It was fairly boring On the Bitcoin entrance, the king of cryptocurrencies seems to be locked in a tighter vary than a miser’s pockets. After a excessive close to $90,353 that bulls and bears alike teased, Bitcoin retreated right into a well-worn channel, leaving analysts unable to decipher the tea leaves and pattern strains in the hunt for clearer route.

Bitcoin chart outlook

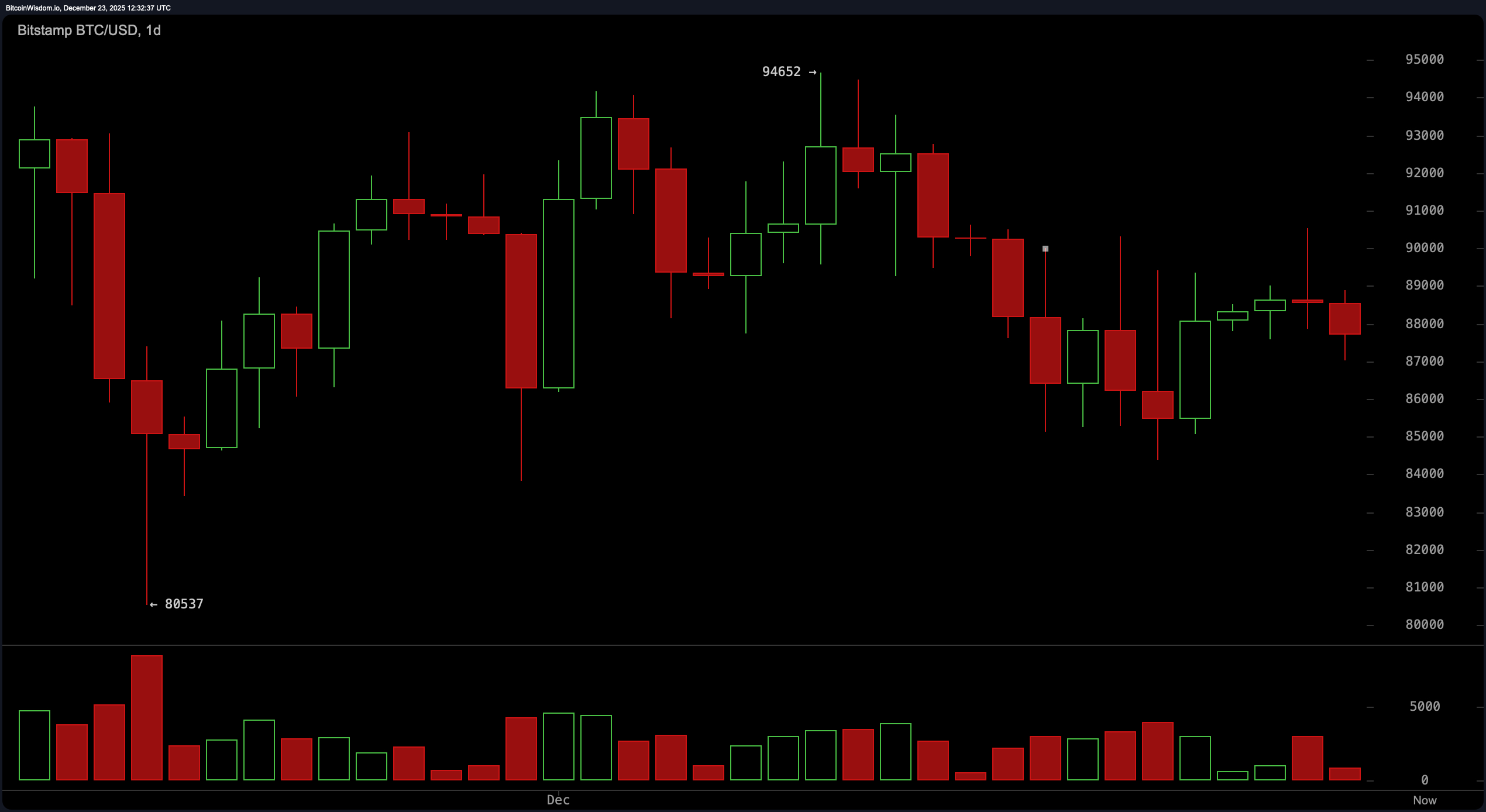

The each day chart tells the story of the diva’s decline. It isn’t a dramatic decline, however the momentum of the drama has undoubtedly slowed down. After a powerful rejection close to $94,600, Bitcoin has been rallying to new highs on the dedication of seasoned cleaning soap opera stars. The present side-to-side motion places the seen vary between $86,000 and $90,000.

