Bitnomial Clearinghouse LLC has acquired approval from the U.S. Commodity Futures Buying and selling Fee (CFTC) to clear totally collateralized swaps, permitting mum or dad firm Bitnomial to launch prediction markets and supply clearing providers to different platforms.

Based on Friday’s announcement, Bitnomial’s prediction market will cowl cryptocurrencies and financial occasions along with present Bitcoin (BTC) and crypto derivatives merchandise. The contract is designed to permit merchants to take positions based mostly on outcomes such because the token’s value stage and macroeconomic knowledge.

This approval expands the vary of buying and selling merchandise provided by Bitnomial. The Chicago-based firm’s change and clearing division provides perpetual contracts, futures contracts, choices contracts and leveraged spot buying and selling. The corporate’s clearinghouse additionally helps crypto-based margining and settlement, permitting accepted merchandise to be margined and settled straight with digital property.

Bitnomial President Michael Dunn mentioned the approval will enable the corporate to “construct a clearing community that serves each our personal exchanges and exterior companions, strengthening all the prediction market ecosystem.”

Bitnomial Clearinghouse operates as an infrastructure-only clearing supplier, not a retail competitor, offering accepted companions with entry to margin and fee programs and permitting collateral to be exchanged between USD and cryptocurrencies.

This approval follows the latest inexperienced mild to launch a CFTC-regulated spot crypto buying and selling platform in the US, permitting clients to purchase, promote, and commerce leveraged and unleveraged crypto merchandise on federally supervised exchanges.

Occasion contracts at Polymarket. sauce: Polymarket

Associated: Coinbase Could Debut Prediction Market, Tokenized Shares on Wednesday: Report

Polymarket positive factors momentum within the US

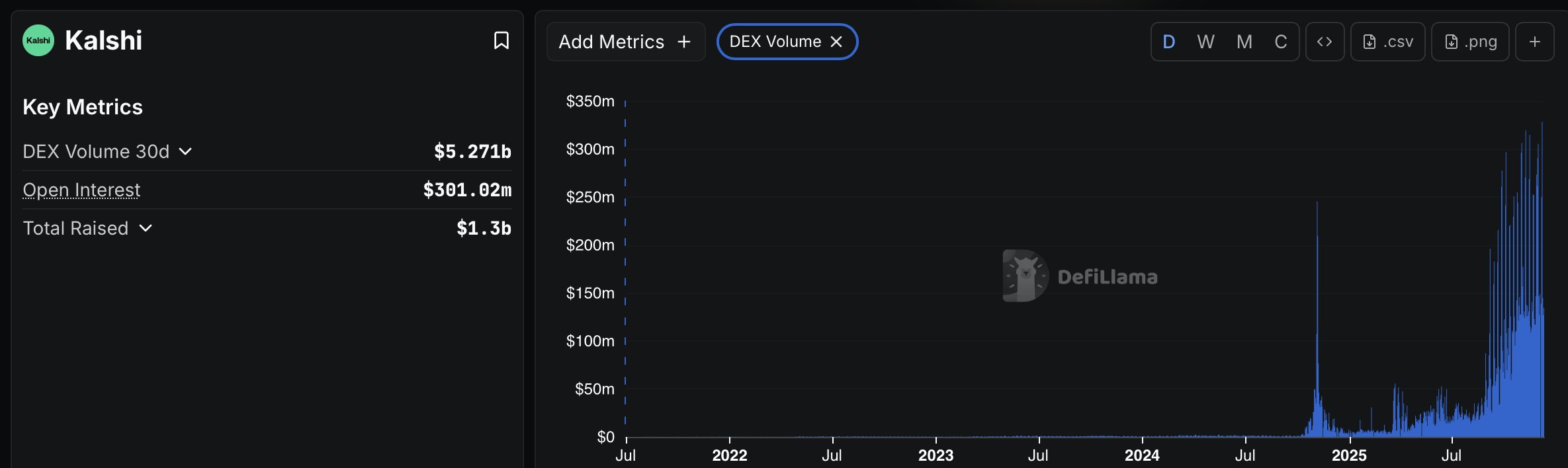

Prediction markets are rising as an enormous development in 2025. Prediction market Kalshi generated $5.27 billion in buying and selling quantity prior to now 30 days, whereas blockchain-based Polymarket recorded just below $2 billion in the identical interval, in accordance with knowledge from DefiLlama.

Carsi buying and selling quantity. sauce: Defilama

In November, Polymarket acquired regulatory approval from the CFTC to function a brokered buying and selling platform, permitting entry by means of registered brokers underneath guidelines governing U.S. markets.

The approval follows the conclusion in July of a CFTC- and U.S. Division of Justice-led investigation into whether or not Polymarket allowed transactions from U.S. customers, which included an FBI raid on founder Shane Coplan’s residence.

Polymarket, which makes use of the USDC (USDC) stablecoin to settle contracts on the Polygon blockchain, has additionally secured a number of partnerships in latest months, together with with the UFC and Zuffa boxing and fantasy sports activities operator PricePicks, which befell in November.

journal: Introducing on-chain crypto detectives who combat crime higher than the police