Ethereum has regained the $3,000 stage after weeks of robust promoting stress, however momentum continues to wane and the restoration stays fragile. Concern continues to dominate the market, and confidence amongst retail merchants has fallen considerably.

Analysts are warning that bulls are dropping management of the development, and a few are starting to name for the early levels of a possible bear market. With Ethereum buying and selling practically 40% beneath its all-time excessive in August, any transfer upwards is being held again, and the broader market setting isn’t but secure.

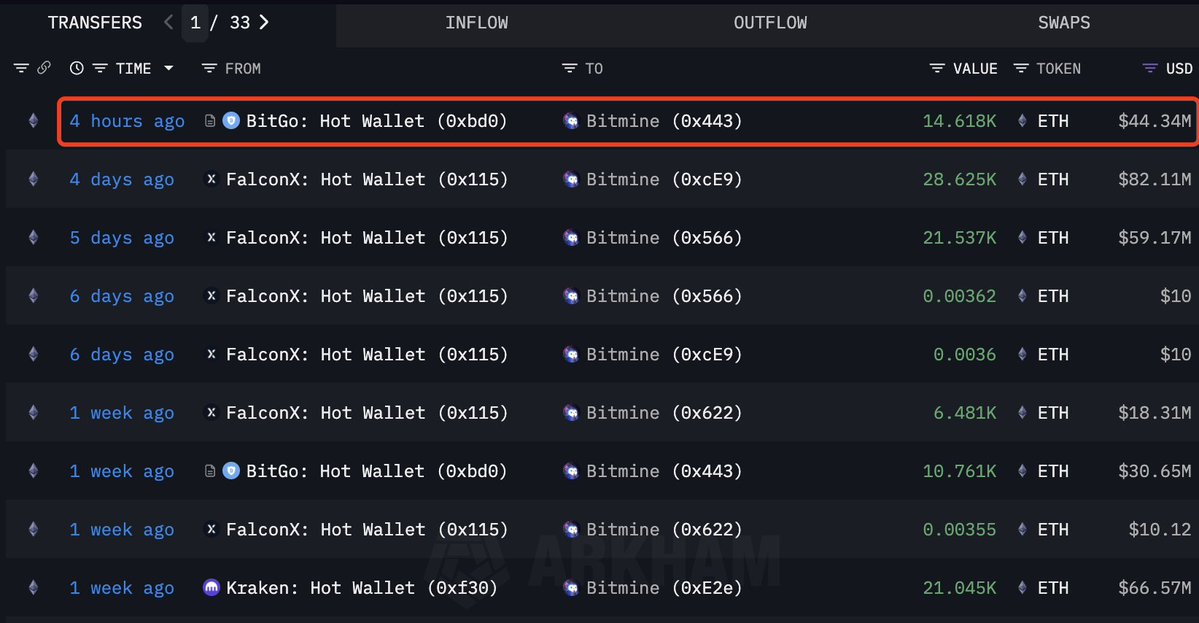

Regardless of this uncertainty, main firms proceed to build up ETH, a sign that contrasts with the prevailing bearish sentiment. New knowledge from Lookonchain exhibits that Bitmine has been constantly buying Ethereum throughout this downturn and exhibits no indicators of slowing down its accumulation technique.

This persistent curiosity amongst giant holders means that whereas short-term merchants stay cautious, institutional buyers and rich patrons should see long-term worth at present ranges.

Bitmine is accumulating as Ethereum struggles for momentum

Lookonchain studies that Bitmine continued its aggressive accumulation technique, buying a further 14,618 ETH (price roughly $44.34 million) a couple of hours in the past. This new acquisition additional strengthens Bitmine’s already big Ethereum place, which presently totals 3.436 million ETH. At present costs, their holdings are valued at roughly $10.39 billion, confirming their long-term beliefs regardless of continued market turmoil.

This stage of accumulation by main gamers stands in sharp distinction to broader market sentiment, the place uncertainty and worry persist. Retail buyers stay cautious, and plenty of analysts argue that Ethereum’s failure to regain momentum above $3,000 is indicative of a declining development.

Nonetheless, Bitmine’s continued purchases counsel a essentially completely different outlook, one rooted in long-term valuation moderately than short-term volatility.

Giant, disciplined patrons typically refill throughout market downturns, viewing discounted costs as strategic entry factors. Bitmine’s habits displays this sample and should point out expectations for worth appreciation within the coming months.

Nonetheless, for Ethereum to learn from this institutional belief, it must stabilize and construct a stronger help base. The approaching weeks will reveal whether or not this sustained whale demand outweighs the broader promoting stress and helps ETH get away of its present downtrend.

ETH tries to recuperate however faces robust resistance

Ethereum is recovering from weeks of sustained promoting stress and making an attempt to regain the $3,000 stage, however continues to be struggling to construct significant momentum. The chart exhibits ETH rebounding from current lows close to the mid-$2,600s, the place a cluster of demand has emerged and the steep decline has stopped.

Nonetheless, regardless of this pullback, Ethereum stays beneath all three main transferring averages (50-day, 100-day, and 200-day), that are presently performing as stratified resistance zones.

The 50-day SMA is trending downward and is already beneath the 100-day SMA, indicating a weakening market construction. In the meantime, the 200-day SMA is barely above the present worth, reinforcing the concept that ETH stays in a weak place. Worth developments stay unstable and have constantly shaped lows because the peak in early October, reflecting sustained bearish management.

Quantity patterns additionally help this alarming state of affairs. Though the current rebound has been accompanied by a modest enhance in buying exercise, it’s nonetheless a lot weaker than the gross sales volumes noticed through the November capitulation. For a significant development reversal, ETH would wish to interrupt out of the $3,300-$3,400 space, retake the transferring common, and set up the next low.

Featured picture from ChatGPT, chart from TradingView.com