Regardless of shedding momentum and weakening the bull market, the $85,500 to $86,000 help zone is proving extra tenacious than a toddler with a lollipop. In the meantime, like an ex-lover who cannot stop, resistance approaches $90,500-$91,000. The underside line? It isn’t the collapse that issues, it is the combination.

BTC/USD 1-day chart by way of Bitstamp for December 23, 2025.

On the 4-hour chart, Bitcoin’s current efficiency has been akin to a failed breakout try adopted by a “tried” pullback. The value peaked at $90,536 after which fell gracefully by means of a sequence of highs and lows, shedding enthusiasm however not collapsing in despair. Quantity indicators present an explosion of promoting stress adopted by a decline. This can be a basic signal of vendor fatigue quite than an entire liquidation. The most important help between $87,500 and $88,000 is strong, and contemplating the resistance set between $89,800 and $90,500, this setup smells extra like a pause than a pivot.

BTC/USD 4-hour chart by way of Bitstamp on December 23, 2025.

Zoom in on the hourly chart and the indicators of life start to twitch. After rebounding from $87,010, Bitcoin is beginning to kind lows, suggesting an early base, however do not pop the champagne simply but. Momentum, whereas enhancing, stays sluggish as cautious consumers recoil like introverts at networking occasions. Fast help lies between $87,000 and $87,300, whereas resistance lies between $88,500 and $89,200. Though this time-frame suggests a short-term restoration try, bulls will stay within the remark interval till Bitcoin clears the intentional overhead degree.

BTC/USD 1 hour chart by way of Bitstamp for December 23, 2025.

The numbers on the oscillator are sufficient to make even a caffeinated day dealer yawn. The Relative Energy Index (RSI) is at a impartial 43, whereas the Stochastic is calm at 38 and the Commodity Channel Index (CCI) is at a modest -64. The common directional index (ADX) is weak at 23, indicating an absence of pattern power. In the meantime, Superior Oscillator is roaring at -977 and momentum has dropped to -2,664. That is the one clear bearish outlier within the crowd. Even the Transferring Common Convergence Divergence (MACD) is enjoying each side, exhibiting a slight purchase sign at -1,408. Briefly, the oscillators are caught in a state of indifference, with solely momentum trying overtly pessimistic.

The shifting averages (MAs) are clearly singing a extra miserable tune. The ten-200 interval exponential shifting averages (EMAs) are all bearish, with the 10-period EMA hovering at $88,196 and the 200-period EMA languishing at $101,843. Easy shifting averages (SMAs) additionally do not supply a lot reassurance. The ten-period SMA is barely bullish at $87,529, barely above the present value, whereas the remaining 20-200 interval stack is firmly beneath the floor. This implies that Bitcoin’s short-term value pattern is holding up higher than its long-term trajectory, however broader traits nonetheless help cautious optimism.

In abstract, Bitcoin is on the verge of an intra-range identification disaster. Not utterly bearish, not utterly bullish, however undoubtedly not boring. Till costs confidently escape the $86,000-$90,000 hall, this stays a play on persistence quite than a breakout binge.

Bullish verdict:

Patrons are exhibiting quiet power on the $87,000 degree, defending the important thing help zone with textbook precision. If Bitcoin clears $89,200 and sustains above $90,500, it may start one other push in the direction of $92,000 and retest the broader vary highs. Momentum is enhancing on the decrease time-frame and the formation of upper lows suggests a possible backside is carved, however bulls have to act quickly or threat shedding the story.

Bear verdict:

Regardless of holding on to help, Bitcoin continues to make new highs and stays beneath nearly all necessary short- to long-term shifting averages. Though the oscillator is almost impartial, the momentum is clearly weak and the broader construction suggests dispersion quite than accumulation. Barring a powerful restoration above $90,000, that is only a bounce inside a downtrend, and a decisive lack of $86,500 on sturdy quantity may shortly speed up the decline.

Incessantly requested questions ❓

- What’s the present value of Bitcoin? Bitcoin is buying and selling at $87,634 as of December 23, 2025.

- Is Bitcoin at present in an uptrend or a downtrend? Bitcoin is buying and selling sideways with a slight downward bias.

- What are the present main help ranges for Bitcoin?Assist holds between $87,000 and $87,500 on the decrease time-frame.

- The place would possibly Bitcoin face resistance?The principle resistance lies between $89,200 and $90,500.