoin.”

Proto was launched in November 2024, however the deployment of the primary mining rig was not introduced till August. Ahuja mentioned third-quarter income was “modest,” however the firm is “aggressively pursuing a strong pipeline into 2026.”

journal: Cliff purchased two houses with Bitcoin mortgages. Intelligent…or insane?