Ethereum has been beneath sturdy promoting strain in current days as your complete cryptocurrency market has entered a extreme correction section. Nonetheless, regardless of the volatility and pervasive issues, ETH was capable of firmly maintain the vital $3,000 degree. This degree is taken into account by many analysts to be important to sustaining the broad bullish construction.

Now, with costs stabilizing and consumers beginning to reappear, a number of market gamers are beginning to argue that Ethereum’s downturn could also be nearing an finish and are beginning to search for a attainable restoration.

Including gas to this story is the continued accumulation by main firms, significantly Tom Lee’s Bitmine. Tom Lee is a distinguished Wall Avenue strategist, co-founder of Fundstrat International Advisors, a longtime Bitcoin and Ethereum bull, and one of the crucial influential voices within the digital asset marketplace for almost a decade. His firm, Bitmine, operates as a big institutional funding targeted on long-term accumulation, market making, and strategic positioning throughout instances of concern.

Latest on-chain knowledge reveals that Bitmine continues to buy ETH regardless of the worth drop, demonstrating sturdy confidence within the asset’s long-term prospects. This habits stands in sharp distinction to the broader market, the place short-term holders are capitulating.

Bitmine continues to build up ETH regardless of market downturn

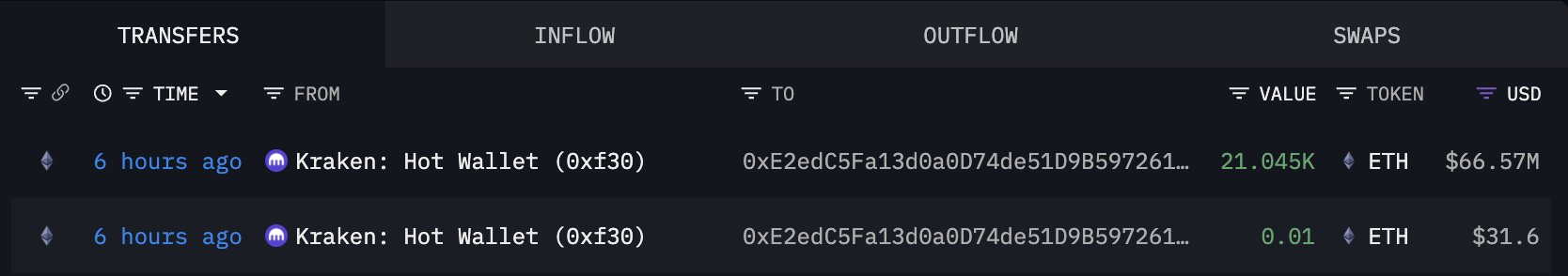

Based on the most recent on-chain knowledge from Lookonchain, the buildup exercise round Ethereum is under no circumstances slowing down. A newly flagged pockets 0xE2ed, believed to be related to Tom Lee’s Bitmine, obtained 21,054 ETH (valued at $66.57 million) from Kraken only a few hours in the past. The transfer reinforces the view that bigger, extra subtle gamers see the current correction as a chance relatively than a risk.

The timing of this switch is noteworthy. Ethereum has been beneath sustained promoting strain for weeks, with sentiment turning sharply bearish because the market grapples with concern, liquidations, and widespread rotation into stablecoins. Nonetheless, regardless of this surroundings, Bitcoin-linked wallets proceed to aggressively take up provide.

This sample is in keeping with Bitmine’s broader technique of accumulating high-quality crypto belongings throughout unsure instances for long-term upside. Traditionally, massive inflows into accumulation wallets throughout drawdowns have typically signaled sturdy institutional investor conviction, previous a section of restoration and renewed power.

Assuming this pockets is definitely related to Bitmine. If that’s the case, this reveals that a number of the market’s best-capitalized members stay assured in Ethereum’s long-term worth, no matter short-term volatility.

ETH Worth Evaluation: Testing Lengthy-Time period Help Amid Excessive Volatility

Ethereum’s weekly chart reveals the asset navigating an vital zone as value hovers simply above $3,000, a degree that has traditionally served as a significant demand space. After weeks of sustained promoting strain, ETH has retreated from the $4,500 space and is presently retesting the long-term shifting common. Particularly, the 200-week shifting common presently sits slightly below the worth and has served as a structural anchor that has supported Ethereum by way of earlier cyclical corrections, together with a deep capitulation in mid-2022 and a restoration section in 2023.

The current candlestick construction displays elevated volatility, with an extended wick suggesting a robust purchaser response close to the $3,000 threshold. Quantity has elevated barely throughout this downturn, indicating lively participation from each sellers locking in earnings and consumers focusing on a attainable reversal. Nonetheless, ETH stays under its 50-week shifting common, indicating that short-term momentum stays bearish.

Nonetheless, the broader sample resembles an early cycle pullback through which Ethereum sharply reversed earlier than forming larger lows and resuming the macro uptrend. If ETH can keep this assist band and regain the $3,300-$3,500 space, it might present renewed power. Nonetheless, a weekly shut under $3,000 dangers opening the door to a deeper correction goal close to $2,700.

Featured picture from ChatGPT, chart from TradingView.com