BlackRock and its tokenization accomplice Securitize have redistributed a big portion of the asset supervisor’s tokenized fund BUIDL throughout a number of blockchains, quietly decreasing Ethereum’s market capitalization by round 60%.

The $2.8 billion fund’s holdings in Avalanche, Aptos, and Polygon jumped from simply $54.3 million, $43.4 million, and $30.7 million, respectively, as of Oct. 19 to roughly $554.7 million, $544.1 million, and $530.9 million as of Oct. 30, in accordance with RWAxyz information. It fell to round $990 million on the Ethereum community.

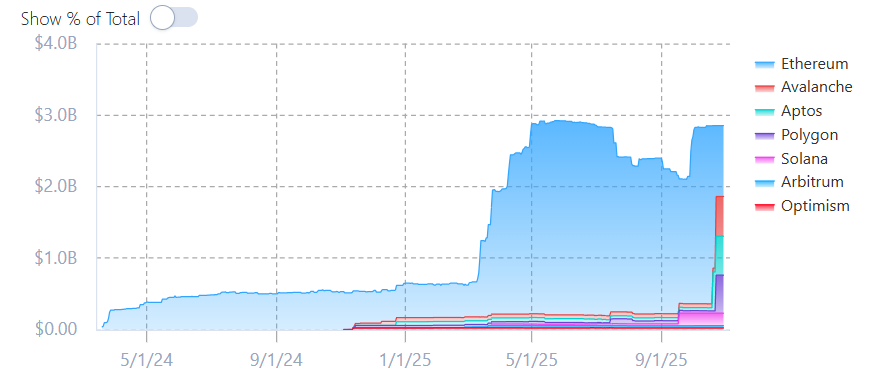

BUIDL initially launched completely on Ethereum in March 2024 after which started increasing to different blockchains just below a yr in the past, with the vast majority of its funds remaining on Ethereum till this month. BlackRock and Securitize didn’t instantly reply to The Defiant’s requests for touch upon the transfer by press time.

BUIDL market capitalization of your complete blockchain. Supply: RWAxyz

BlackRock is the world’s largest asset supervisor, with greater than $13.4 trillion in belongings underneath administration as of the third quarter. BUIDL stays the most important tokenized actual world asset (RWA) product, with over $2.85 billion in belongings.

Complete RWA worth. Supply: RWAxyz

Based on RWAxyz, BUIDL’s community diversification continues to see the full quantity of tokenized RWA proceed to soar this yr, now reaching greater than $35.6 billion, a rise of roughly 8.8% over the previous 30 days.

Ethereum stays the preferred blockchain for RWA, with tokenized RWA worth reaching practically $12 billion, or about 53% of the sector.

BUIDL, launched by BlackRock in partnership with Securitize, permits accredited buyers to carry and earn dividends on blockchain-based tokens backed by U.S. Treasury securities, money, and repurchase contracts.

Earlier this week, Securitize introduced plans to develop into a publicly traded firm by means of a enterprise mixture with Cantor Fairness Companions II, a SPAC backed by Cantor Fitzgerald, the corporate Howard Lutnick led earlier than turning into U.S. Secretary of Commerce.

The deal values the corporate at roughly $1.25 billion, and the mixed firm will commerce on the Nasdaq underneath the ticker SECZ.